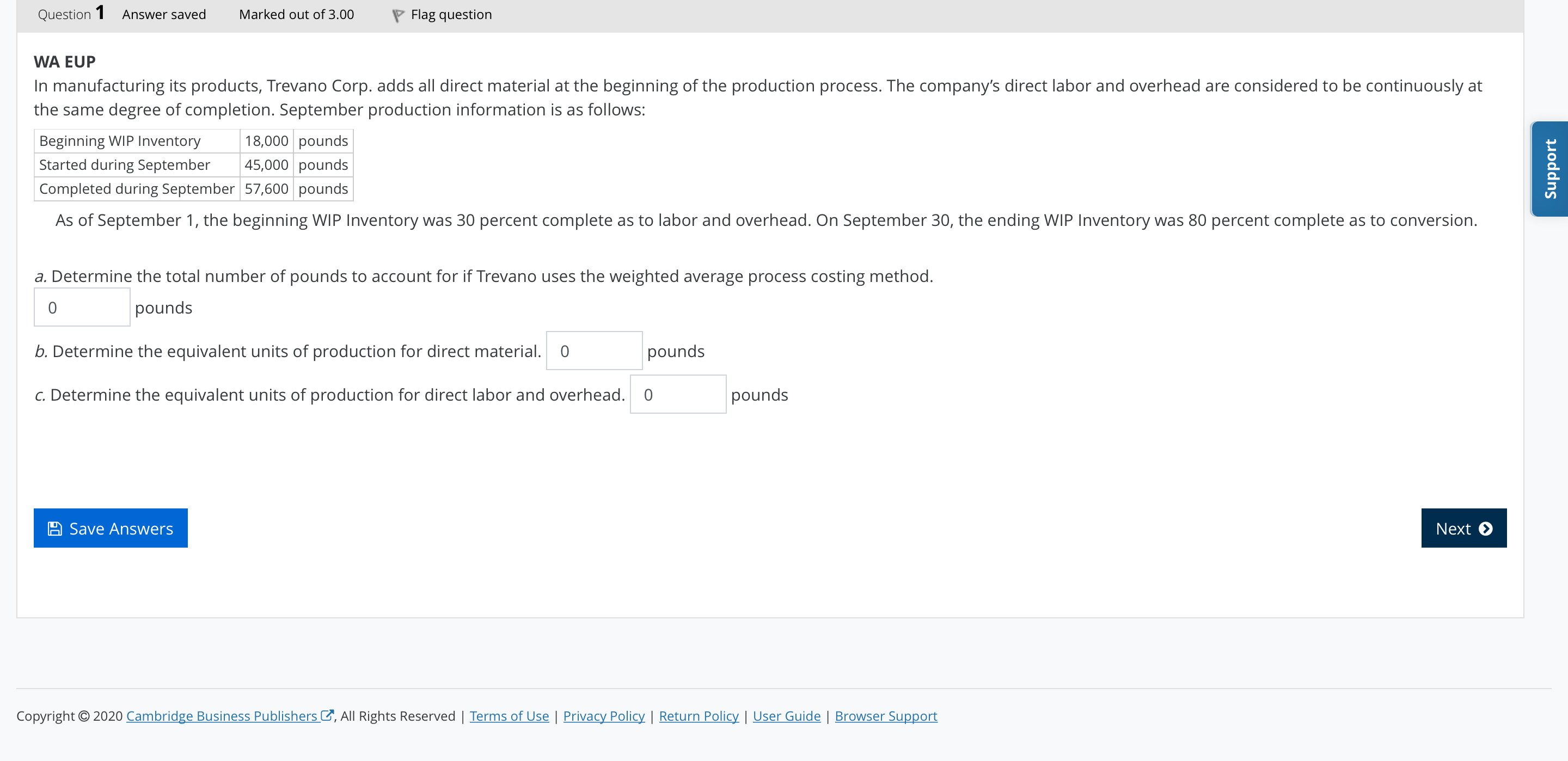

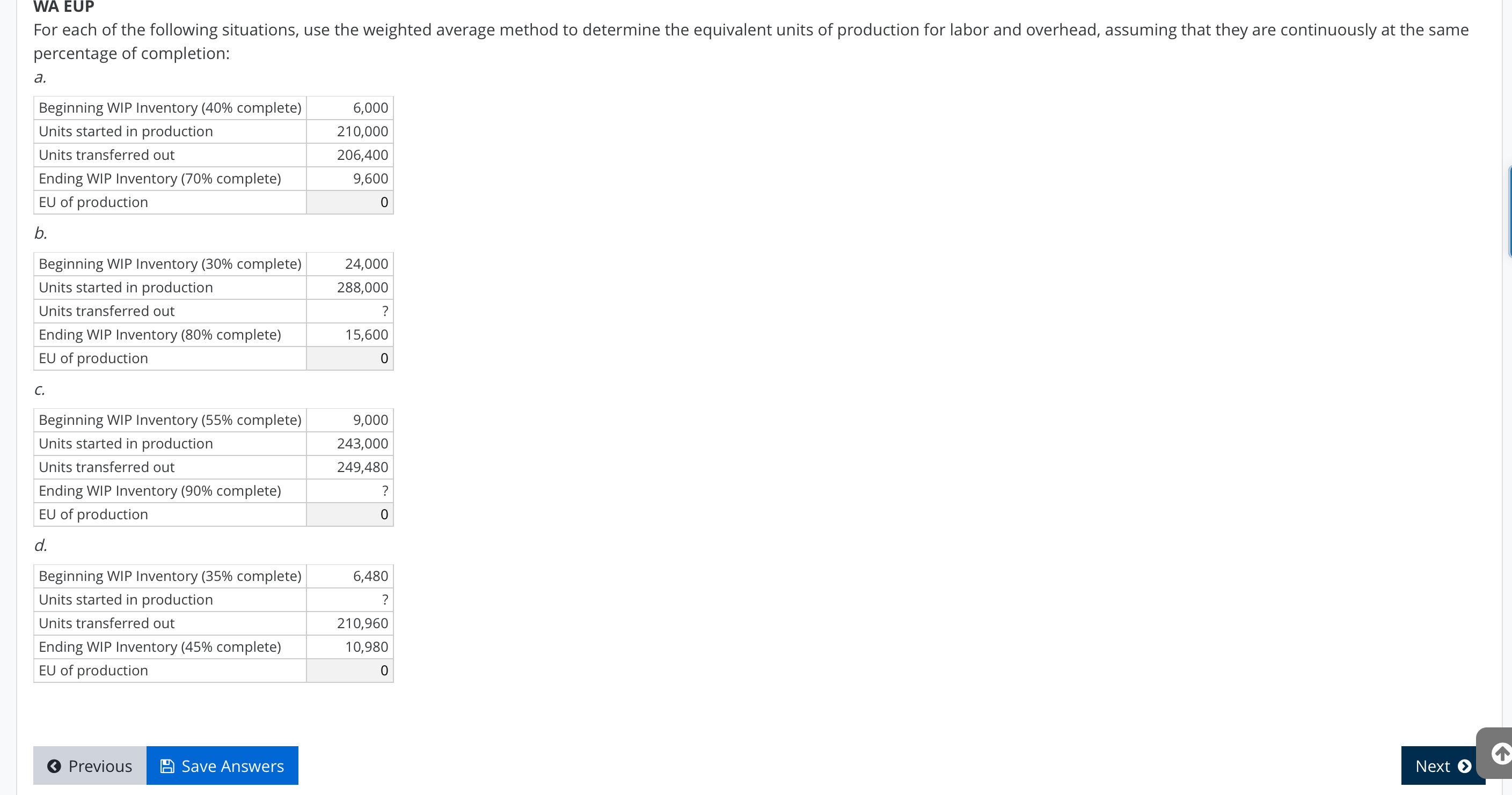

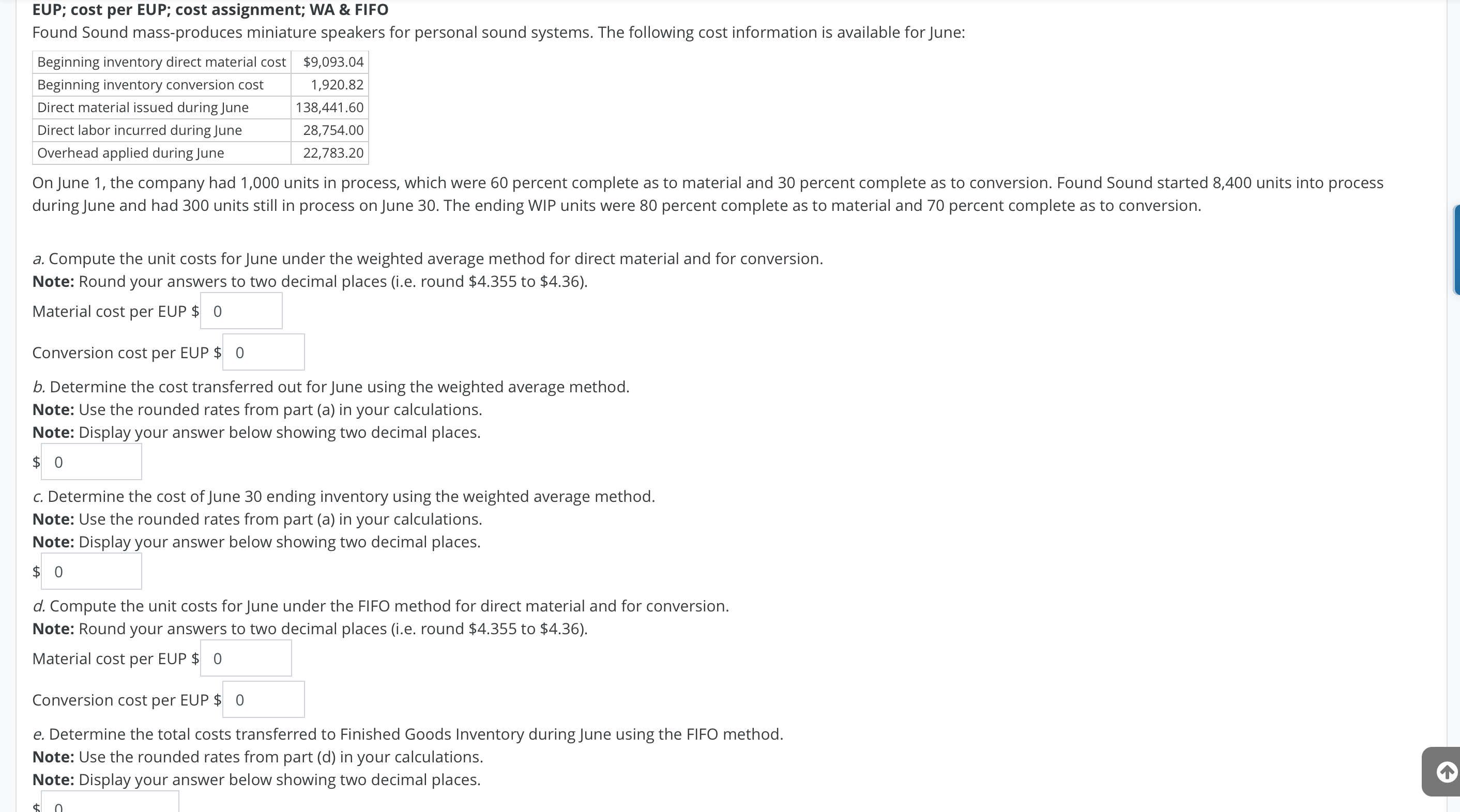

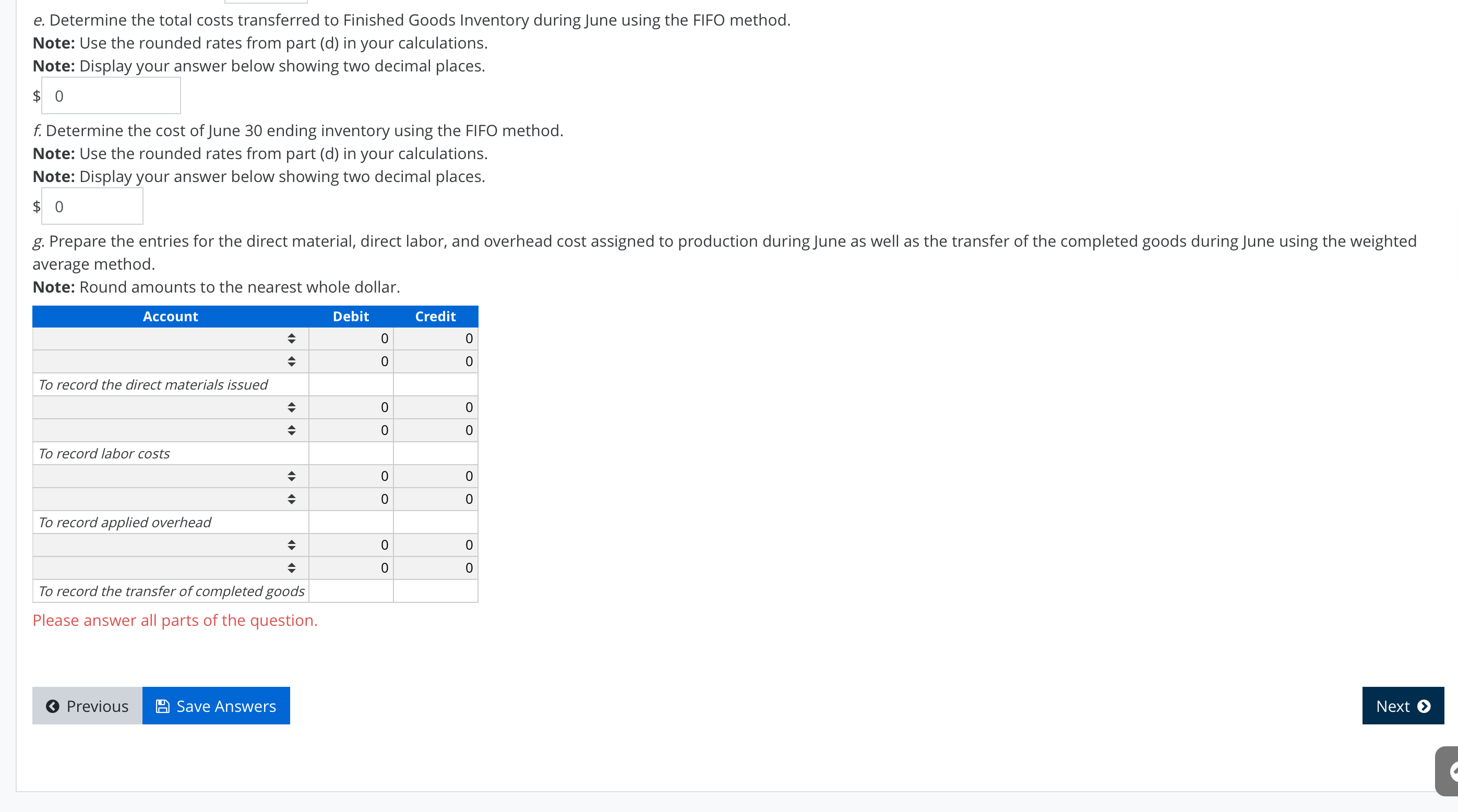

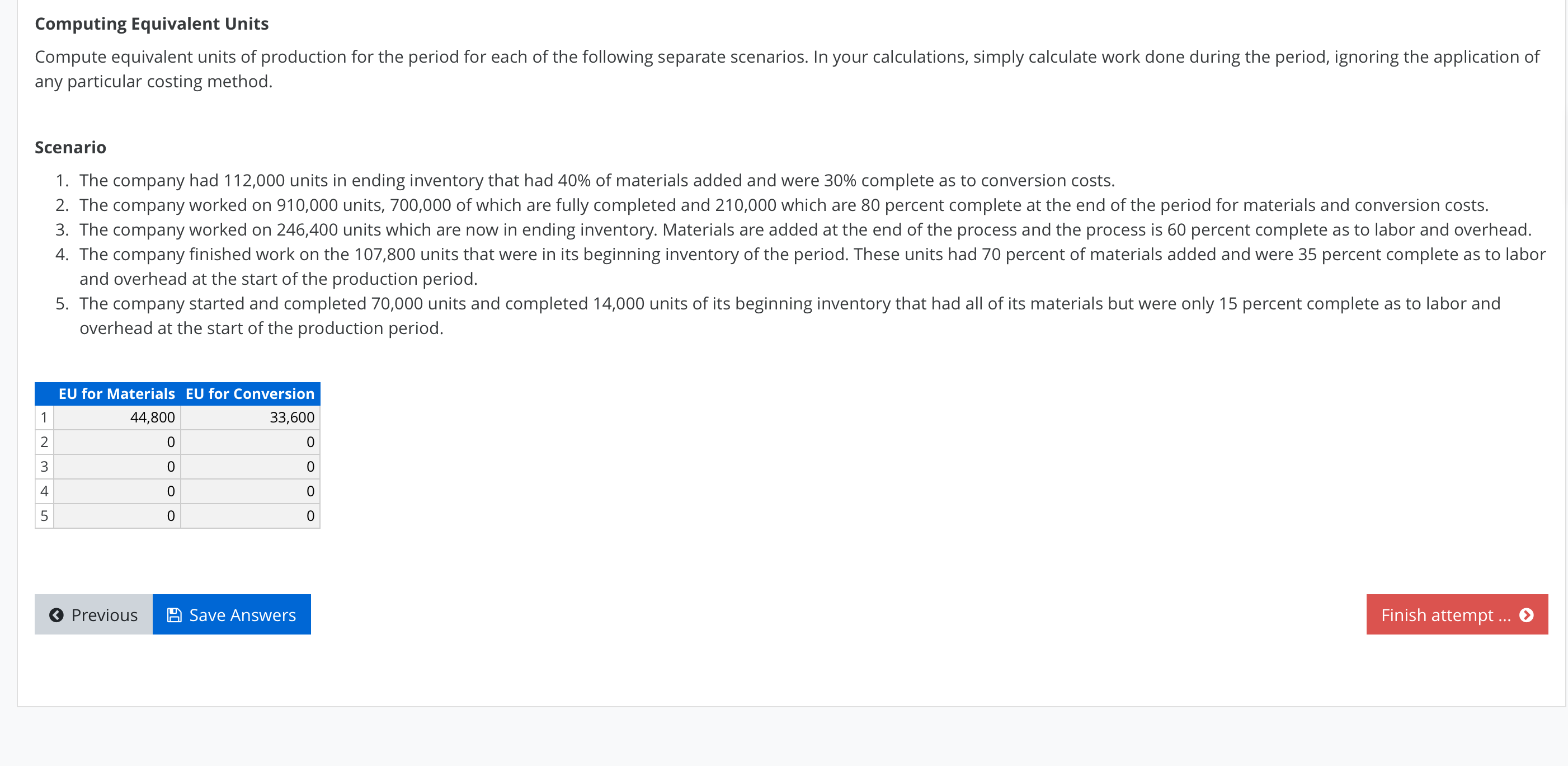

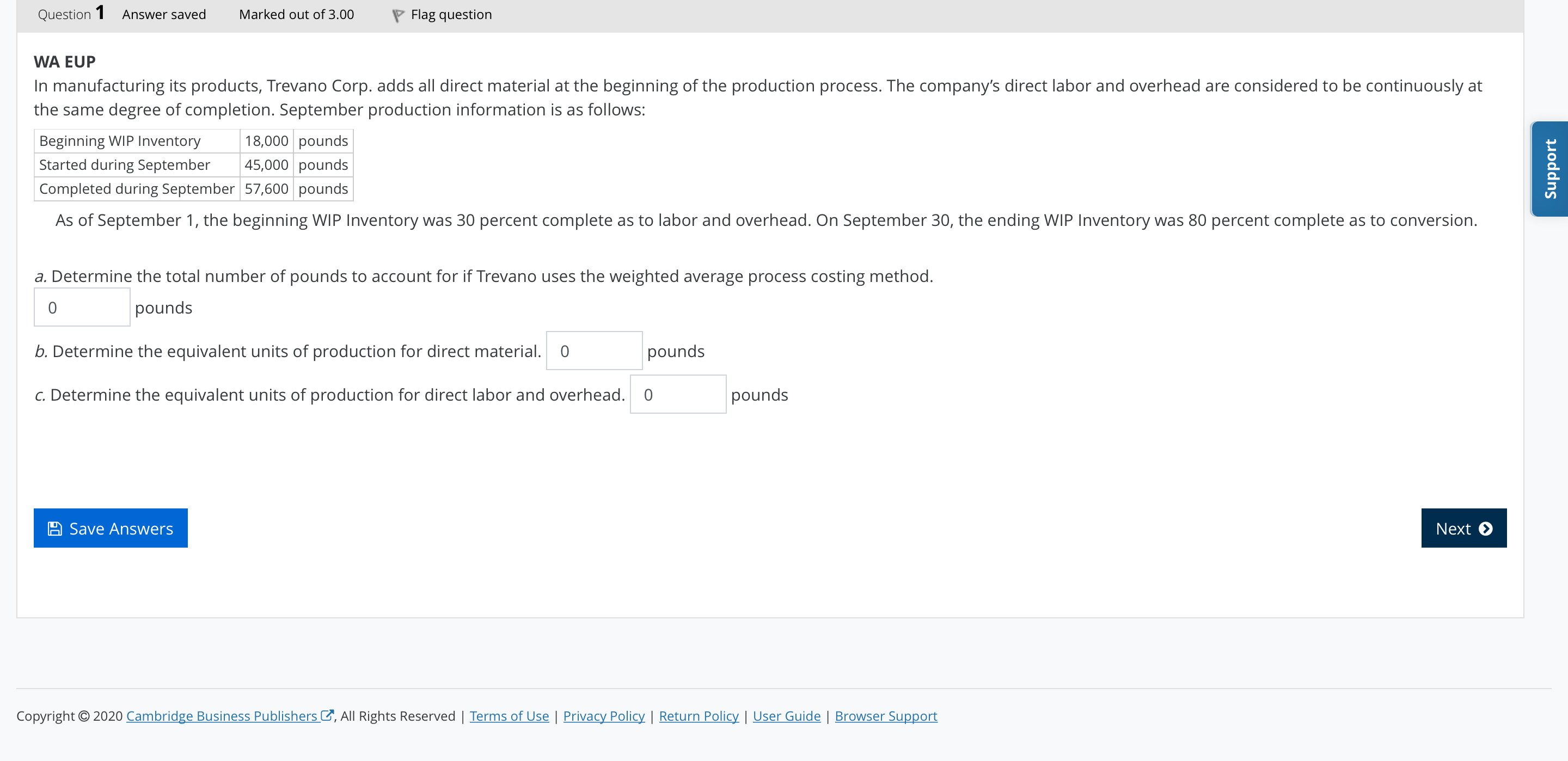

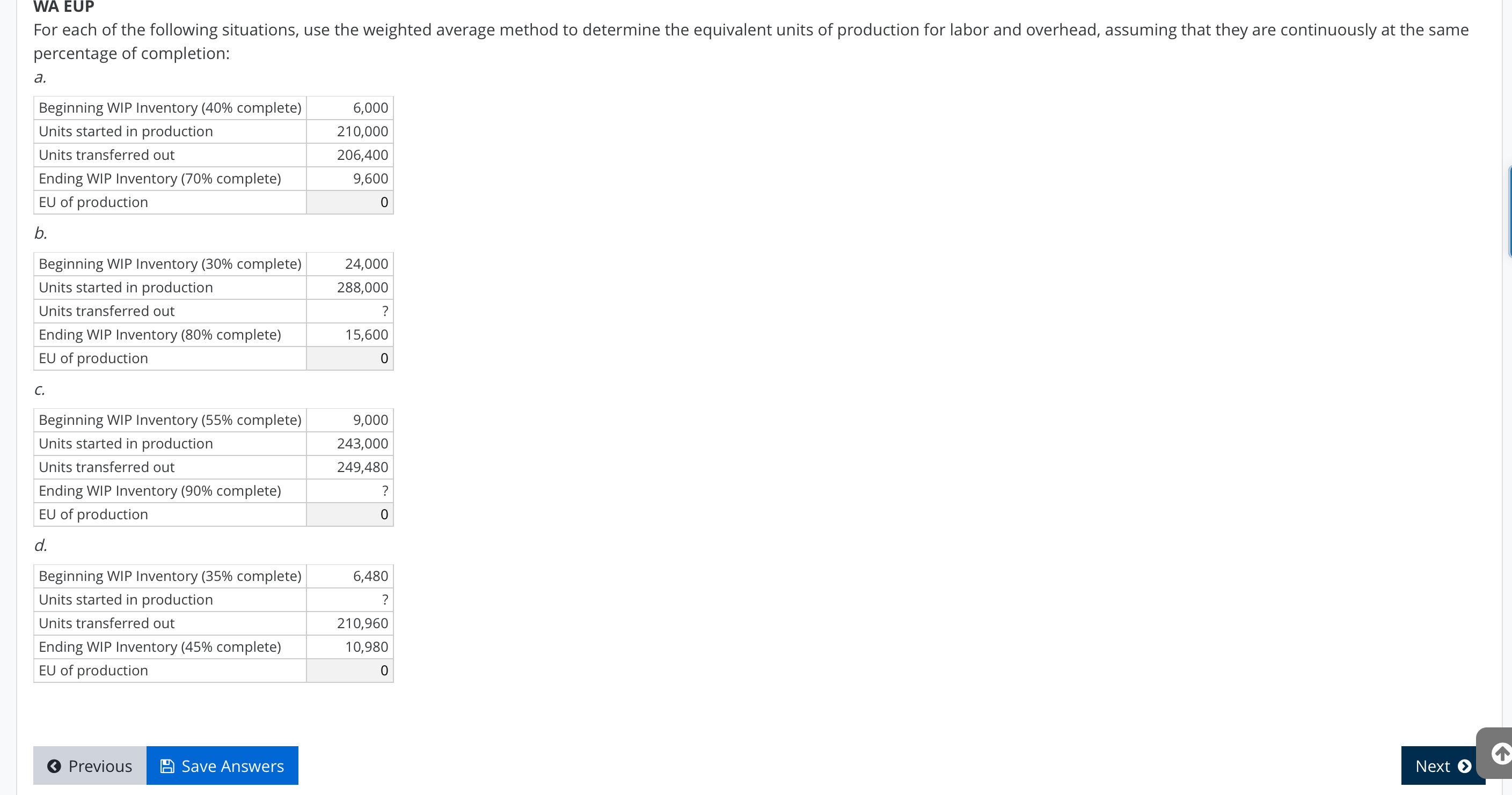

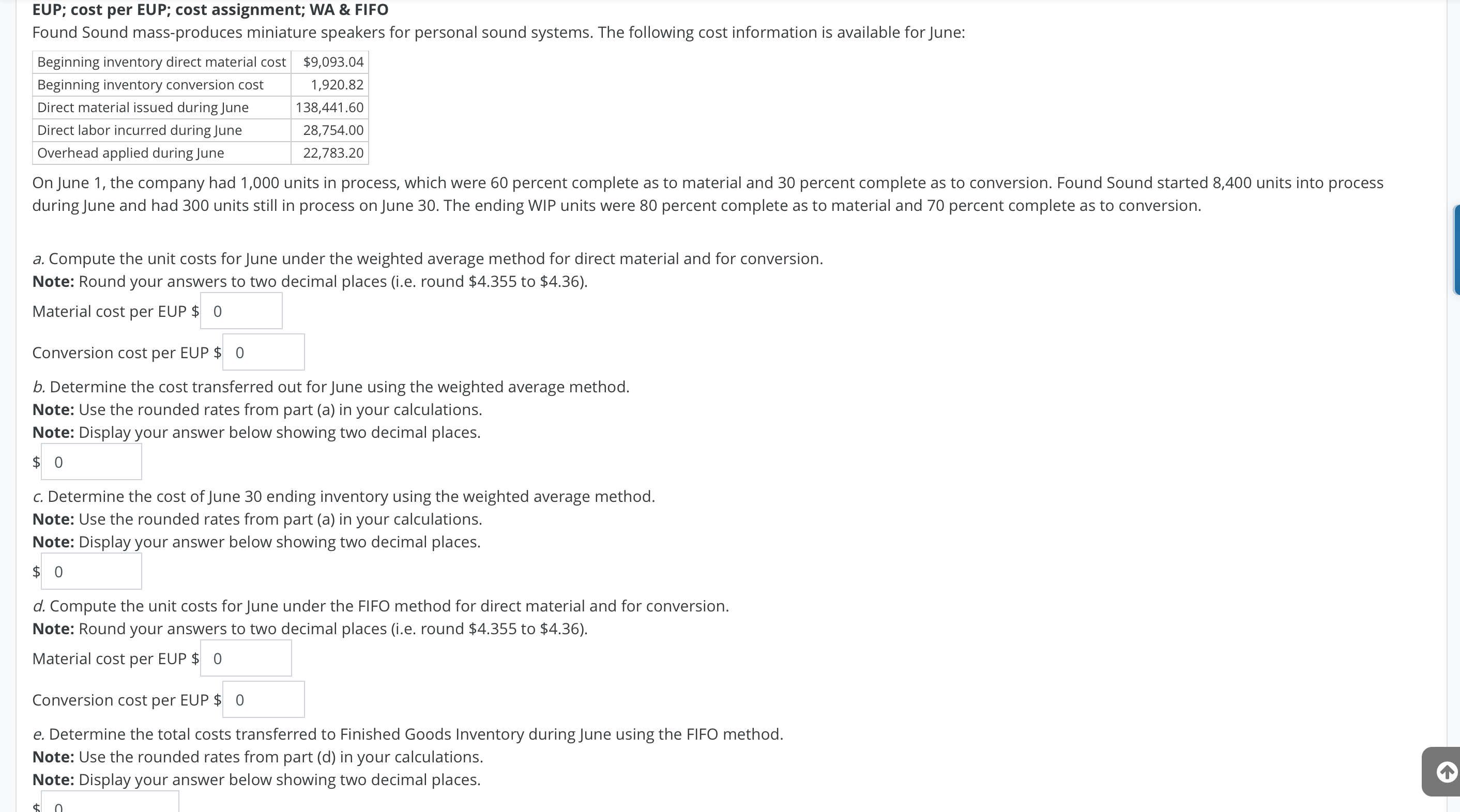

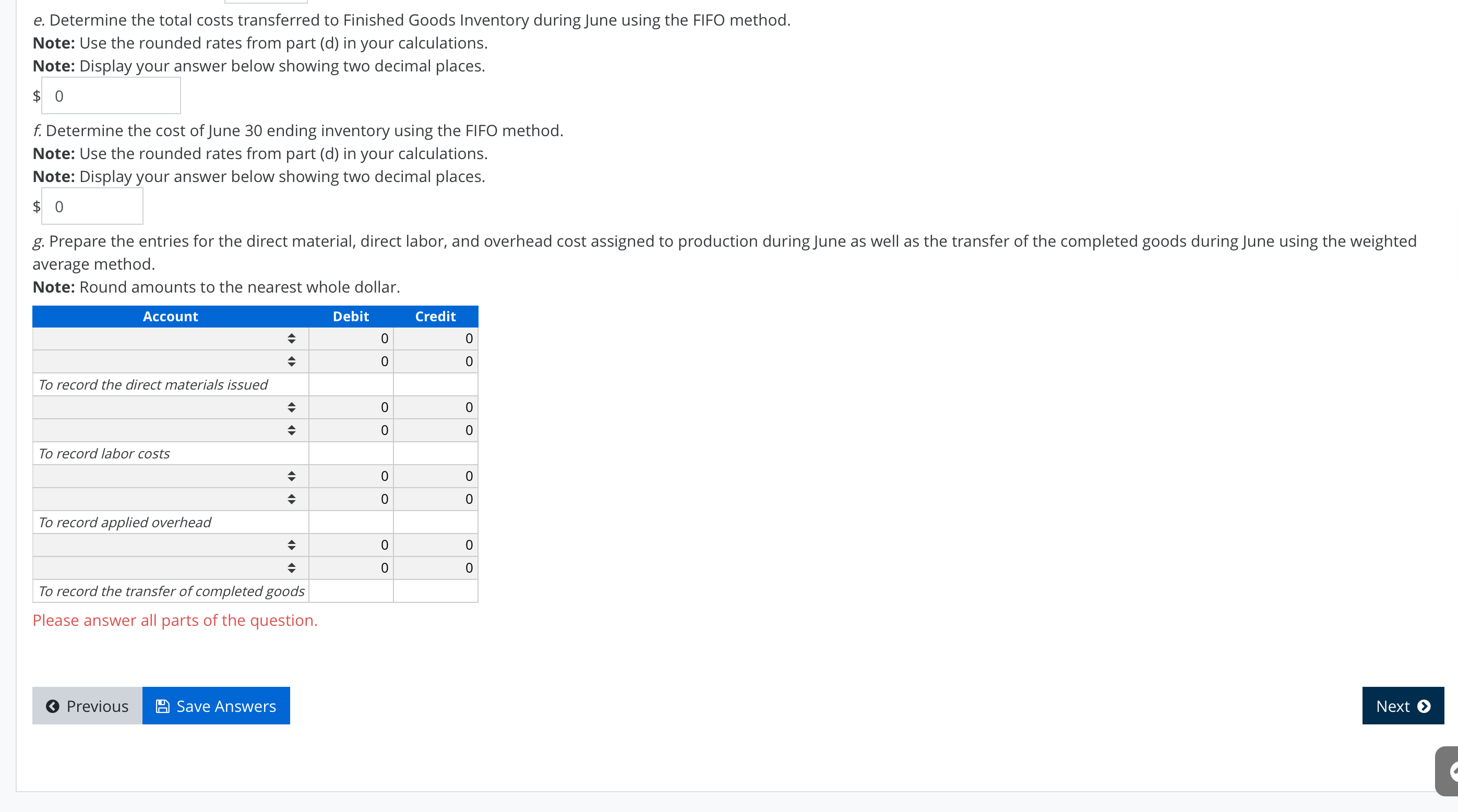

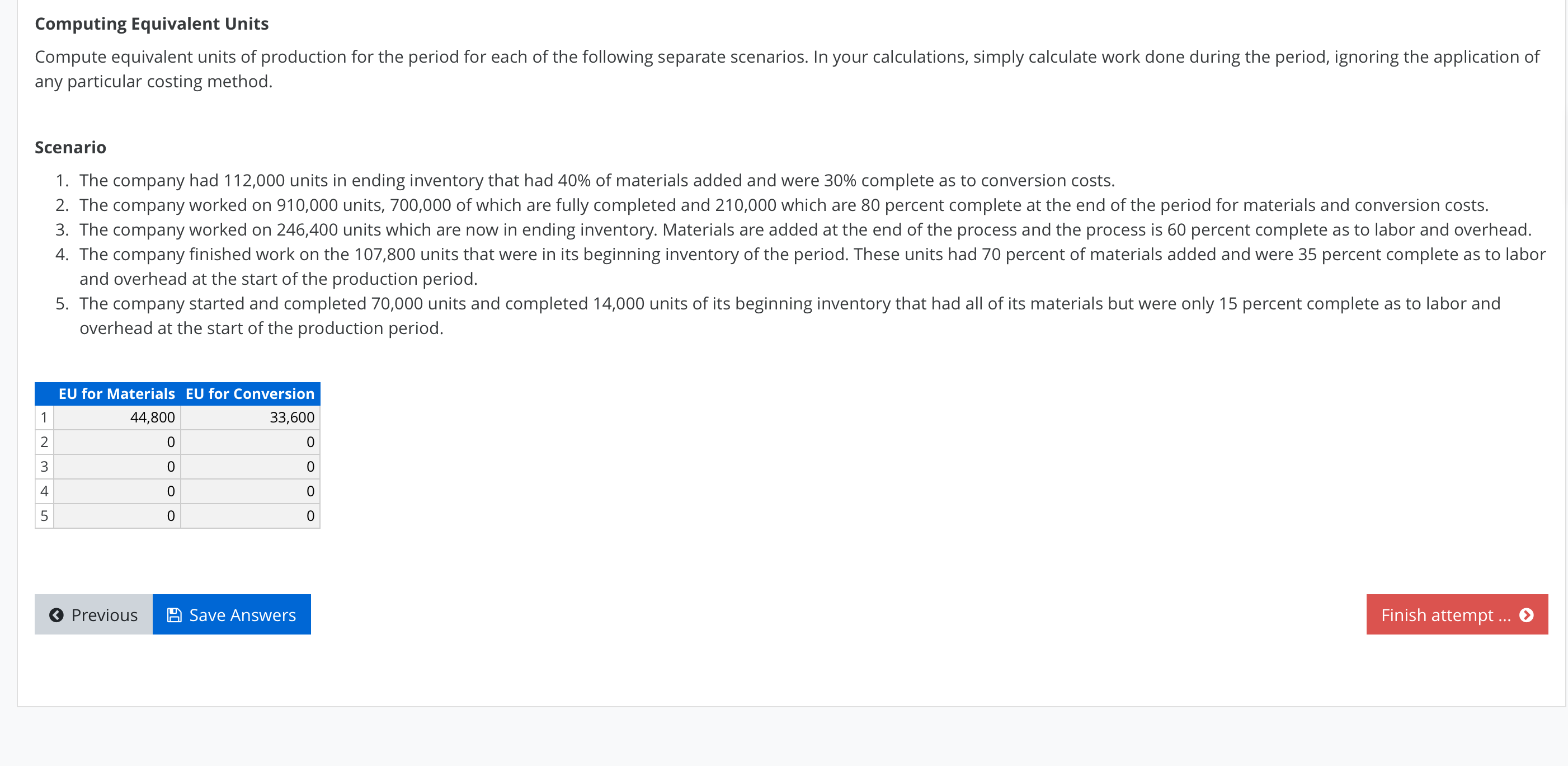

Question 1 Answer saved Marked out of 3.00 P Flag question WA EUP In manufacturing its products, Trevano Corp. adds all direct material at the beginning of the production process. The company's direct labor and overhead are considered to be continuously at the same degree of completion. September production information is as follows: Beginning WIP Inventory 18,000 pounds Started during September 