Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 and 2 please. With this information, you are tasked with completing the following: 1. Which costing method does this company likely use, Job

question 1 and 2 please.

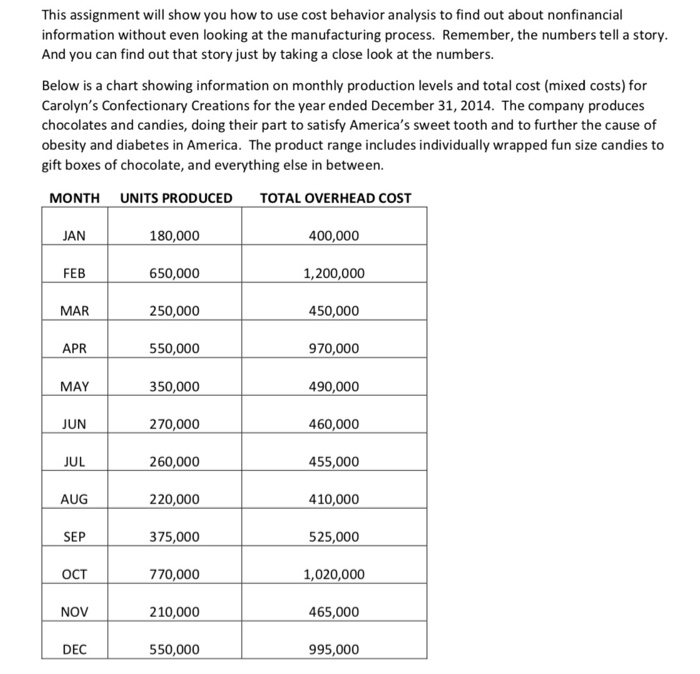

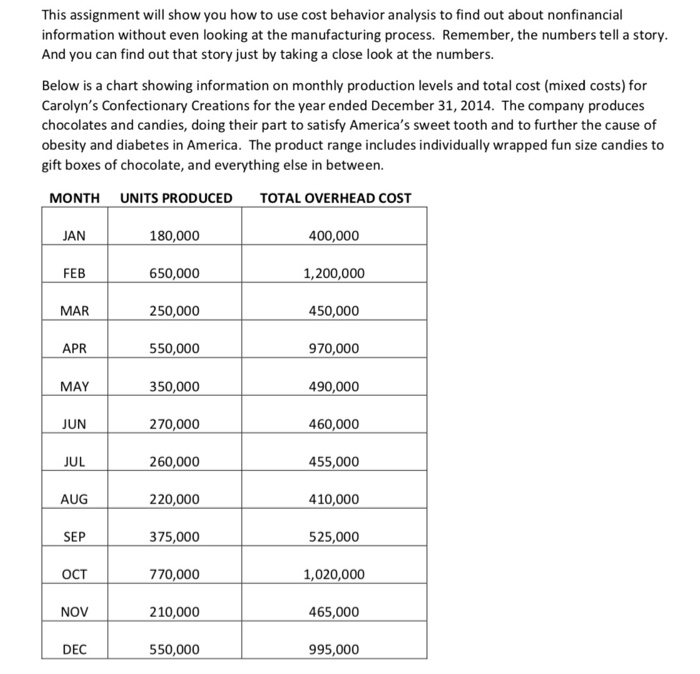

With this information, you are tasked with completing the following: 1. Which costing method does this company likely use, Job Order Costing or Process Costing? xplain. Would this company potentially benefit from using ABC, and why? Prepare a scattergraph on a sheet of graph paper (If you don't have any available, go to printfreegraphpaper.com and select "Engineering Graph Paper" as the type of graph paper 2. to print.) Draw a regression line between the points. What do you estimate total fixed costs to be? Using the High-Low Method, calculate variable cost per unit as well as fixed costs. Using the Regression Analysis function in Excel (you may need to install the Analysis Tool Pak), find the following: 3. 4. a. b. c. Total Fixed Costs Variable Cost per Unit What percentage of variable costs are directly related to how much is produced 5. Answer the following (think about it, and be creative) Production in April and December were the same, but overhead was higher in December. Consider what makes up manufacturing overhead. What is a possible reason that manufacturing overhead was greater in December? Why do you think production was so much higher in February, April and December than in other months? a. b. c. We know that variable costs are not entirely related to how much is produced. Again, think about what makes up overhead and what this company manufactures. What might be another factor involved in overhead? (HINT: Look at the month in which the overhead is the highest.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started