Question:

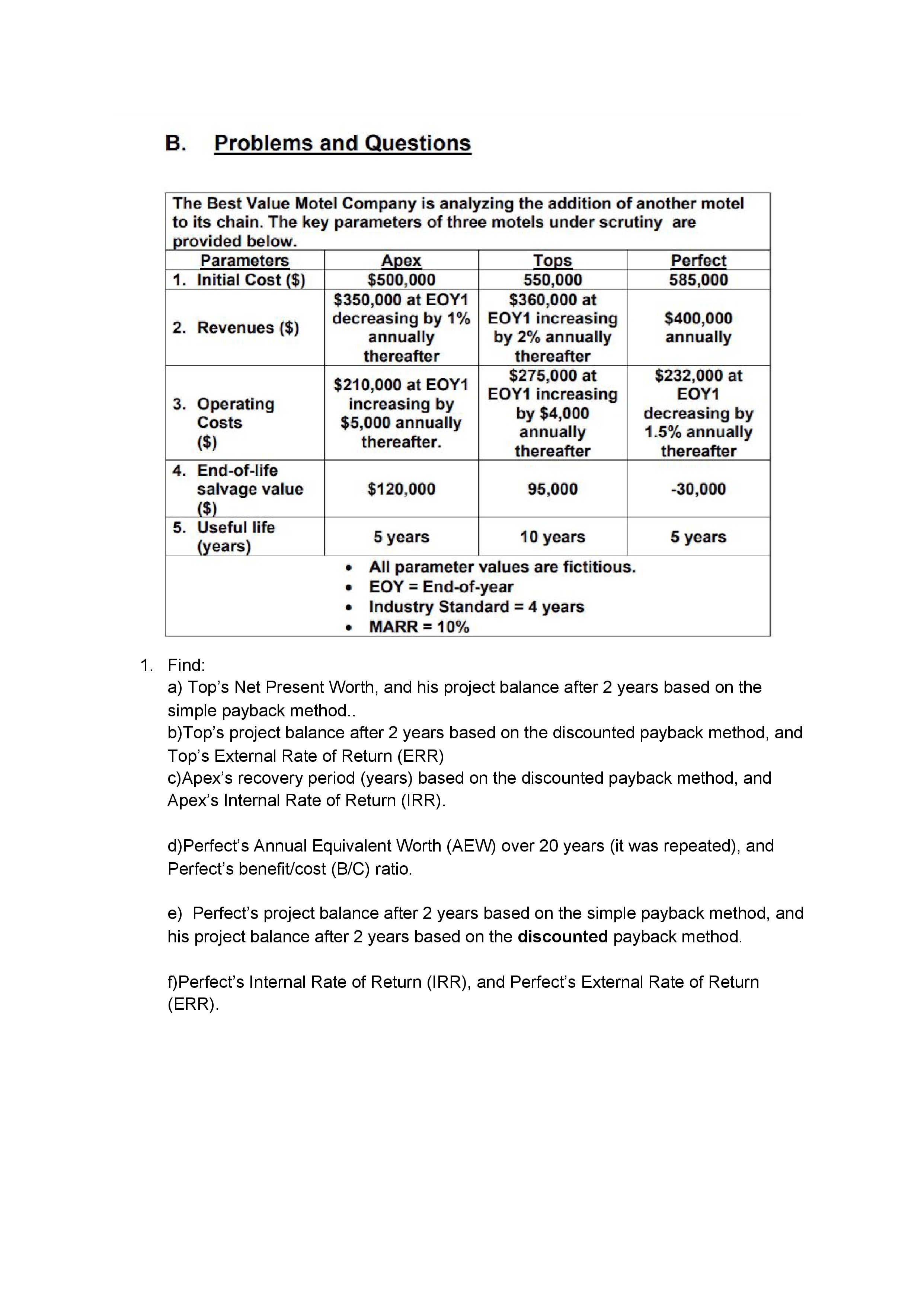

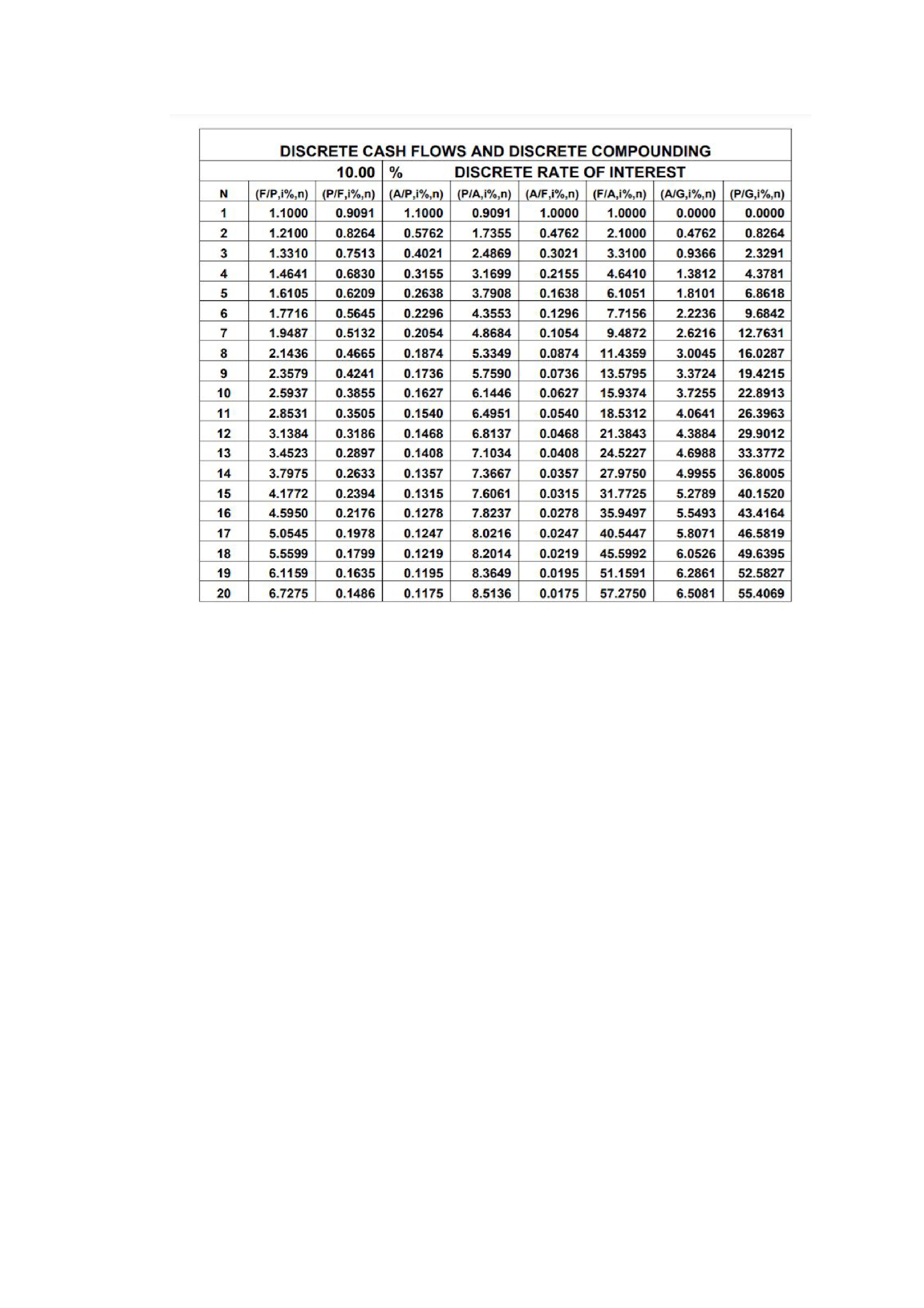

1. B. Problems and Questions The Best Value Motel Company is analyzing the addition of another motel to its chain. The key parameters of three motels under scrutiny are . rovided below. Parameters A - X \"m 1. InItIaI Cost $ 5500.000 $350,000 at E0\" $360,000 at decreasing by 1% EOY1 increasing $400,000 2. Revenues ($) annually by 2% annually annually thereafter thereafter $210,000 at 50w [50:217st at. \"3293\" at _ increasmg E01\"! 3. Operating increasing by by $4,000 decreasing by Costs $5,000 annually It 1 '7 II ($) thereafter. annua y .5 o annua y thereafter thereafter 4. End-of-Iife salvage value $120,000 95,000 60,000 $ 5. Useful life (years) 5 years to years 5 years a All parameter values are ctitious. - EOY = End-oi-year . Industry Standard = 4 years I "ARR = 10% Find: a) Top's Net Present Worth, and his project balance after 2 years based on the simple payback method. b)Top's project balance after 2 years based on the discounted payback method, and Top's External Rate of Return (ERR) c)Apex's recovery period (years) based on the discounted payback method, and Apex's Internal Rate of Return (IRR). d)Perfect's Annual Equivalent Worth (AEW) over 20 years (it was repeated), and Perfect's benefit/cost (B/C) ratio. e) Perfect's project balance after 2 years based on the simple payback method, and