Question

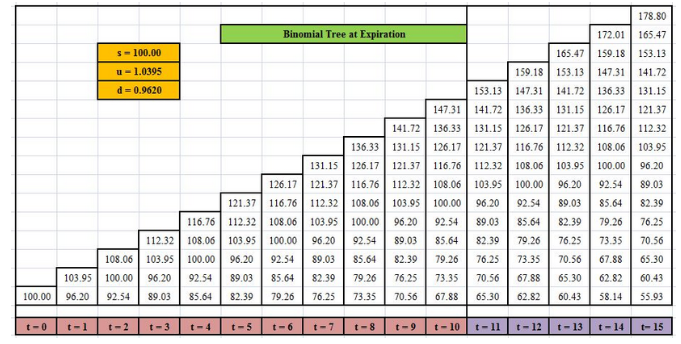

Question 1 and 2 should be answered by building a 15-period binomial model whose parameters should be calibrated to a Black-Scholes geometric Brownian motion model

Question 1 and 2 should be answered by building a 15-period binomial model whose parameters should be calibrated to a Black-Scholes geometric Brownian motion model with: T = .25 years, S0 = 100, r = 2%, =30% and a dividend yield of c = 1%.

THE MODEL HAS BEEN BUILT and ATTACHED

1. Compute the price of an American call option with strike K=110 and maturity T=.25 years.

Ans: 2.60

2. Compute the price of an American put option with strike K = 110 and maturity T = .25 years

Ans: 12.3

KINDLY PROVIDE THE STEP BY STEP SOLUTION TO THE ANSWERS ATTACHED.

thanks.

178.80 Binomial Tree at Expiration 172.01 165.47 153.13 s-100.00 -1.0395 141.72 d = 0.9620 131.15 147.31 121.37 165.47 159.18 159.18 153.13 147.31 153.13 | 147.31 141.72 136.33 141.72 136.33 131.15 126.17 131.15 126.17 121.37 116.76 121.37 116.76 112.32 108.06 112.32 108.06 103.95 100.00 103.95 100.00 96.20 92.54 112.32 103.95 96.20 89.03 96.20 92.54 89.03 85.64 82.39 141.72 136.33 136.33 131.15 126.17 131.15 126.17 121.37 116.76 126.17 121.37 116.76 112.32 108.06 121.37 116.76 112.32 108.06 103.95 100.00 112.32 108.06 103.95 100.00 96.20 92.54 103.95 100.00 96.20 92.54 89.03 85.64 96.20 92.54 89.03 85.64 82.39 79.26 89.03 85.64 82.39 79.26 76.25 73.35 82.39 79.26 76.25 73.35 70.56 67.88 82.39 79.26 76.25 116.76 112.32 108.06 89.03 82.39 85.64 79.26 73.35 70.56 76.25 70.56 100.00 76.25 67.88 65.30 108.06 103.95 100.00 96.20 92.54 103.95 96.20 89.03 73.35 67.88 65.30 92.54 85.64 70.56 65.30 62.82 58.14 60.43 55.93 100.00 62.82 60.43 t-0 t-1 t-4 t-5 t-7 t-8 t-9 t-10 t-11 t-12 t-13 t-14 1-15 178.80 Binomial Tree at Expiration 172.01 165.47 153.13 s-100.00 -1.0395 141.72 d = 0.9620 131.15 147.31 121.37 165.47 159.18 159.18 153.13 147.31 153.13 | 147.31 141.72 136.33 141.72 136.33 131.15 126.17 131.15 126.17 121.37 116.76 121.37 116.76 112.32 108.06 112.32 108.06 103.95 100.00 103.95 100.00 96.20 92.54 112.32 103.95 96.20 89.03 96.20 92.54 89.03 85.64 82.39 141.72 136.33 136.33 131.15 126.17 131.15 126.17 121.37 116.76 126.17 121.37 116.76 112.32 108.06 121.37 116.76 112.32 108.06 103.95 100.00 112.32 108.06 103.95 100.00 96.20 92.54 103.95 100.00 96.20 92.54 89.03 85.64 96.20 92.54 89.03 85.64 82.39 79.26 89.03 85.64 82.39 79.26 76.25 73.35 82.39 79.26 76.25 73.35 70.56 67.88 82.39 79.26 76.25 116.76 112.32 108.06 89.03 82.39 85.64 79.26 73.35 70.56 76.25 70.56 100.00 76.25 67.88 65.30 108.06 103.95 100.00 96.20 92.54 103.95 96.20 89.03 73.35 67.88 65.30 92.54 85.64 70.56 65.30 62.82 58.14 60.43 55.93 100.00 62.82 60.43 t-0 t-1 t-4 t-5 t-7 t-8 t-9 t-10 t-11 t-12 t-13 t-14 1-15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started