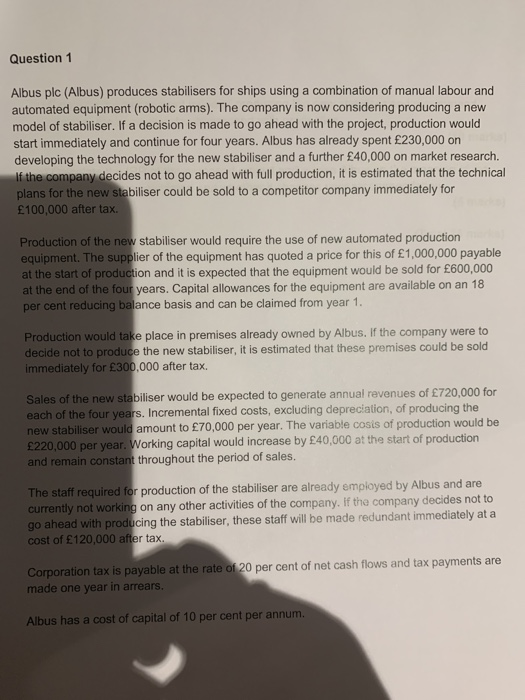

Question 1 Albus plc (Albus) produces stabilisers for ships using a combination of manual labour and automated equipment (robotic ams). The company is now considering producing a new model of stabiliser. If a decision is made to go ahead with the project, production would start immediately and continue for four years. Albus has already spent 230,000 on developing the technology for the new stabiliser and a further 40,000 on market research. If the company decides not to go ahead with full production, it is estimated that the technical plans for the new stabiliser could be sold to a competitor company immediately for 100,000 after tax. Production of the new stabiliser would require the use of new automated production equipment. The supplier of the equipment has quoted a price for this of 1,000,000 payable at the start of production and it is expected that the equipment would be sold for 600,000 at the end of the four years. Capital allowances for the equipment are available on an 18 per cent reducing balance basis and can be claimed from year 1. Production would take place in premises already owned by Albus. If the company were to decide not to produce the new stabiliser, it is estimated that these premises could be sold immediately for 300,000 after tax. Sales of the new stabiliser would be expected to generate annual revenues of 720,000 for each of the four years. Incremental fixed costs, excluding depreciation, of producing the new stabiliser would amount to 70,000 per year. The variable cosis of production would be 220,000 per year. Working capital would increase by 40,000 at the start of production and remain constant throughout the period of sales. The staff required for production of the stabiliser are already employed by Albus and are currently not working on any other activities of the company. If the company decides not to go ahead with producing the stabiliser, these staff will be made redundant immediately at a cost of 120,000 after tax. Corporation tax is payable at the rate of 20 per cent of net cash flows and tax payments are made one year in arrears. Albus has a cost of capital of 10 per cent per annum. Required (a) Calculate the net present value of producing the new stabiliser and recommend whether the company should proceed with production. (19 marks) (b) Calculate the IRR of the proposed project and advise Albus on the meaning of the figure you have calculated and whether it changes your recommendation. (6 marks) (Total 25 marks)