his project balance after 2 years based on the discounted payback method. f)Perfect's Internal Rate of Return (IRR), and Perfect's External Rate of Return (ERR). DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00 % DISCRETE RATE OF INTEREST N (F/P,1%,n) (P/F,i%,n) (A/P,1%,n) (P/A,1%,n) (A/F,i%,n) (F/A,1%,n) (A/G,i%,n) (P/G,i%,n) N- 0.0000 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 1.2100 0.8264 0.5762 1.7355 0.4762 2.1000 0.4762 .8264 On A W 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.3310 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.3812 4.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 5.8618 6 1.7716 0.5645 0.2296 4.3553 0.1296 7.7156 2.2236 9.6842 0.5132 0.2054 4.8684 0.1054 9.4872 2.6216 12.7631 1.9487 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.5795 3.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 10 11 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 12 13 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 14 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 0.2394 0.1315 7.6061 31.7725 5.2789 40.1520 15 4.1772 0.0315 16 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 0. 1978 40.5447 46.5819 17 5.0545 0.1247 8.0216 0.0247 5.8071 18 5.5599 0.1799 0.1219 8.2014 0.0219 45.5992 6.0526 49.6395 19 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 0.1486 55.4069 6.7275 0.1175 8.5136 6.5081 20 0.0175 57.2750