45,000 pounds Completed during September 57,600 pounds Support As of September 1, the beginning WIP Inventory was 30 percent complete as to labor and overhead. On September 30, the ending WIP Inventory was 80 percent complete as to conversion. a. Determine the total number of pounds to account for if Trevano uses the weighted average process costing method. 0 pounds b. Determine the equivalent units of production for direct material. O pounds c. Determine the equivalent units of production for direct labor and overhead. pounds A Save Answers Next > Copyright 2020 Cambridge Business Publishers C, All Rights Reserved | Terms of Use | Privacy Policy | Return Policy | User Guide | Browser Support WA EUP For each of the following situations, use the weighted average method to determine the equivalent units of production for labor and overhead, assuming that they are continuously at the same percentage of completion: a. 6,000 Beginning WIP Inventory (40% complete) Units started in production Units transferred out Ending WIP Inventory (70% complete) EU of production 210,000 206,400 9,600 b. 24,000 288,000 Beginning WIP Inventory (30% complete) Units started in production Units transferred out Ending WIP Inventory (80% complete) EU of production ? 15,600 0 C. Beginning WIP Inventory (55% complete) Units started in production Units transferred out Ending WIP Inventory (90% complete) EU of production 9,000 243,000 249,480 ? 0 d. 6,480 ? Beginning WIP Inventory (35% complete) Units started in production Units transferred out Ending WIP Inventory (45% complete) EU of production 210,960 10,980 0 Previous A Save Answers Next