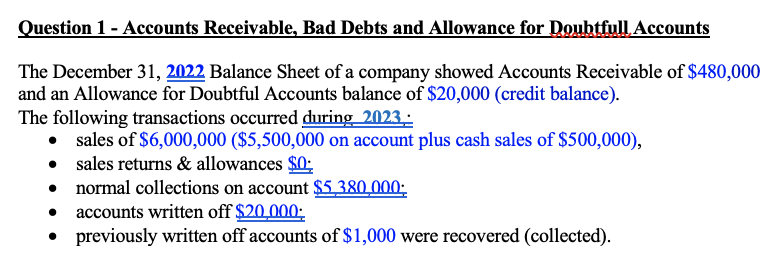

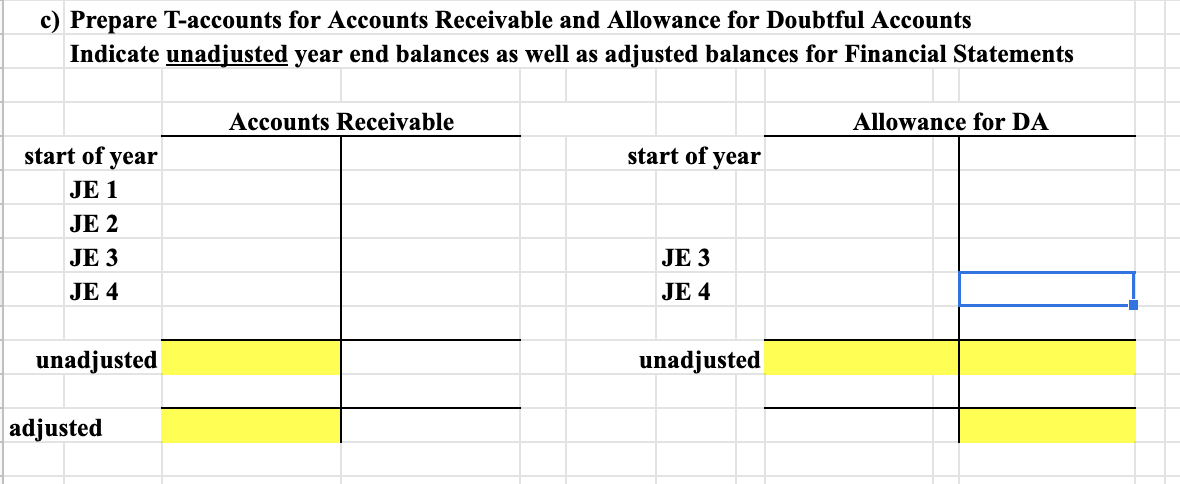

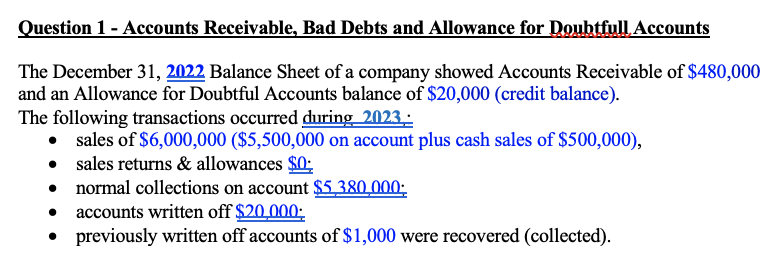

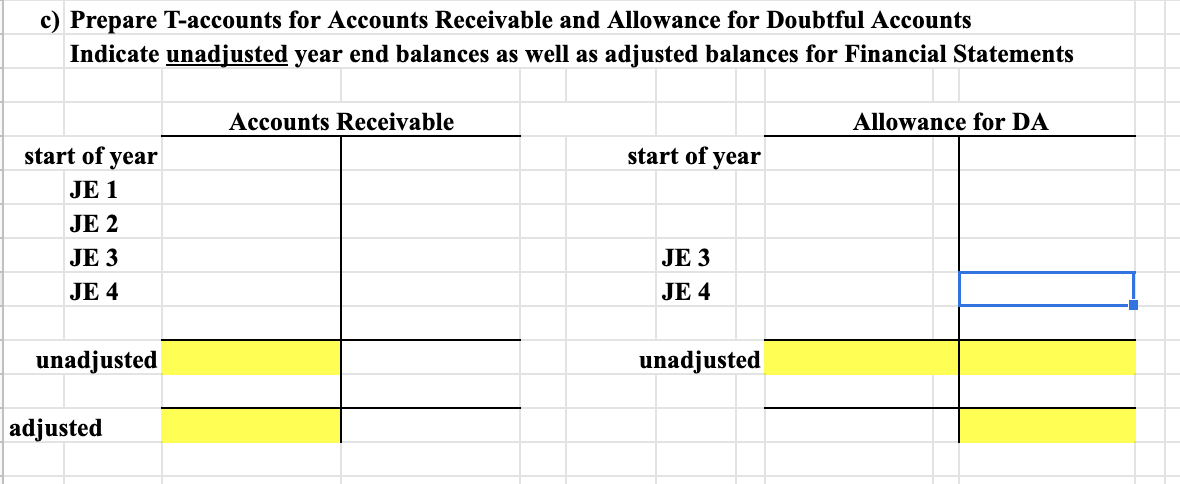

Question 1 - Accounts Receivable, Bad Debts and Allowance for Doubtfull, Accounts The December 31,2022 Balance Sheet of a company showed Accounts Receivable of $480,000 and an Allowance for Doubtful Accounts balance of $20,000 (credit balance). The following transactions occurred during 2023 . - sales of $6,000,000($5,500,000 on account plus cash sales of $500,000), - sales returns \& allowances $0 - normal collections on account $5,380,000 - accounts written off $20000. - previously written off accounts of $1,000 were recovered (collected). c) Prepare T-accounts for Accounts Receivable and Allowance for Doubtful Accounts Indicate unadjusted year end balances as well as adjusted balances for Financial Statements \begin{tabular}{|c|c|c|c|c|c|} & \multicolumn{2}{|c|}{ Accounts Receivable } & \multicolumn{2}{c|}{ Allowance for DA } \\ \cline { 2 - 3 } \cline { 5 - 6 } start of year & & start of year & \\ \hline JE 1 & & & & \\ \hline JE 2 & & JE 3 & & \\ \hline JE 3 & & JE 4 & & \\ \hline JE 4 & & & & \\ \hline & & unadjusted & & \\ \hline