Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Are the following statements true or false? Provide a short justification for your answer. ( Evaluations are based on your justification. ) (

Question

Are the following statements true or false? Provide a short justification for your answer. Evaluations are based on your justification.

On a balance of payments table, the current account balance and financial account balance cannot be surplus at the same time.

Depreciation of the domestic currency is a positive shock to the current account balance in the short run and negative shock in the long run.

The existence of bidask spreads makes it impossible to profit from triangular arbitrage strategies.

A market with higher liquidity usually has smaller bidask spreads.

If currency X is trading at a premium to currency Y then X can earn higher interest rate than Y going forward.

Question

For the following multiplechoice questions, select all the choices that are correct.

Information about which of the following can potentially be learned from a country's balance of payments accounts?

A The foreign currency reserve held by the central bank

B The country's international competitiveness

C The country's status as a net creditor or debtor

D The country's openness to trade

A credit entry in a country's balance of payments has a sign and gives rise to an increase in the

a country's currency.

A negative; demand for

B negative; supply of

C positive; demand for

D positive; supply of

The interest rate will be higher in the United States than in the UK when the dollar is at a forward that is when the dollar is expected to against the pound.

A premium; appreciate

B discount; depreciate

C discount; appreciate

D premium; depreciate

Question

A bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar:

Question: An Australian firm asks the bank for an SFrA$ quote. What crossrate would the bank quote? Round your answers to decimal places.

A foreign exchange trader with a US bank took a short position of when the exchange rate was Subsequently, the exchange rate has changed to

Question: Is this movement in the exchange rate good from the point of view of the position taken by the trader? By how much has the bank's liability changed because of the change in exchange rate?

Question

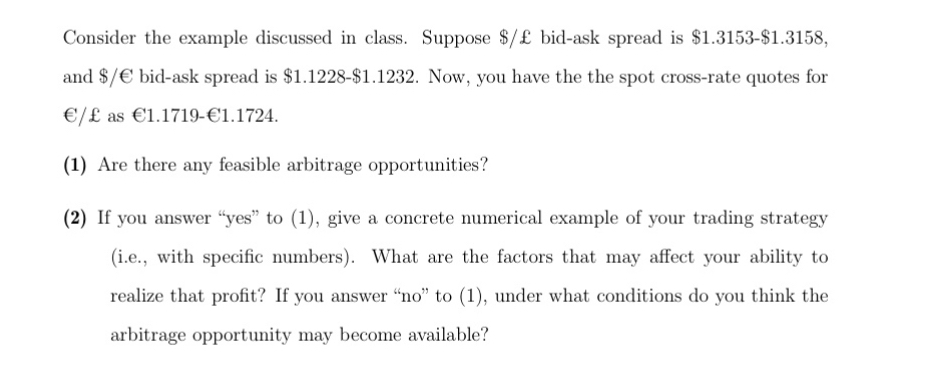

Consider the example discussed in class. Suppose bidask spread is $ $ and bidask spread is $ $ Now, you have the the spot crossrate quotes for as

Are there any feasible arbitrage opportunities?

If you answer "yes" to give a concrete numerical example of your trading strategy ie with specific numbers What are the factors that may affect your ability to realize that profit? If you answer no to under what conditions do you think the arbitrage opportunity may become available?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started