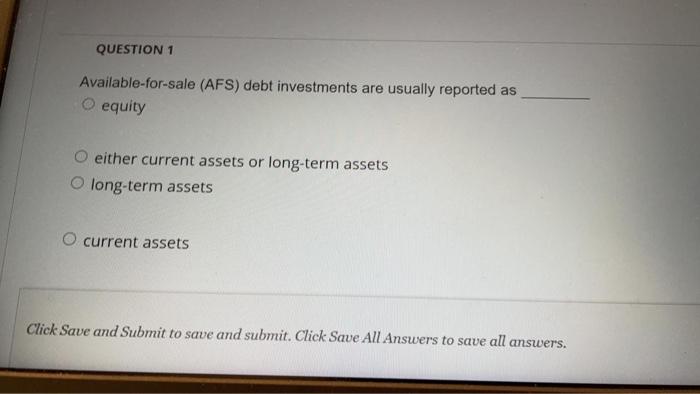

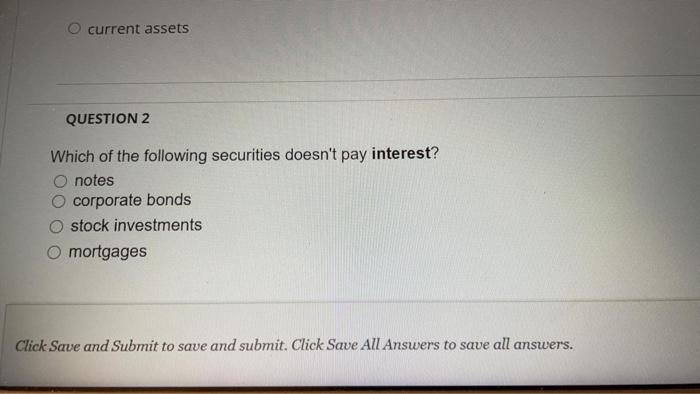

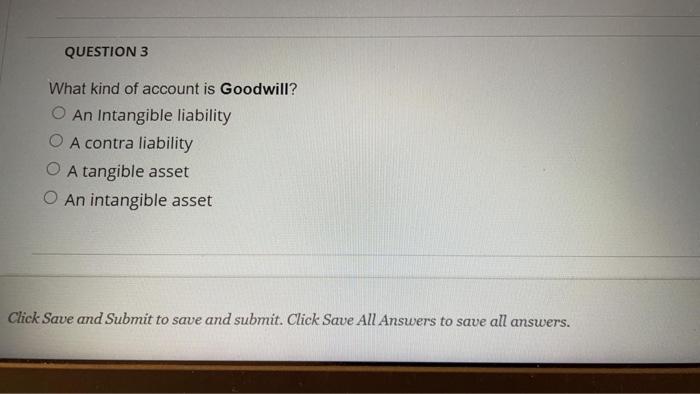

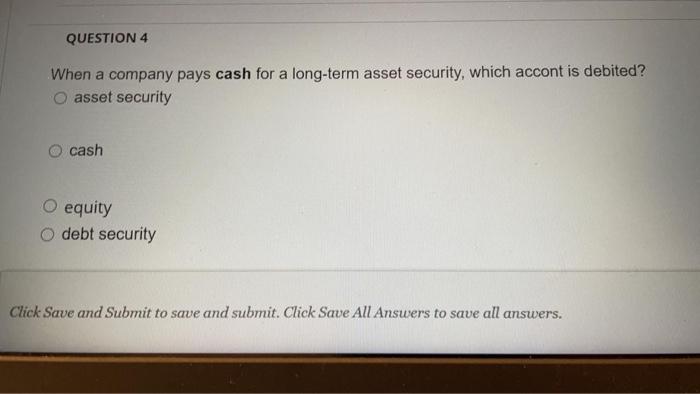

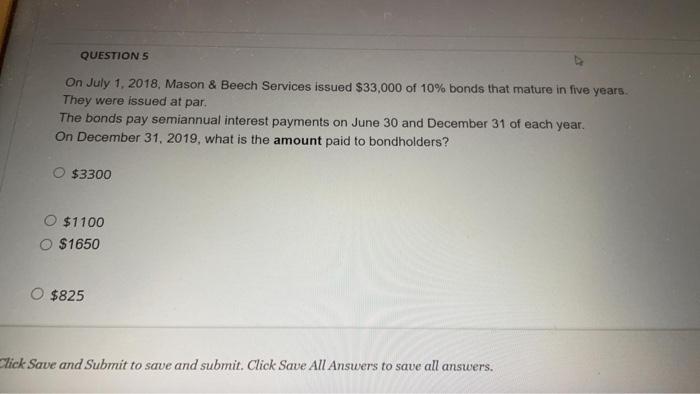

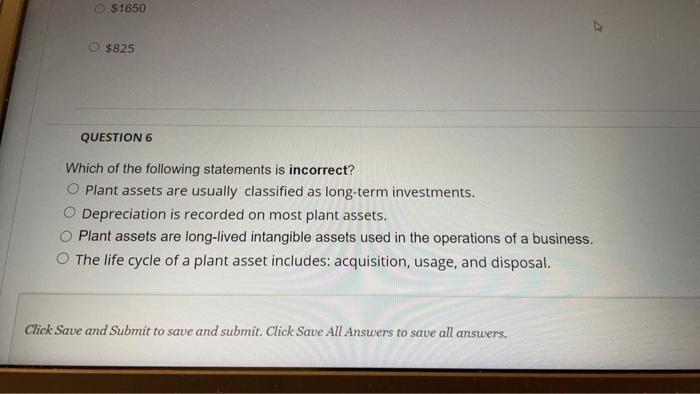

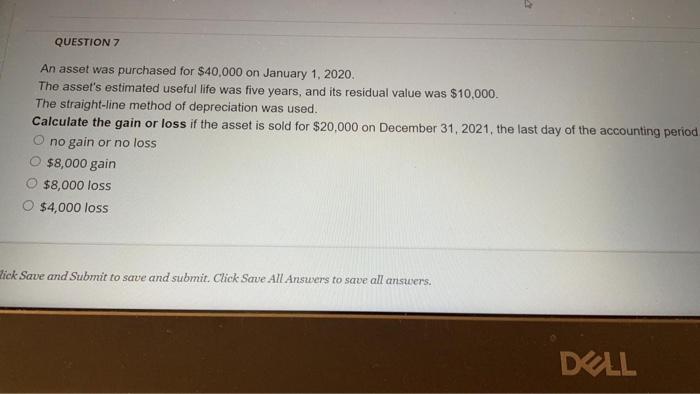

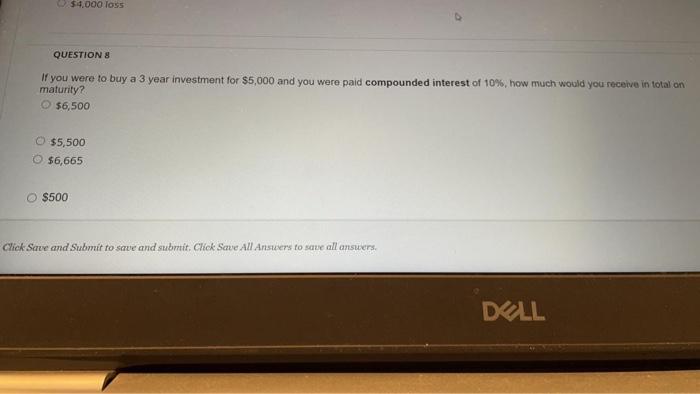

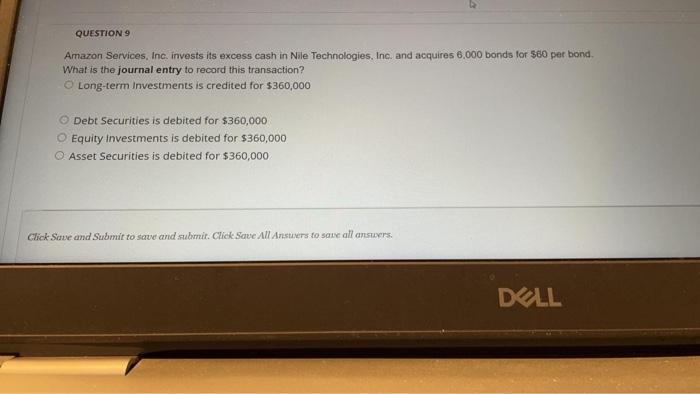

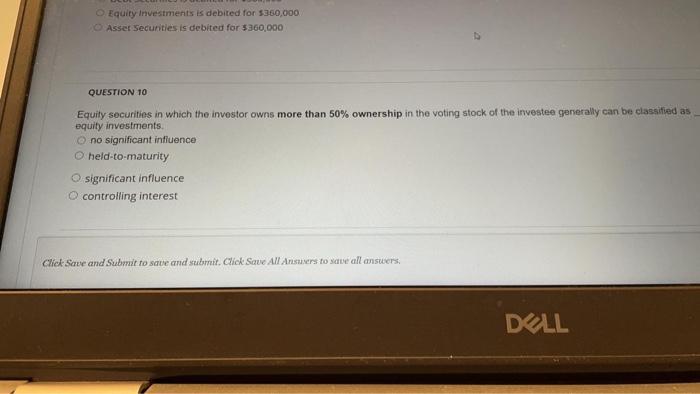

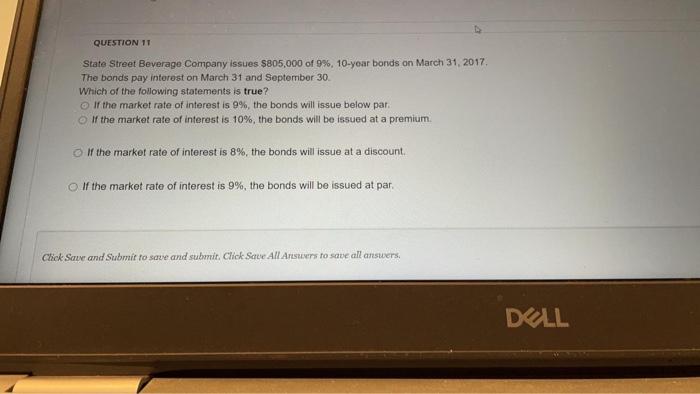

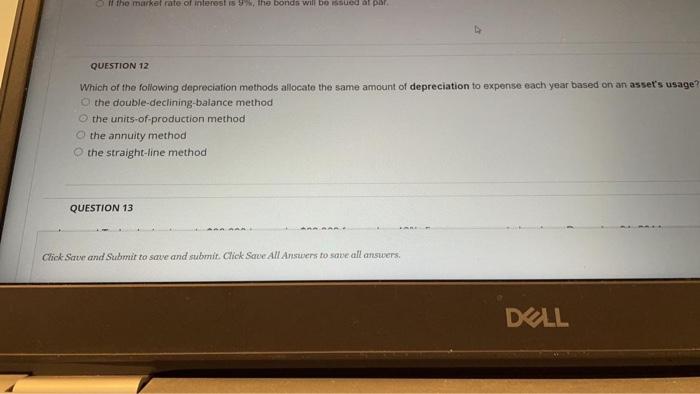

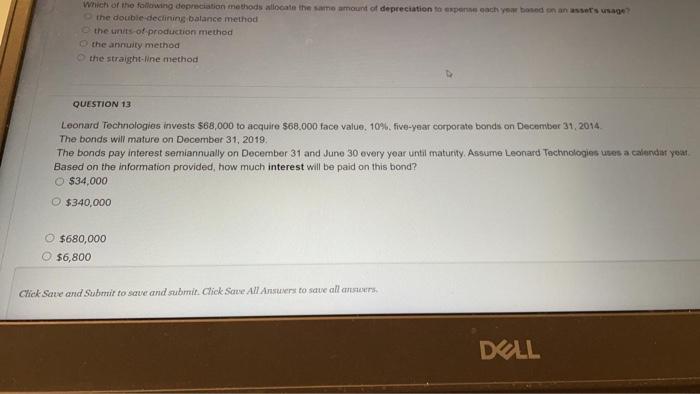

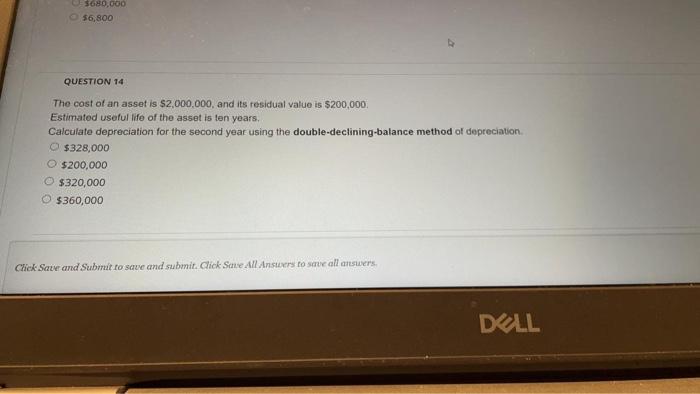

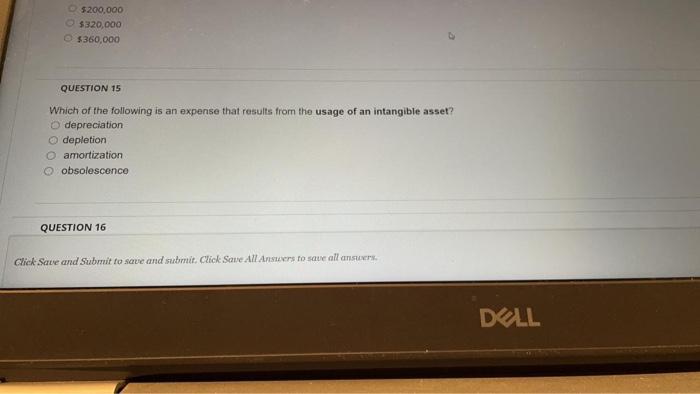

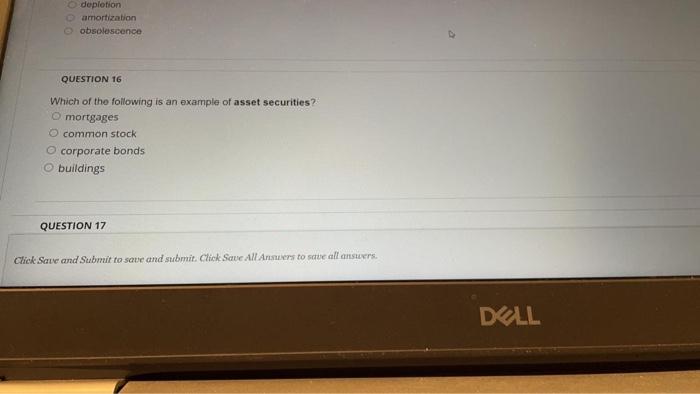

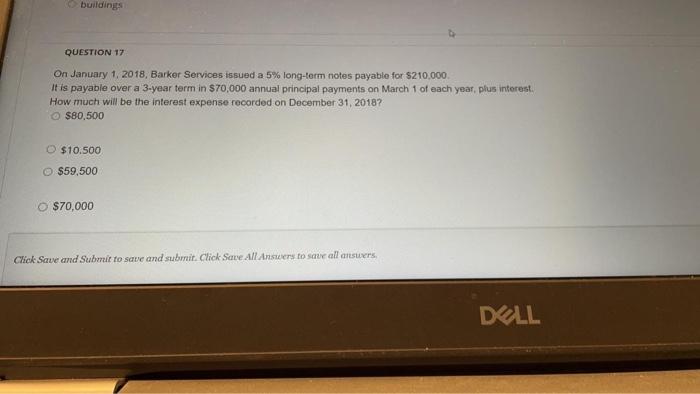

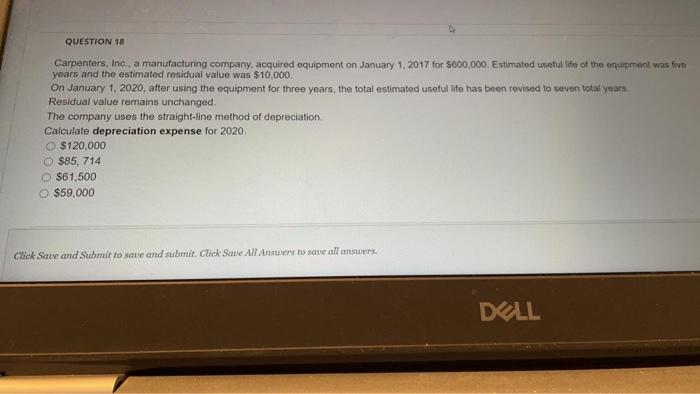

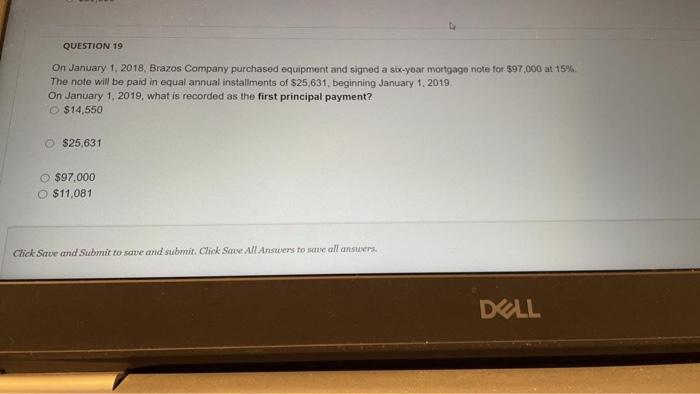

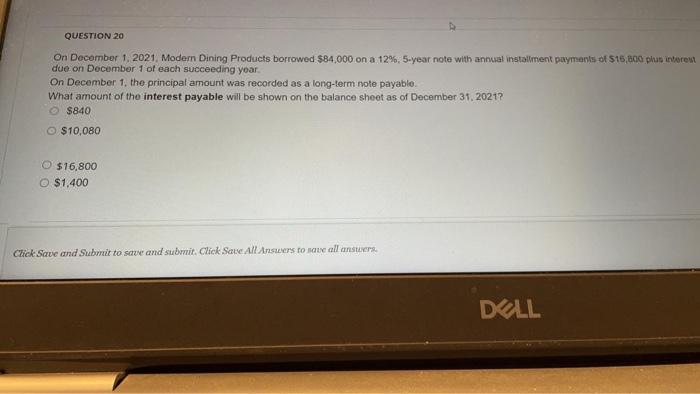

QUESTION 1 Available-for-sale (AFS) debt investments are usually reported as O equity either current assets or long-term assets O long-term assets O current assets Click Save and Submit to save and submit. Click Save All Answers to save all answers. O current assets QUESTION 2 Which of the following securities doesn't pay interest? notes corporate bonds stock investments O mortgages Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 3 What kind of account is Goodwill? O An Intangible liability A contra liability A tangible asset An intangible asset Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 