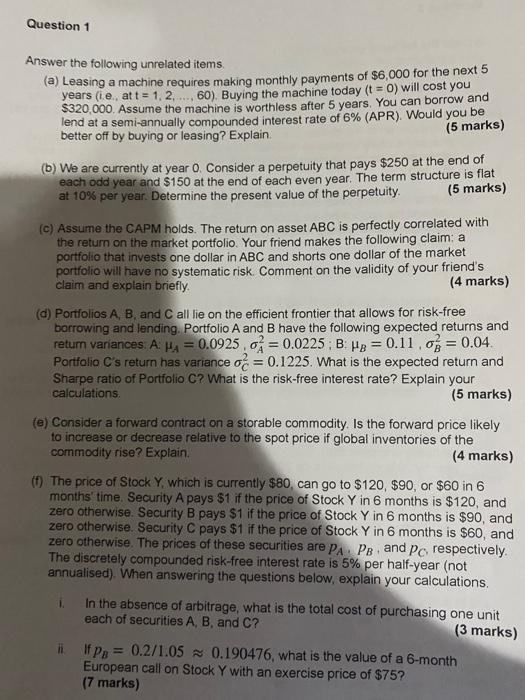

Question 1 Answer the following unrelated items (a) Leasing a machine requires making monthly payments of $6,000 for the next 5 years (ie att = 1, 2, ..., 60). Buying the machine today (t = 0) will cost you $320,000. Assume the machine is worthless after 5 years. You can borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would you be better off by buying or leasing? Explain (5 marks) (b) We are currently at year 0. Consider a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Determine the present value of the perpetuity. (5 marks) (C) Assume the CAPM holds. The return on asset ABC is perfectly correlated with the return on the market portfolio. Your friend makes the following claim: a portfolio that invests one dollar in ABC and shorts one dollar of the market portfolio will have no systematic risk. Comment on the validity of your friend's claim and explain briefly. (4 marks) (d) Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free borrowing and lending Portfolio A and B have the following expected returns and return variances: A HA=0.0925 c = 0.0225; B: HB = 0.11.03 = 0.04. Portfolio C's return has variance o= 0.1225. What is the expected return and Sharpe ratio of Portfolio C? What is the risk-free interest rate? Explain your calculations (5 marks) (e) Consider a forward contract on a storable commodity. Is the forward price likely to increase or decrease relative to the spot price if global inventories of the commodity rise? Explain. (4 marks) ( The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months' time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are PA PB and Po respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualised). When answering the questions below, explain your calculations. 1 In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? (3 marks) Ifps = 0.2/1.05 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75? (7 marks) Question 1 Answer the following unrelated items (a) Leasing a machine requires making monthly payments of $6,000 for the next 5 years (ie att = 1, 2, ..., 60). Buying the machine today (t = 0) will cost you $320,000. Assume the machine is worthless after 5 years. You can borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would you be better off by buying or leasing? Explain (5 marks) (b) We are currently at year 0. Consider a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Determine the present value of the perpetuity. (5 marks) (C) Assume the CAPM holds. The return on asset ABC is perfectly correlated with the return on the market portfolio. Your friend makes the following claim: a portfolio that invests one dollar in ABC and shorts one dollar of the market portfolio will have no systematic risk. Comment on the validity of your friend's claim and explain briefly. (4 marks) (d) Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free borrowing and lending Portfolio A and B have the following expected returns and return variances: A HA=0.0925 c = 0.0225; B: HB = 0.11.03 = 0.04. Portfolio C's return has variance o= 0.1225. What is the expected return and Sharpe ratio of Portfolio C? What is the risk-free interest rate? Explain your calculations (5 marks) (e) Consider a forward contract on a storable commodity. Is the forward price likely to increase or decrease relative to the spot price if global inventories of the commodity rise? Explain. (4 marks) ( The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months' time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are PA PB and Po respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualised). When answering the questions below, explain your calculations. 1 In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? (3 marks) Ifps = 0.2/1.05 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75? (7 marks)