EUP; cost per EUP; cost assignment; WA & FIFO Found Sound mass-produces miniature speakers for personal sound systems. The following cost information is available for June: Beginning inventory direct material cost $9,093.04 Beginning inventory conversion cost 1,920.82 Direct material issued during June 138,441.60 Direct labor incurred during June 28,754.00 Overhead applied during June 22,783.20 On June 1, the company had 1,000 units in process, which were 60 percent complete as to material and 30 percent complete as to conversion. Found Sound started 8,400 units into process during June and had 300 units still in process on June 30. The ending WIP units were 80 percent complete as to material and 70 percent complete as to conversion. a. Compute the unit costs for June under the weighted average method for direct material and for conversion. Note: Round your answers to two decimal places (i.e. round $4.355 to $4.36). Material cost per EUP $ 0 Conversion cost per EUP $ 0 b. Determine the cost transferred out for June using the weighted average method. Note: Use the rounded rates from part (a) in your calculations. Note: Display your answer below showing two decimal places. $ 0 c. Determine the cost of June 30 ending inventory using the weighted average method. Note: Use the rounded rates from part (a) in your calculations. Note: Display your answer below showing two decimal places. $ 0. d. Compute the unit costs for June under the FIFO method for direct material and for conversion. Note: Round your answers to two decimal places (i.e. round $4.355 to $4.36). Material cost per EUP $ 0 Conversion cost per EUP $ 0 e. Determine