Question

Question 1: Amy and Jay Golden have worked for five years in a firm specializing in restoration of historical buildings. Amy has focused on interior

Question 1:

Amy and Jay Golden have worked for five years in a firm specializing in restoration of historical buildings. Amy has focused on interior reconditioning and Jay on architectural and structural design. They have specialized in residential structures for the past two years, and are thinking of forming their own residential restoration firm. They plan to do all the structural and decorative design, and subcontract the actual construction and decorative work. One of their concerns is to have an accounting system in place when they begin their business. You have been asked to assist them by answering the following questions. Required: (1) Since we have a very basic service-type firm, can a simple accounting system be developed?

(2) What kinds of information does the accounting system need to collect?

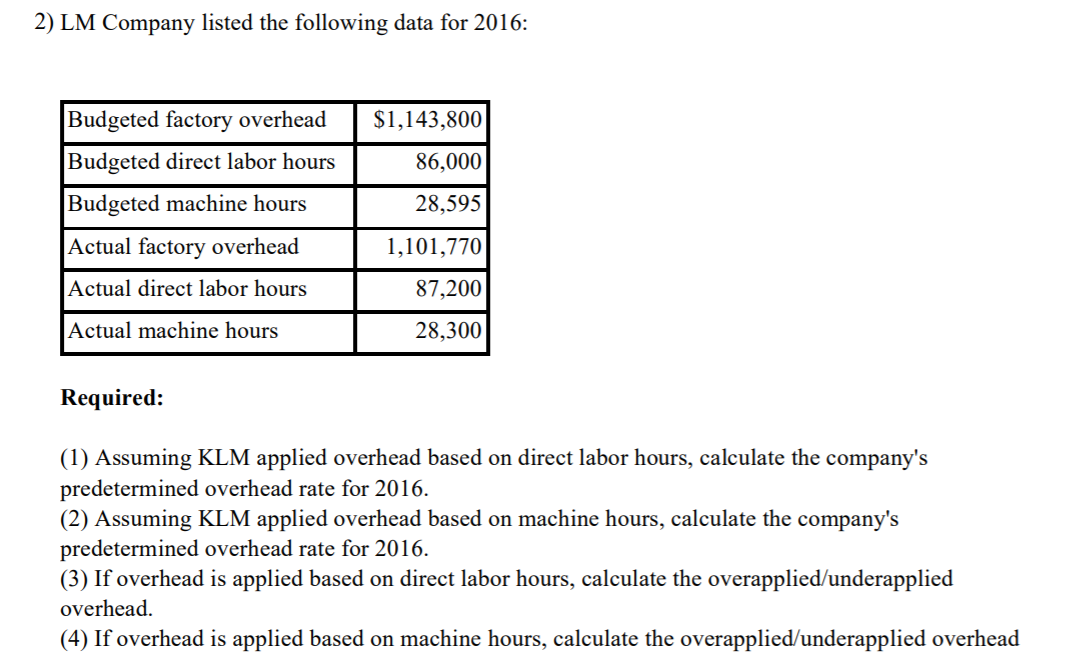

Question 2:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started