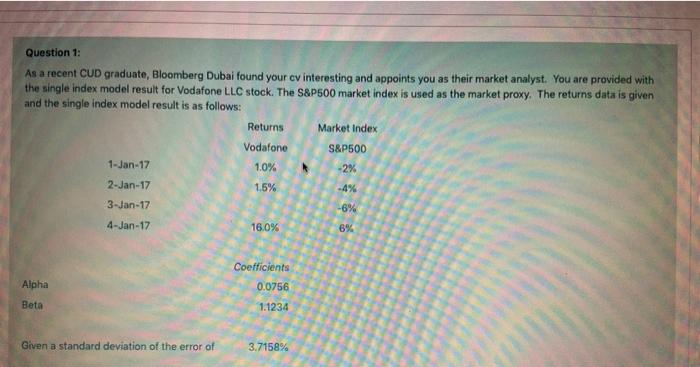

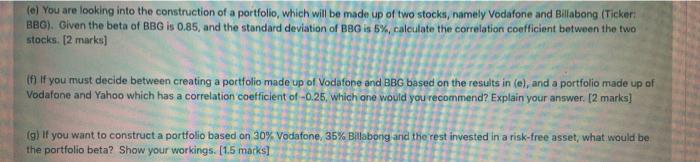

Question 1: As a recent CUD graduate, Bloomberg Dubai found your ev interesting and appoints you as their market analyst. You are provided with the single index model result for Vodafone LLC stock. The S&P500 market index is used as the market proxy. The returns data is given and the single index model result is as follows: Returns Market Index Vodafone S&P500 1-Jan-17 1.0% -2% 1.5% 2-Jan-17 3-Jan-17 -6% 4-Jan-17 16.0% 6% Alpha Coefficients 0.0756 1.1234 Beta Given a standard deviation of the error of 3.7158% (e) You are looking into the construction of a portfolio, which will be made up of two stocks, namely Vodafone and Billabong (Ticker BBG). Given the beta of BBG is 0.85, and the standard deviation of Beg is 5%, calculate the correlation coefficient between the two stocks. [2 marks) t if you must decide between creating a portfolio made up of Vodafone and BBG based on the results in (e), and a portfolio made up of Vodafone and Yahoo which has a correlation coefficient of -0.25. Which one would you recommend? Explain your answer. [2 marks] (g) If you want to construct a portfolio based on 30% Vodafone, 35% Billabong and the rest invested in a risk-free asset, what would be the portfolio beta? Show your workings. (1.5 marks] Question 1: As a recent CUD graduate, Bloomberg Dubai found your ev interesting and appoints you as their market analyst. You are provided with the single index model result for Vodafone LLC stock. The S&P500 market index is used as the market proxy. The returns data is given and the single index model result is as follows: Returns Market Index Vodafone S&P500 1-Jan-17 1.0% -2% 1.5% 2-Jan-17 3-Jan-17 -6% 4-Jan-17 16.0% 6% Alpha Coefficients 0.0756 1.1234 Beta Given a standard deviation of the error of 3.7158% (e) You are looking into the construction of a portfolio, which will be made up of two stocks, namely Vodafone and Billabong (Ticker BBG). Given the beta of BBG is 0.85, and the standard deviation of Beg is 5%, calculate the correlation coefficient between the two stocks. [2 marks) t if you must decide between creating a portfolio made up of Vodafone and BBG based on the results in (e), and a portfolio made up of Vodafone and Yahoo which has a correlation coefficient of -0.25. Which one would you recommend? Explain your answer. [2 marks] (g) If you want to construct a portfolio based on 30% Vodafone, 35% Billabong and the rest invested in a risk-free asset, what would be the portfolio beta? Show your workings. (1.5 marks]