Question

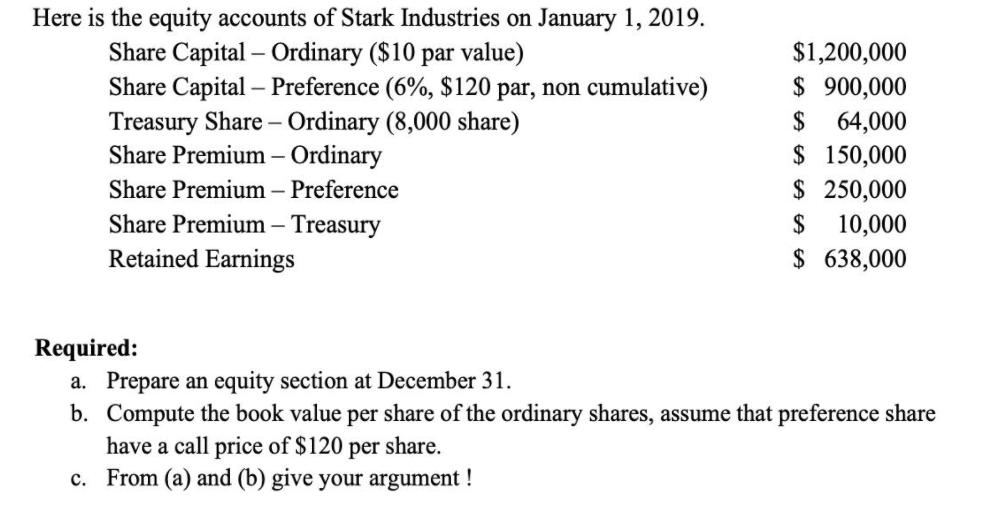

Here is the equity accounts of Stark Industries on January 1, 2019. Share Capital Ordinary ($10 par value) Share Capital Preference (6%, $120 par,

Here is the equity accounts of Stark Industries on January 1, 2019. Share Capital Ordinary ($10 par value) Share Capital Preference (6%, $120 par, non cumulative) Treasury Share Ordinary (8,000 share) Share Premium Ordinary $1,200,000 $ 900,000 64,000 $ 150,000 $ 250,000 10,000 $ Share Premium Preference - Share Premium Treasury Retained Earnings $ $ 638,000 Required: a. Prepare an equity section at December 31. b. Compute the book value per share of the ordinary shares, assume that preference share have a call price of $120 per share. c. From (a) and (b) give your argument !

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The answers are attached below With ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

IFRS 3rd edition

1118978080, 978-1119153726, 1119153727, 978-1119153702, 978-1118978085

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App