Answered step by step

Verified Expert Solution

Question

1 Approved Answer

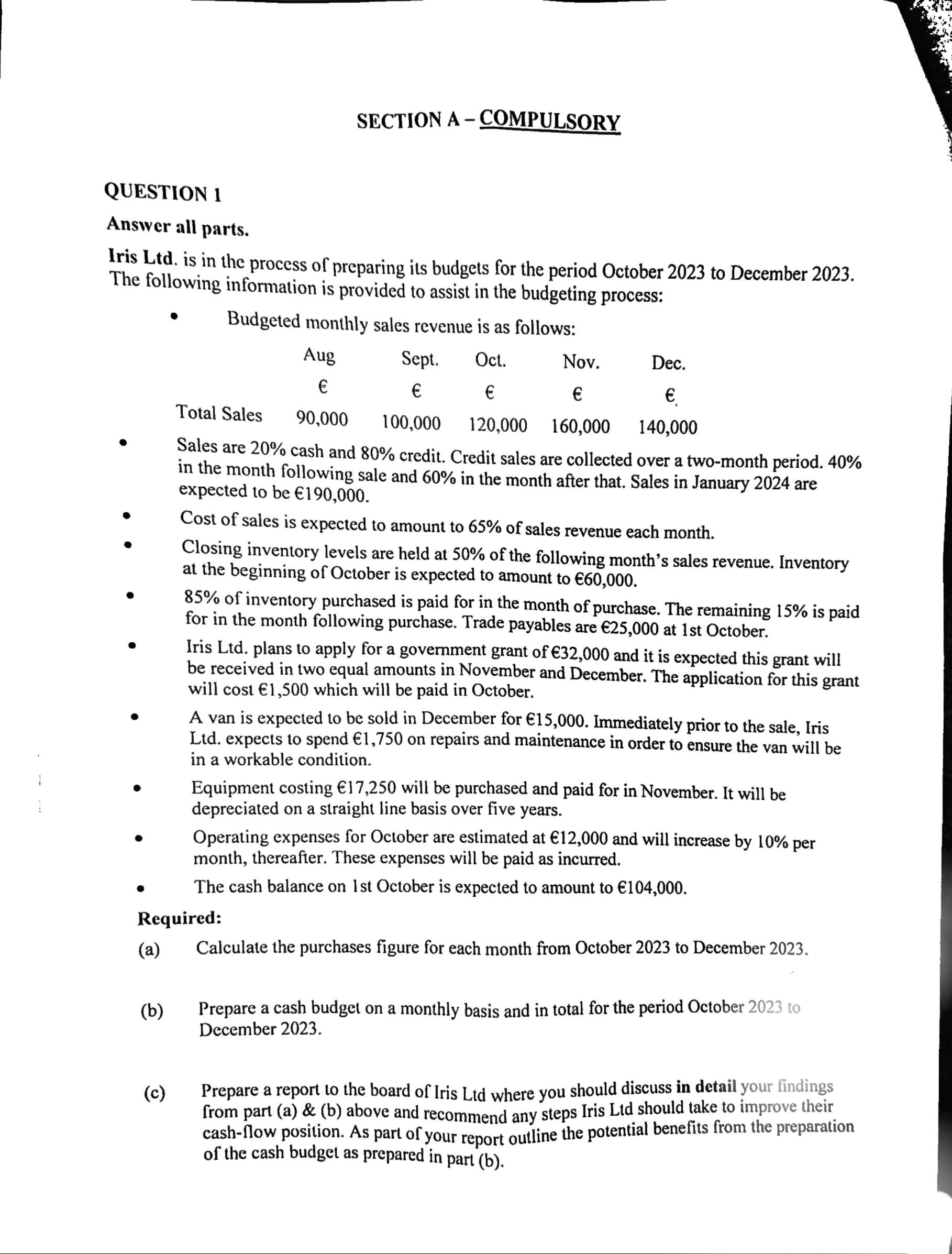

QUESTION 1 Answer all parts. Iris Ltd. is in the process of preparing its budgets for the period October 2023 to December 2023. The following

