Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 An entrepreneur wants to raise outside financing to undertake an investme investment costs $80m today. Next year, the investment will generate cas depend

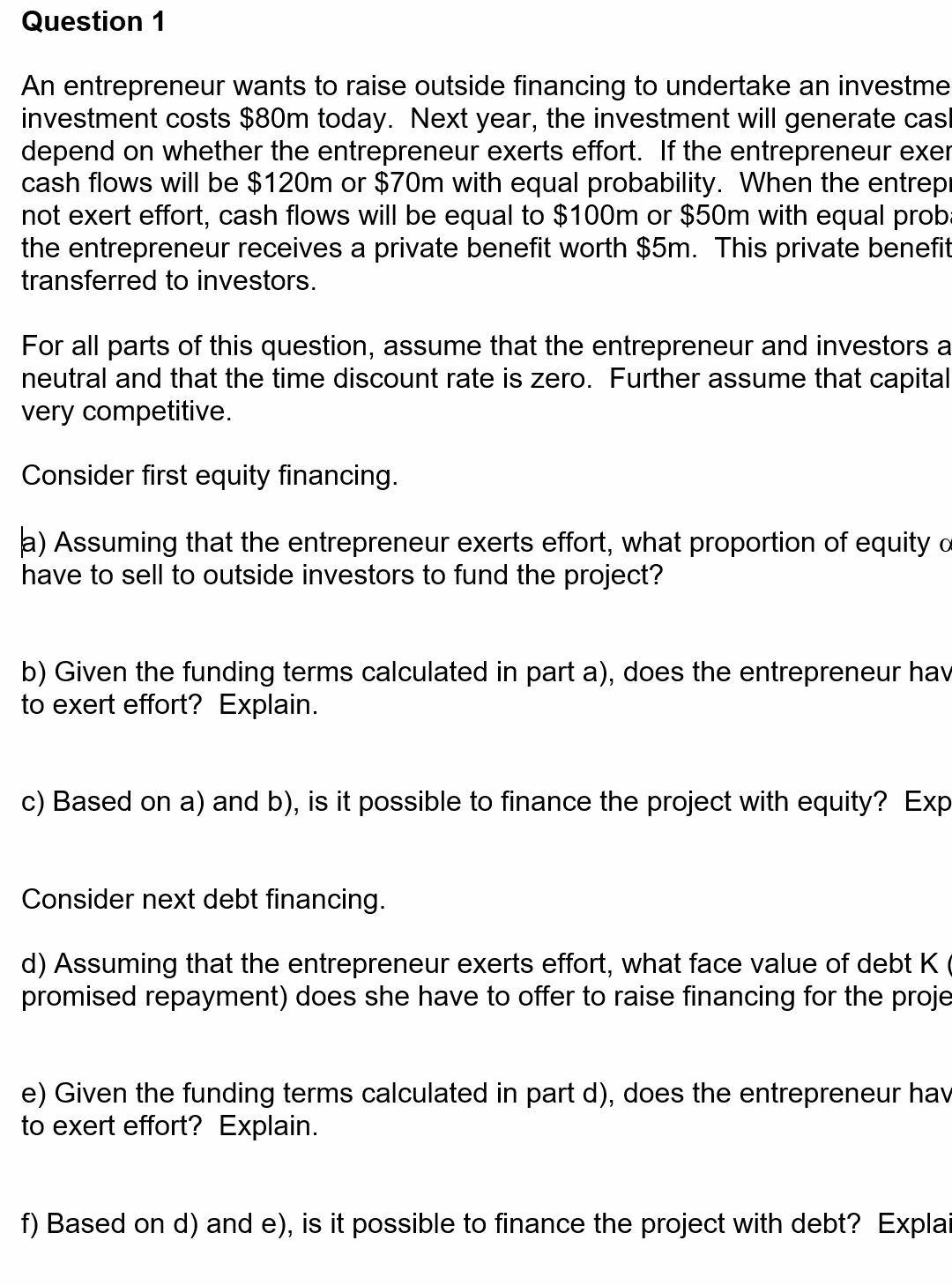

Question 1 An entrepreneur wants to raise outside financing to undertake an investme investment costs $80m today. Next year, the investment will generate cas depend on whether the entrepreneur exerts effort. If the entrepreneur exer cash flows will be $120m or $70m with equal probability. When the entrep not exert effort, cash flows will be equal to $100m or $50m with equal prob the entrepreneur receives a private benefit worth $5m. This private benefit transferred to investors. For all parts of this question, assume that the entrepreneur and investors a neutral and that the time discount rate is zero. Further assume that capital very competitive. Consider first equity financing. la) Assuming that the entrepreneur exerts effort, what proportion of equity o have to sell to outside investors to fund the project? b) Given the funding terms calculated in part a), does the entrepreneur hav to exert effort? Explain. c) Based on a) and b), is it possible to finance the project with equity? Exp Consider next debt financing. d) Assuming that the entrepreneur exerts effort, what face value of debt K promised repayment) does she have to offer to raise financing for the proje e) Given the funding terms calculated in part d), does the entrepreneur hav to exert effort? Explain. f) Based on d) and e), is it possible to finance the project with debt? Explai Question 1 An entrepreneur wants to raise outside financing to undertake an investme investment costs $80m today. Next year, the investment will generate cas depend on whether the entrepreneur exerts effort. If the entrepreneur exer cash flows will be $120m or $70m with equal probability. When the entrep not exert effort, cash flows will be equal to $100m or $50m with equal prob the entrepreneur receives a private benefit worth $5m. This private benefit transferred to investors. For all parts of this question, assume that the entrepreneur and investors a neutral and that the time discount rate is zero. Further assume that capital very competitive. Consider first equity financing. la) Assuming that the entrepreneur exerts effort, what proportion of equity o have to sell to outside investors to fund the project? b) Given the funding terms calculated in part a), does the entrepreneur hav to exert effort? Explain. c) Based on a) and b), is it possible to finance the project with equity? Exp Consider next debt financing. d) Assuming that the entrepreneur exerts effort, what face value of debt K promised repayment) does she have to offer to raise financing for the proje e) Given the funding terms calculated in part d), does the entrepreneur hav to exert effort? Explain. f) Based on d) and e), is it possible to finance the project with debt? Explai

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started