4 When a company pays cash for a long-term asset security, which accont is debited? O asset security O cash O equity debt security Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTIONS On July 1, 2018, Mason & Beech Services issued $33,000 of 10% bonds that mature in five years. They were issued at par. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On December 31, 2019, what is the amount paid to bondholders? $3300 O $1100 O $1650 $825 Click Save and Submit to save and submit. Click Save All Answers to save all answers. $1650 $825 QUESTION 6 Which of the following statements is incorrect? Plant assets are usually classified as long-term investments. Depreciation is recorded on most plant assets. Plant assets are long-lived intangible assets used in the operations of a business. The life cycle of a plant asset includes: acquisition, usage, and disposal. Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 7 An asset was purchased for $40,000 on January 1, 2020. The asset's estimated useful life was five years, and its residual value was $10,000 The straight-line method of depreciation was used. Calculate the gain or loss if the asset is sold for $20,000 on December 31, 2021, the last day of the accounting period no gain or no loss $8,000 gain $8,000 loss O $4,000 loss Lick Save and Submit to save and submit. Click Save All Answers to save all answers. DELL $4.000 loss QUESTIONS If you were to buy a 3 year investment for $5,000 and you were paid compounded interest of 10%, how much would you receive in total on maturity? $6,500 $5,500 $6,665 $500 Click Save and Submit to save and submit. Chick Save All Answers to save all answers DOLL QUESTIONS Amazon Services, Inc. invests its excess cash in Nile Technologies, Inc. and acquires 6,000 bonds for $60 per bond. What is the journal entry to record this transaction? Long-term Investments is credited for $360,000 Debt Securities is debited for $360,000 Equity Investments is debited for $360,000 Asset Securities is debited for $360,000 Click Save and Submit to save and submit. Click Save All Ants to an all answers. DALL Equity Investments is debited for $360,000 Asser Securities is debited for $360,000 QUESTION 10 Equity securities in which the investor owns more than 50% ownership in the voting stock of the investee generally can be classified as equity investments no significant influence held-to-maturity O significant influence O controlling interest Click Save and Submit to save and submit. Click Save All Answers to save all answers, DELL QUESTION 11 State Street Beverage Company issues $805,000 of 9%, 10-year bonds on March 31, 2017 The bonds pay interest on March 31 and September 30 Which of the following statements is true? If the market rate of interest is 9%, the bonds will issue below par If the market rate of