QUESTION 1 Answer all parts. Iris Ltd. is in the process of preparing its budgets for the period October 2023 to December 2023. The following information is provided to assist in the budgeting process: - Budgeted monthly sales revenue is as follows: - Sales are \20 cash and \80 credit. Credit sales are collected over a two-month period. \40 in the month following sale and \60 in the month after that. Sales in January 2024 are expected to be \\( 190,000 \\). - Cost of sales is expected to amount to \65 of sales revenue each month. - Closing inventory levels are held at \50 of the following month's sales revenue. Inventory at the beginning of October is expected to amount to \\( 60,000 \\). - \85 of inventory purchased is paid for in the month of purchase. The remaining \15 is paid for in the month following purchase. Trade payables are \\( 25,000 \\) at 1 st October. - Iris Ltd. plans to apply for a government grant of \\( 32,000 \\) and it is expected this grant will be received in two equal amounts in November and December. The application for this grant will cost \\( 1,500 \\) which will be paid in October. - A van is expected to be sold in December for \\( 15,000 \\). Immediately prior to the sale, Iris Ltd. expects to spend \\( 1,750 \\) on repairs and maintenance in order to ensure the van will be in a workable condition. - Equipment costing \\( 17,250 \\) will be purchased and paid for in November. It will be depreciated on a straight line basis over five years. - Operating expenses for October are estimated at \\( 12,000 \\) and will increase by \10 per month, thereafter. These expenses will be paid as incurred. - The cash balance on 1st October is expected to amount to \\( 104,000 \\). Required: (a) Calculate the purchases figure for each month from October 2023 to December 2023. (b) Prepare a cash budget on a monthly basis and in total for the period October 2023 to December 2023. (c) Prepare a report to the board of Iris Ltd where you should discuss in detail your findings from part (a) \\& (b) above and recommend any steps Iris Ltd should take to improve their cash-flow position. As part of your report outline the potential benefits from the preparation of the cash budget as prepared in part (b). QUESTION 1 Answer all parts. Iris Ltd. is in the process of preparing its budgets for the period October 2023 to December 2023. The following information is provided to assist in the budgeting process: - Budgeted monthly sales revenue is as follows: - Sales are \20 cash and \80 credit. Credit sales are collected over a two-month period. \40 in the month following sale and \60 in the month after that. Sales in January 2024 are expected to be \\( 190,000 \\). - Cost of sales is expected to amount to \65 of sales revenue each month. - Closing inventory levels are held at \50 of the following month's sales revenue. Inventory at the beginning of October is expected to amount to \\( 60,000 \\). - \85 of inventory purchased is paid for in the month of purchase. The remaining \15 is paid for in the month following purchase. Trade payables are \\( 25,000 \\) at 1 st October. - Iris Ltd. plans to apply for a government grant of \\( 32,000 \\) and it is expected this grant will be received in two equal amounts in November and December. The application for this grant will cost \\( 1,500 \\) which will be paid in October. - A van is expected to be sold in December for \\( 15,000 \\). Immediately prior to the sale, Iris Ltd. expects to spend \\( 1,750 \\) on repairs and maintenance in order to ensure the van will be in a workable condition. - Equipment costing \\( 17,250 \\) will be purchased and paid for in November. It will be depreciated on a straight line basis over five years. - Operating expenses for October are estimated at \\( 12,000 \\) and will increase by \10 per month, thereafter. These expenses will be paid as incurred. - The cash balance on 1st October is expected to amount to \\( 104,000 \\). Required: (a) Calculate the purchases figure for each month from October 2023 to December 2023. (b) Prepare a cash budget on a monthly basis and in total for the period October 2023 to December 2023. (c) Prepare a report to the board of Iris Ltd where you should discuss in detail your findings from part (a) \\& (b) above and recommend any steps Iris Ltd should take to improve their cash-flow position. As part of your report outline the potential benefits from the preparation of the cash budget as prepared in part (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started