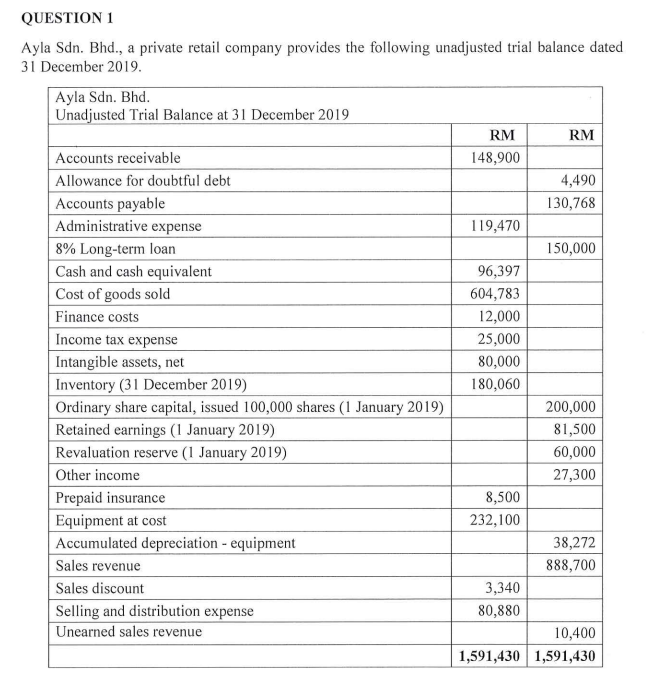

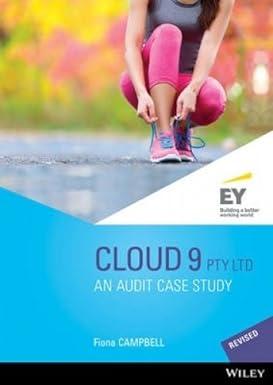

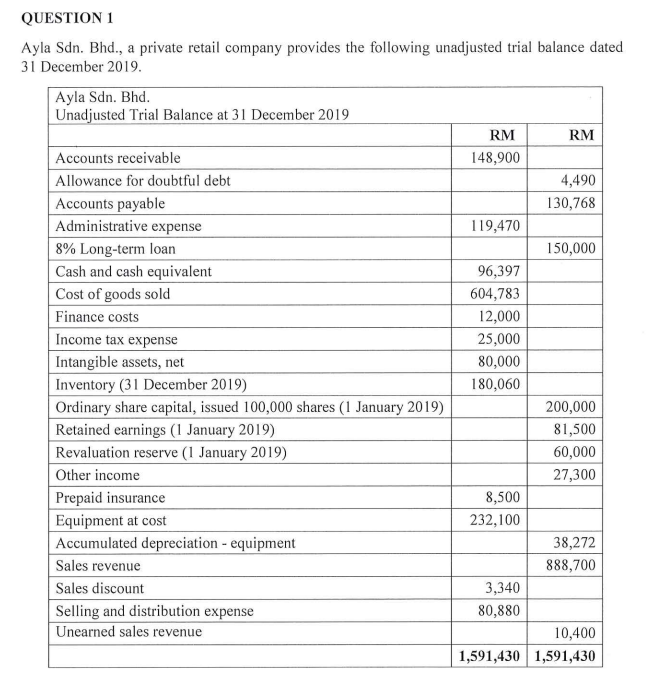

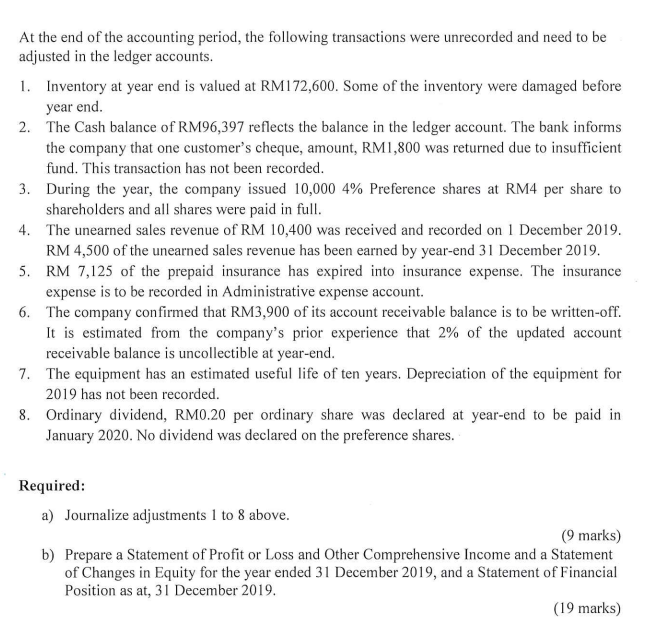

QUESTION 1 Ayla Sdn. Bhd., a private retail company provides the following unadjusted trial balance dated 31 December 2019. Ayla Sdn. Bhd. Unadjusted Trial Balance at 31 December 2019 RM RM Accounts receivable 148,900 Allowance for doubtful debt 4,490 Accounts payable 130,768 Administrative expense 119,470 8% Long-term loan 150,000 Cash and cash equivalent 96,397 Cost of goods sold 604,783 Finance costs 12,000 Income tax expense 25,000 Intangible assets, net 80,000 Inventory (31 December 2019) 180,060 Ordinary share capital, issued 100,000 shares (1 January 2019) 200,000 Retained earnings (1 January 2019) 81,500 Revaluation reserve (1 January 2019) 60,000 Other income 27,300 Prepaid insurance 8,500 Equipment at cost 232,100 Accumulated depreciation - equipment 38,272 Sales revenue 888,700 Sales discount 3,340 Selling and distribution expense 80,880 Unearned sales revenue 10,400 1,591,430 1,591,430 At the end of the accounting period, the following transactions were unrecorded and need to be adjusted in the ledger accounts. 1. Inventory at year end is valued at RM172,600. Some of the inventory were damaged before year end. 2. The Cash balance of RM96,397 reflects the balance in the ledger account. The bank informs the company that one customer's cheque, amount, RM1,800 was returned due to insufficient fund. This transaction has not been recorded. 3. During the year, the company issued 10,000 4% Preference shares at RM4 per share to shareholders and all shares were paid in full. 4. The unearned sales revenue of RM 10,400 was received and recorded on 1 December 2019. RM 4,500 of the unearned sales revenue has been earned by year-end 31 December 2019. 5. RM 7,125 of the prepaid insurance has expired into insurance expense. The insurance expense is to be recorded in Administrative expense account. 6. The company confirmed that RM3,900 of its account receivable balance is to be written-off. It is estimated from the company's prior experience that 2% of the updated account receivable balance is uncollectible at year-end. 7. The equipment has an estimated useful life of ten years. Depreciation of the equipment for 2019 has not been recorded. 8. Ordinary dividend, RM0.20 per ordinary share was declared at year-end to be paid in January 2020. No dividend was declared on the preference shares. Required: a) Journalize adjustments 1 to 8 above. (9 marks) b) Prepare a Statement of Profit or Loss and Other Comprehensive Income and a Statement of Changes in Equity for the year ended 31 December 2019, and a Statement of Financial Position as at, 31 December 2019. (19 marks)