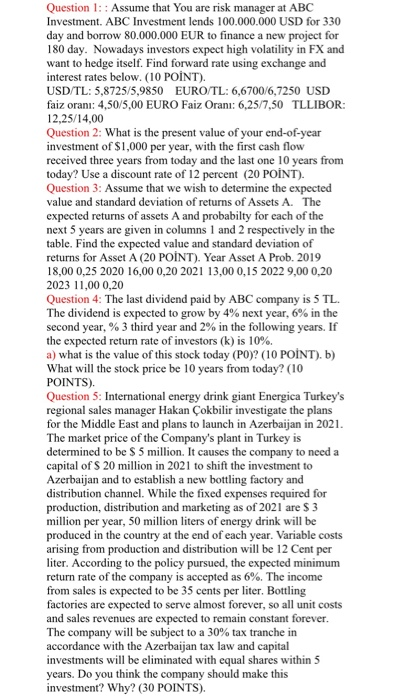

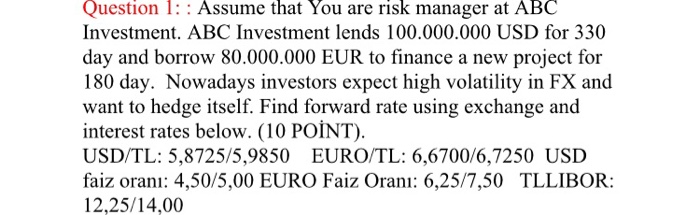

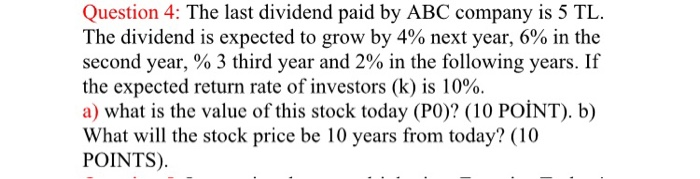

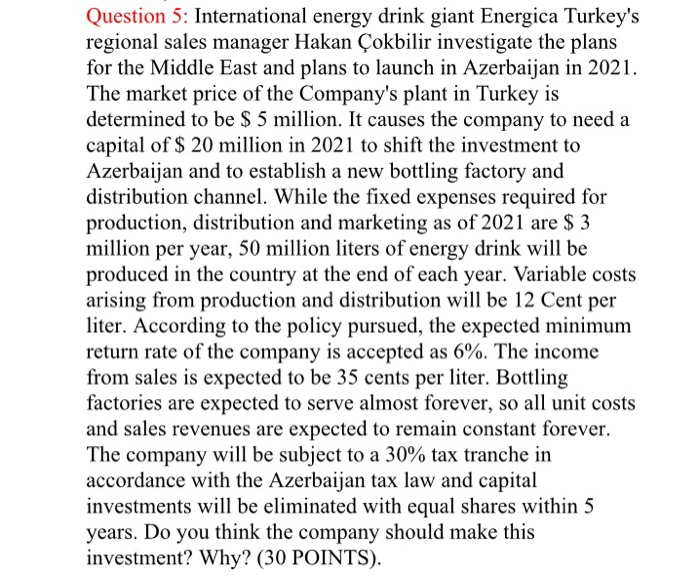

Question 1:: Assume that you are risk manager at ABC Investment. ABC Investment lends 100.000.000 USD for 330 day and borrow 80.000.000 EUR to finance a new project for 180 day. Nowadays investors expect high volatility in FX and want to hedge itself. Find forward rate using exchange and interest rates below. (10 POINT). USD/TL: 5,8725/5,9850 EURO/TL: 6,6700/6,7250 USD faiz oran: 4,50/5,00 EURO Faiz Oran: 6,25/7,50 TLLIBOR: 12,25/14,00 Question 2: What is the present value of your end-of-year investment of $1,000 per year, with the first cash flow received three years from today and the last one 10 years from today? Use a discount rate of 12 percent (20 POINT). Question 3: Assume that we wish to determine the expected value and standard deviation of returns of Assets A. The expected returns of assets A and probabilty for each of the next 5 years are given in columns 1 and 2 respectively in the table. Find the expected value and standard deviation of returns for Asset A (20 POINT). Year Asset A Prob. 2019 18,00 0,25 2020 16,00 0,20 2021 13,00 0,15 2022 9,00 0,20 2023 11,00 0,20 Question 4: The last dividend paid by ABC company is 5 TL. The dividend is expected to grow by 4% next year, 6% in the second year, %3 third year and 2% in the following years. If the expected return rate of investors (k) is 10%. a) what is the value of this stock today (PO)? (10 POINT). b) What will the stock price be 10 years from today? (10 POINTS). Question 5: International energy drink giant Energica Turkey's regional sales manager Hakan okbilir investigate the plans for the Middle East and plans to launch in Azerbaijan in 2021. The market price of the Company's plant in Turkey is determined to be $ 5 million. It causes the company to need a capital of $ 20 million in 2021 to shift the investment to Azerbaijan and to establish a new bottling factory and distribution channel. While the fixed expenses required for production, distribution and marketing as of 2021 are $ 3 million per year, 50 million liters of energy drink will be produced in the country at the end of each year. Variable costs arising from production and distribution will be 12 Cent per liter. According to the policy pursued, the expected minimum return rate of the company is accepted as 6%. The income from sales is expected to be 35 cents per liter. Bottling factories are expected to serve almost forever, so all unit costs and sales revenues are expected to remain constant forever. The company will be subject to a 30% tax tranche in accordance with the Azerbaijan tax law and capital investments will be eliminated with equal shares