Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ali performs the following accounting tasks: 1. Analyzing and interpreting information. 2. Classifying economic events. 3. Explaining uses, meaning, and limitations of data. 4.

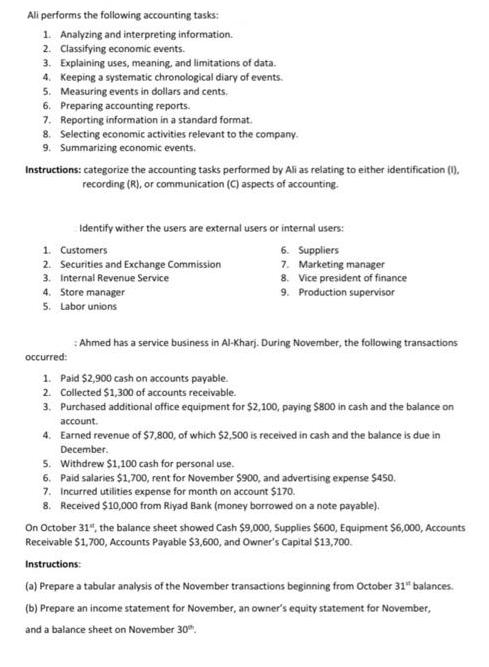

Ali performs the following accounting tasks: 1. Analyzing and interpreting information. 2. Classifying economic events. 3. Explaining uses, meaning, and limitations of data. 4. Keeping a systematic chronological diary of events. 5. Measuring events in dollars and cents. 6. Preparing accounting reports. 7. Reporting information in a standard format. 8. Selecting economic activities relevant to the company. 9. Summarizing economic events. Instructions: categorize the accounting tasks performed by Ali as relating to either identification (1), recording (R), or communication (C) aspects of accounting. Identify wither the users are external users or internal users: 1. Customers 2. Securities and Exchange Commission 3. Internal Revenue Service 4. Store manager 5. Labor unions 6. Suppliers 7. Marketing manager 8. Vice president of finance 9. Production supervisor : Ahmed has a service business in Al-Kharj. During November, the following transactions occurred: 1. Paid $2,900 cash on accounts payable. 2. Collected $1,300 of accounts receivable. 3. Purchased additional office equipment for $2,100, paying S800 in cash and the balance on account. 4. Earned revenue of $7,800, of which $2,500 is received in cash and the balance is due in December. 5. Withdrew $1,100 cash for personal use. 6. Paid salaries $1,700, rent for November $900, and advertising expense $450. 7. Incurred utilities expense for month on account $170. 8. Received $10,000 from Riyad Bank (money borrowed on a note payable). On October 31", the balance sheet showed Cash $9,000, Supplies $600, Equipment $6,000, Accounts Receivable $1,700, Accounts Payable $3,600, and Owner's Capital $13,700. Instructions: (a) Prepare a tabular analysis of the November transactions beginning from October 31" balances. (b) Prepare an income statement for November, an owner's equity statement for November, and a balance sheet on November 30".

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answers Question 1 1 Categorize the accounting tasks performed Analyzing and i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started