Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Analyze and journalize transactions. 1. (LO 2) Presented below is information related to Provence Real Estate Agency (amounts in thousands). Oct.1 Henri Bos

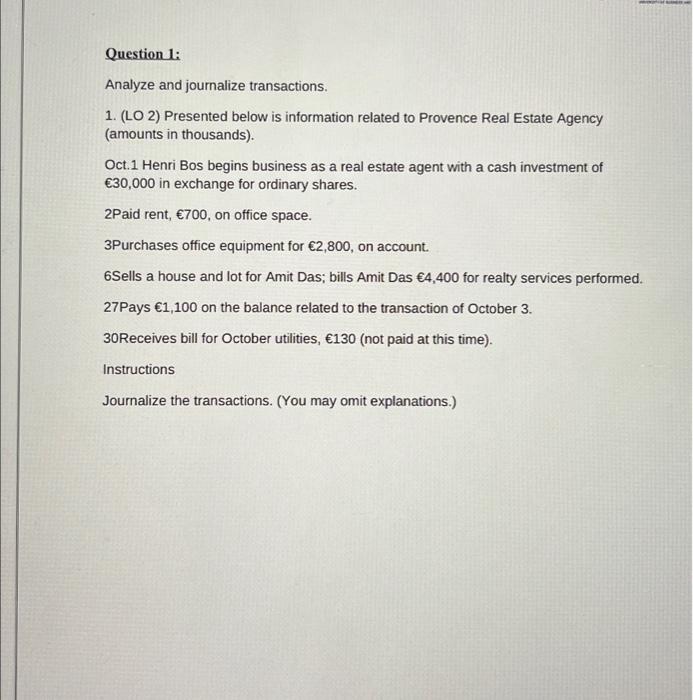

Question 1: Analyze and journalize transactions. 1. (LO 2) Presented below is information related to Provence Real Estate Agency (amounts in thousands). Oct.1 Henri Bos begins business as a real estate agent with a cash investment of 30,000 in exchange for ordinary shares. 2Paid rent, 700, on office space. 3Purchases office equipment for 2,800, on account. 6Sells a house and lot for Amit Das; bills Amit Das 4,400 for realty services performed. 27Pays 1,100 on the balance related to the transaction of October 3. 30Receives bill for October utilities, 130 (not paid at this time). Instructions Journalize the transactions. (You may omit explanations.) VERSTOF BAND

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started