within 5 years. Do you think the company should make this investment? Why? (30 POINTS). Question 1: : Assume that you are risk manager at ABC Investment. ABC Investment lends 100.000.000 USD for 330 day and borrow 80.000.000 EUR to finance a new project for 180 day. Nowadays investors expect high volatility in FX and want to hedge itself. Find forward rate using exchange and interest rates below. (10 PONT). USD/TL: 5,8725/5,9850 EURO/TL: 6,6700/6,7250 USD faiz oran: 4,50/5,00 EURO Faiz Oran: 6,25/7,50 TLLIBOR: 12,25/14,00 Question 2: What is the present value of your end-of-year investment of $1,000 per year, with the first cash flow received three years from today and the last one 10 years from today? Use a discount rate of 12 percent (20 PONT). Question 3: Assume that we wish to determine the expected value and standard deviation of returns of Assets A. The expected returns of assets A and probabilty for each of the next 5 years are given in columns 1 and 2 respectively in the table. Find the expected value and standard deviation of returns for Asset A (20 PONT). Year Asset A Prob. 2019 18,00 0,25 2020 16,00 0,20 2021 13,00 0,15 2022 9,00 0,20 2023 11,00 0,20 Question 4: The last dividend paid by ABC company is 5 TL. The dividend is expected to grow by 4% next year, 6% in the second year, % 3 third year and 2% in the following years. If the expected return rate of investors (k) is 10%. a) what is the value of this stock today (PO)? (10 PONT). b) What will the stock price be 10 years from today? (10 POINTS). Question 5: International energy drink giant Energica Turkey's regional sales manager Hakan okbilir investigate the plans for the Middle East and plans to launch in Azerbaijan in 2021. The market price of the Company's plant in Turkey is determined to be $ 5 million. It causes the company to need a capital of $ 20 million in 2021 to shift the investment to Azerbaijan and to establish a new bottling factory and distribution channel. While the fixed expenses required for production, distribution and marketing as of 2021 are $ 3 million per year, 50 million liters of energy drink will be produced in the country at the end of each year. Variable costs arising from production and distribution will be 12 Cent per liter. According to the policy pursued, the expected minimum return rate of the company is accepted as 6%. The income from sales is expected to be 35 cents per liter. Bottling factories are expected to serve almost forever, so all unit costs and sales revenues are expected to remain constant forever. The company will be subject to a 30% tax tranche in accordance with the Azerbaijan tax law and capital investments will be eliminated with equal shares within 5 years. Do you think the company should make this investment? Why? (30 POINTS)