unadjusted & & & & \\ \hline & & & & \\ \hline adjusted & & & & \\ \hline \end{tabular} Question 1 - Accounts Receivable, Bad Debts and Allowance for Doubtfull, Accounts The December 31,2022 Balance Sheet of a company showed Accounts Receivable of $480,000 and an Allowance for Doubtful Accounts balance of $20,000 (credit balance). The following transactions occurred during 2023 . - sales of $6,000,000($5,500,000 on account plus cash sales of $500,000), - sales returns \& allowances $0 - normal collections on account $5,380,000 - accounts written off $20000. - previously written off accounts of $1,000 were recovered (collected). c) Prepare T-accounts for Accounts Receivable and Allowance for Doubtful Accounts Indicate unadjusted year end balances as well as adjusted balances for Financial Statements \begin{tabular}{|c|c|c|c|c|c|} & \multicolumn{2}{|c|}{ Accounts Receivable } & \multicolumn{2}{c|}{ Allowance for DA } \\ \cline { 2 - 3 } \cline { 5 - 6 } start of year & & start of year & \\ \hline JE 1 & & & & \\ \hline JE 2 & & JE 3 & & \\ \hline JE 3 & & JE 4 & & \\ \hline JE 4 & & & & \\ \hline & & unadjusted & & \\ \hline unadjusted & & & & \\ \hline & & & & \\ \hline adjusted & & & & \\ \hline \end{tabular}