Question

Question 1 Additional information: (i) During the year a machine which costs 8,360 and with accumulated depreciation of 6,270 was sold for 3,344. (ii) Dividends

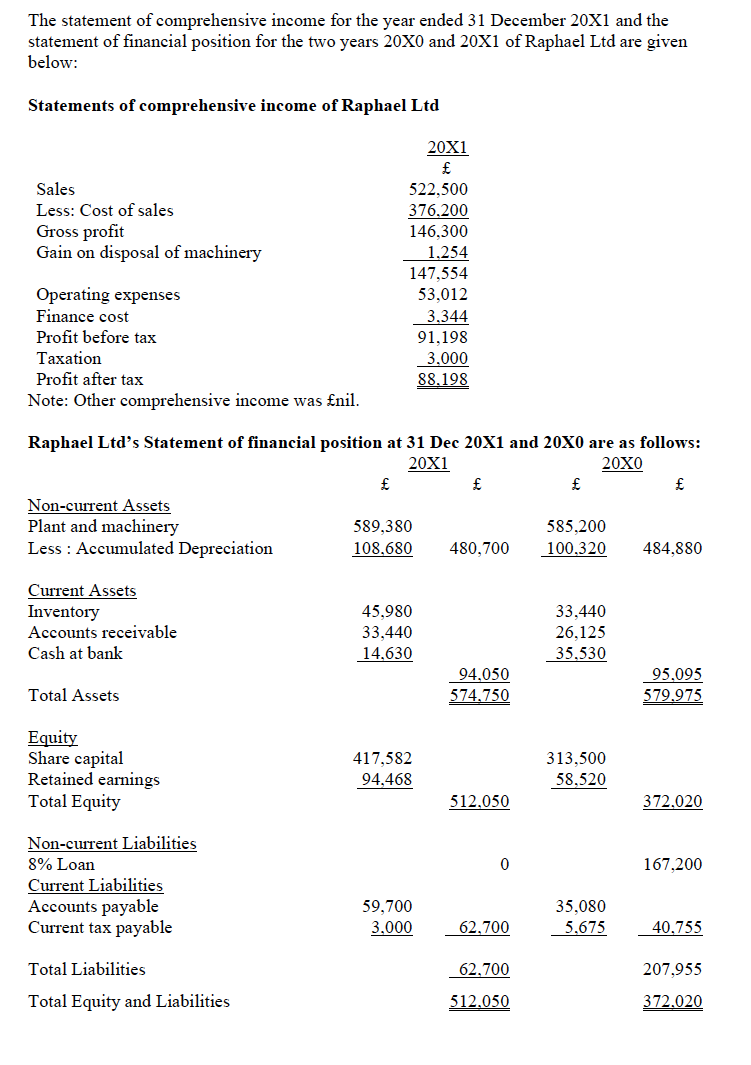

Question 1

Additional information:

- (i) During the year a machine which costs 8,360 and with accumulated depreciation of 6,270 was sold for 3,344.

- (ii) Dividends paid for the year was 52,250.

Required :

Prepare a statement of cash flows for the year ended 31 December 20X1 as required under IAS 7 using

- (a) Direct method.

- (b) Explain the significances of the information from the statement of cash flows of Raphael Ltd.

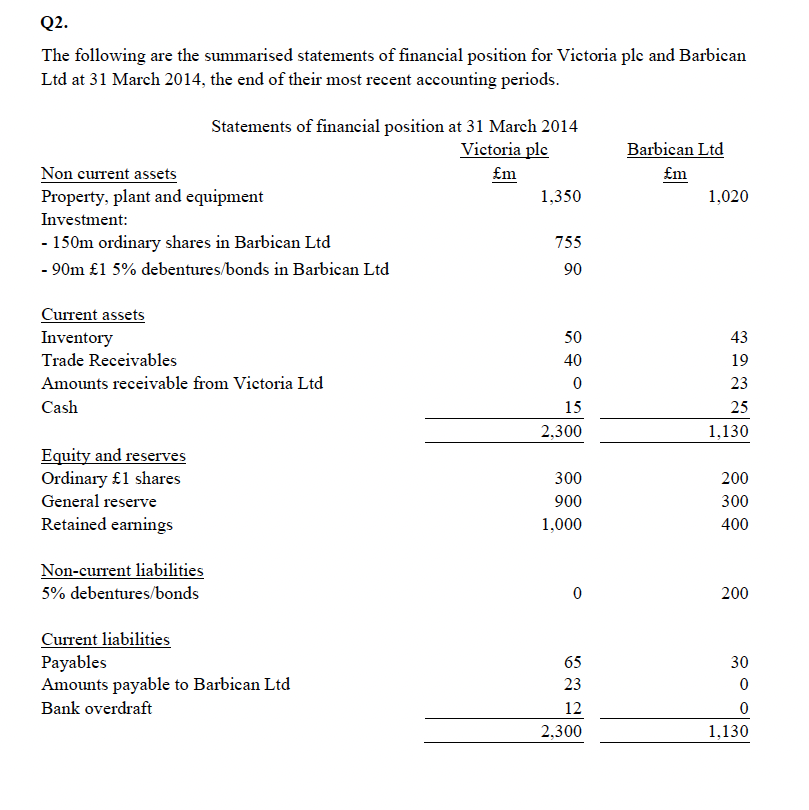

Question 2

The following information is also available:

i) On 1 April 2013 Victoria plc acquired 75% of the share capital in Barbican Limited. At that date the retained earnings of Barbican Limited amounted to 360m and general reserve of 180M.

ii) On 1 April 2013 the fair value of Barbican Limiteds Property, plant and equipment exceeded the carrying amount by 100m.

iii) At the end of the financial year, an impairment loss of goodwill amounted to 20%.

iv) At 31 March 2014 Barbican Ltds inventory includes 20m relating to goods purchased from Victoria plc. These goods had cost Victoria plc 12m. 50% of these goods remain in Barbican Ltds inventory.

Required

a) Calculate goodwill arising on the acquisition of Barbican Ltd at 1 April 2013 and the goodwill balance at the end of the financial year on 31 March 2014. b) Calculate the following:

(i) Consolidated retained earnings as at 31 March 2014. (ii) Consolidated general reserve as at 31 March 2014.

(iii) Non-controlling interest as at 31 March 2014. c) Prepare a consolidated statement of financial position for Victoria plc as at 31 March 2014.

The statement of comprehensive income for the year ended 31 December 20X1 and the statement of financial position for the two years 20X0 and 20X1 of Raphael Ltd are given below: Statements of comprehensive income of Raphael Ltd The following are the summarised statements of financial position for Victoria ple and Barbican

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started