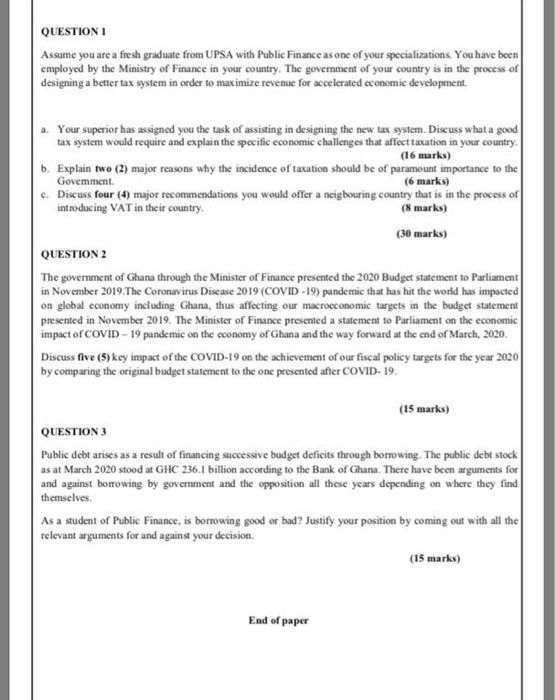

QUESTION 1 Assume you are a fresh graduate from UPSA with Public Finance as one of your specializations. You have been employed by the Ministry of Finance in your country. The government of your country is in the process of designing a better tax system in order to maximize revenue for accelerated economic development. Your superior has assigned you the task of assisting in designing the new tax system. Discuss what a good tax system would require and explain the specific economic challenges that affect taxation in your country. (16 marks) b. Explain two (2) major reasons why the incidence of taxation should be of paramount importance to the Govemment (6 marks) c. Discuss four (1) major recommendations you would offer a neigbouring country that is in the process of introducing VAT in their country, (8 marks) (30 marks) QUESTION 2 The government of Ghana through the Minister of Finance presented the 2020 Budget statement to Parliament in November 2019. The Coronavirus Disease 2019 (COVID -19) pandemic that has hit the world has impacted on global economy including Ghana, thus affecting our macroeconomic targets in the budget statement presented in November 2019. The Minister of Finance presented a statement to Parliament on the economic impact of COVID - 19 pandemic on the economy of Ghana and the way forward at the end of March, 2020. Discuss five (5) key impact of the COVID-19 on the achievement of our fiscal policy targets for the year 2020 by comparing the original budget statement to the one presented after COVID-19. (15 marks) QUESTION 3 Public debt arises as a result of financing successive budget deficits through borrowing. The public debt stock as at March 2020 stood at GHC 236.1 billion according to the Bank of Ghana. There have been arguments for and against borrowing by government and the opposition all these years depending on where they find themselves As a student of Public Finance, is borrowing good or bad? Justify your position by coming out with all the relevant arguments for and against your decision. (15 marks) End of paper QUESTION 1 Assume you are a fresh graduate from UPSA with Public Finance as one of your specializations. You have been employed by the Ministry of Finance in your country. The government of your country is in the process of designing a better tax system in order to maximize revenue for accelerated economic development. Your superior has assigned you the task of assisting in designing the new tax system. Discuss what a good tax system would require and explain the specific economic challenges that affect taxation in your country. (16 marks) b. Explain two (2) major reasons why the incidence of taxation should be of paramount importance to the Govemment (6 marks) c. Discuss four (1) major recommendations you would offer a neigbouring country that is in the process of introducing VAT in their country, (8 marks) (30 marks) QUESTION 2 The government of Ghana through the Minister of Finance presented the 2020 Budget statement to Parliament in November 2019. The Coronavirus Disease 2019 (COVID -19) pandemic that has hit the world has impacted on global economy including Ghana, thus affecting our macroeconomic targets in the budget statement presented in November 2019. The Minister of Finance presented a statement to Parliament on the economic impact of COVID - 19 pandemic on the economy of Ghana and the way forward at the end of March, 2020. Discuss five (5) key impact of the COVID-19 on the achievement of our fiscal policy targets for the year 2020 by comparing the original budget statement to the one presented after COVID-19. (15 marks) QUESTION 3 Public debt arises as a result of financing successive budget deficits through borrowing. The public debt stock as at March 2020 stood at GHC 236.1 billion according to the Bank of Ghana. There have been arguments for and against borrowing by government and the opposition all these years depending on where they find themselves As a student of Public Finance, is borrowing good or bad? Justify your position by coming out with all the relevant arguments for and against your decision. (15 marks) End of paper