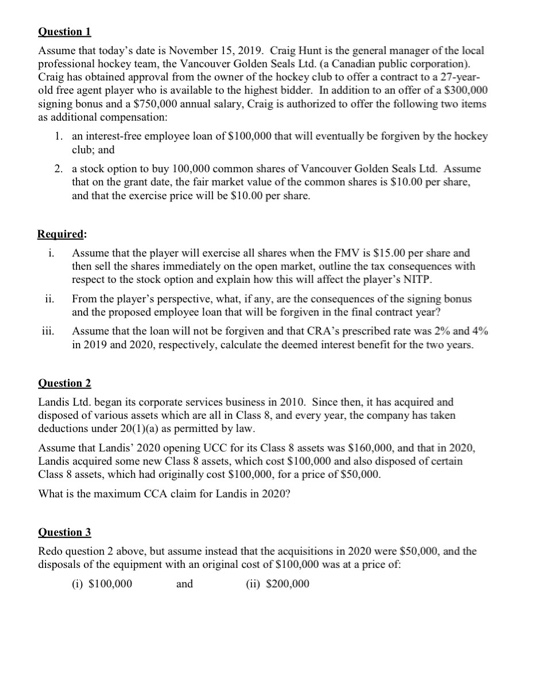

Question 1 Assume that today's date is November 15, 2019. Craig Hunt is the general manager of the local professional hockey team, the Vancouver Golden Seals Ltd. (a Canadian public corporation). Craig has obtained approval from the owner of the hockey club to offer a contract to a 27-year- old free agent player who is available to the highest bidder. In addition to an offer of a $300,000 signing bonus and a $750,000 annual salary, Craig is authorized to offer the following two items as additional compensation: 1. an interest-free employee loan of S100,000 that will eventually be forgiven by the hockey club; and 2. a stock option to buy 100,000 common shares of Vancouver Golden Seals Ltd. Assume that on the grant date, the fair market value of the common shares is $10.00 per share, and that the exercise price will be $10.00 per share. Required: i. Assume that the player will exercise all shares when the FMV is $15.00 per share and then sell the shares immediately on the open market, outline the tax consequences with respect to the stock option and explain how this will affect the player's NITP. ii. From the player's perspective, what, if any, are the consequences of the signing bonus and the proposed employee loan that will be forgiven in the final contract year? Assume that the loan will not be forgiven and that CRA's prescribed rate was 2% and 4% in 2019 and 2020, respectively, calculate the deemed interest benefit for the two years. Question 2 Landis Ltd. began its corporate services business in 2010. Since then, it has acquired and disposed of various assets which are all in Class 8, and every year, the company has taken deductions under 20(1)(a) as permitted by law. Assume that Landis 2020 opening UCC for its Class 8 assets was $160,000, and that in 2020, Landis acquired some new Class 8 assets, which cost $100,000 and also disposed of certain Class 8 assets, which had originally cost $100,000, for a price of $50,000. What is the maximum CCA claim for Landis in 2020? Question 3 Redo question 2 above, but assume instead that the acquisitions in 2020 were $50,000, and the disposals of the equipment with an original cost of $100,000 was at a price of: (0) $100,000 and (ii) $200,000