interest is 10%, the bonds will be issued at a premium of the market rate of interest is 8%, the bonds will issue at a discount If the market rate of interest is 9%, the bonds will be issued at par Chick Save and Submit to save and submit. Click Save All Ars to save all answers, DOLL Of the market rate of interest 159, the bonds will be issued a par QUESTION 12 Which of the following depreciation methods allocate the same amount of depreciation to expense each year based on an asset's usage? the double-declining balance method the units of production method the annuity method o the straight-line method QUESTION 13 Click Save and Submit to save and submit. Click Save All Answers to save all answers DELL Which of the following depreciation methods allocate the same amount of depreciation to expers each you honed on an assets ? the double declining balance method the units of production method the annuity method the straight-line method QUESTION 13 Leonard Technologies invests $68,000 to acquire 568.000 face value, 10% five-year corporate bonds on December 31, 2014 The bonds will mature on December 31, 2019 The bonds pay interest semiannually on December 31 and June 30 every year until maturity. Assume Leonard Technologies us a calendar yeat Based on the information provided, how much interest will be paid on this bond? $34.000 $340,000 O $680,000 $6,800 Click Save and Submit to sue and submit. Click Save All Answers to save alla DOLL S680,000 56,800 QUESTION 14 The cost of an asset is $2,000,000, and its residual value is $200,000 Estimated useful life of the asset is ten years. Calculate depreciation for the second year using the double-declining-balance method of depreciation $328,000 O $200,000 $320,000 O $360,000 Chick Save and Submit to save and submit. Click Save All Answers to see all answers. DELL $200,000 $320,000 $360,000 QUESTION 15 Which of the following is an expense that results from the usage of an intangible asset? depreciation depletion O amortization obsolescence QUESTION 16 Click Save and Submit to save and submit. Click Save All Answers to save all answers DELL deplotion amortization obsolescence QUESTION 16 Which of the following is an example of asset securities? mortgages O common stock corporate bonds O buildings QUESTION 17 Click Save and Submit to save and submit. Click Save All Anser to save all answers DOLL buildings QUESTION 17 On January 1, 2018, Barker Services issued a 5% long-term notes payable for $210,000 It is payable over a 3-year term in $70,000 annual principal payments on March 1 of each year, plus interest. How much will be the interest expense recorded on December 31, 2018? $80,500 O $10.500 $59,500 O $70,000 Click Save and Submit to save and submit. Click Save All Answers to see all answers DELL QUESTION 18 Carpenters, Inc. a manufacturing company, acquired equipment on January 1, 2017 for $600,000. Estimated useful life of the equipment was five years and the estimated residual value was $10,000. On January 1, 2020, after using the equipment for three years, the total estimated useful life has been revised to seven total years Residual value remains unchanged. The company uses the straight-line method of depreciation Calculate depreciation expense for 2020 O $120.000 $85, 714 O $61,500 $59,000 Click Save and submit to save and submit. Click Save All Answer to save all answers, DELL QUESTION 19 On January 1, 2018. Brazos Company purchased equipment and signed a six-year mortgage note for $97,000 at 15% The note will be paid in equal annual installments of $25,631, beginning January 1, 2019 On January 1, 2019, what is recorded as the first principal payment? $14,550 $25,631 $97.000 O $11,081 Click Save and Submit to save and submit. Click Save All Answers to see all answers DELL QUESTION 20 On December 1, 2021, Modern Dining Products borrowed $84,000 on a 12%, 5-year note with annual installment payments of $15,000 plus interest due on December 1 of each succeeding yoar On December 1, the principal amount was recorded as a long-term noto payable What amount of the interest payable will be shown on the balance sheet as of December 31, 2021? $840 $10,080 $16.800 O $1,400 Click Save and Submit to save and submit. Click Save All Answers to me all answer DELL