the total costs transferred to Finished Goods Inventory during June using the FIFO method. Note: Use the rounded rates from part (d) in your calculations. Note: Display your answer below showing two decimal places. e. Determine the total costs transferred to Finished Goods Inventory during June using the FIFO method. Note: Use the rounded rates from part (d) in your calculations. Note: Display your answer below showing two decimal places. $ 0 f. Determine the cost of June 30 ending inventory using the FIFO method. Note: Use the rounded rates from part (d) in your calculations. Note: Display your answer below showing two decimal places. $ 0 production during June as well as the transfer of the completed goods during June using weighted g. Prepare the entries for the direct material, direct labor, and overhead cost assigned average method. Note: Round amounts to the nearest whole dollar. Account Debit Credit 0 0 0 O To record the direct materials issued 0 O 0 To record labor costs 0 o A o 0 To record applied overhead 0 O o O To record the transfer of completed goods Please answer all parts of the question. Previous Save Answers Next > Computing Equivalent Units Compute equivalent units of production for the period for each of the following separate scenarios. In your calculations, simply calculate work done during the period, ignoring the application of any particular costing method. Scenario 1. The company had 112,000 units in ending inventory that had 40% of materials added and were 30% complete as to conversion costs. 2. The company worked on 910,000 units, 700,000 of which are fully completed and 210,000 which are 80 percent complete at the end of the period for materials and conversion costs. 3. The company worked on 246,400 units which are now in ending inventory. Materials are added at the end of the process and the process is 60 percent complete as to labor and overhead. 4. The company finished work on the 107,800 units that were in its beginning inventory of the period. These units had 70 percent of materials added and were 35 percent complete as to labor and overhead at the start of the production period. 5. The company started and completed 70,000 units and completed 14,000 units of its beginning inventory that had all of its materials but were only 15 percent complete as to labor and overhead at the start of the production period. EU for Materials EU for Conversion 44,800 33,600 1 2. 0 0 3 0 0 4 0 0 5 0 0