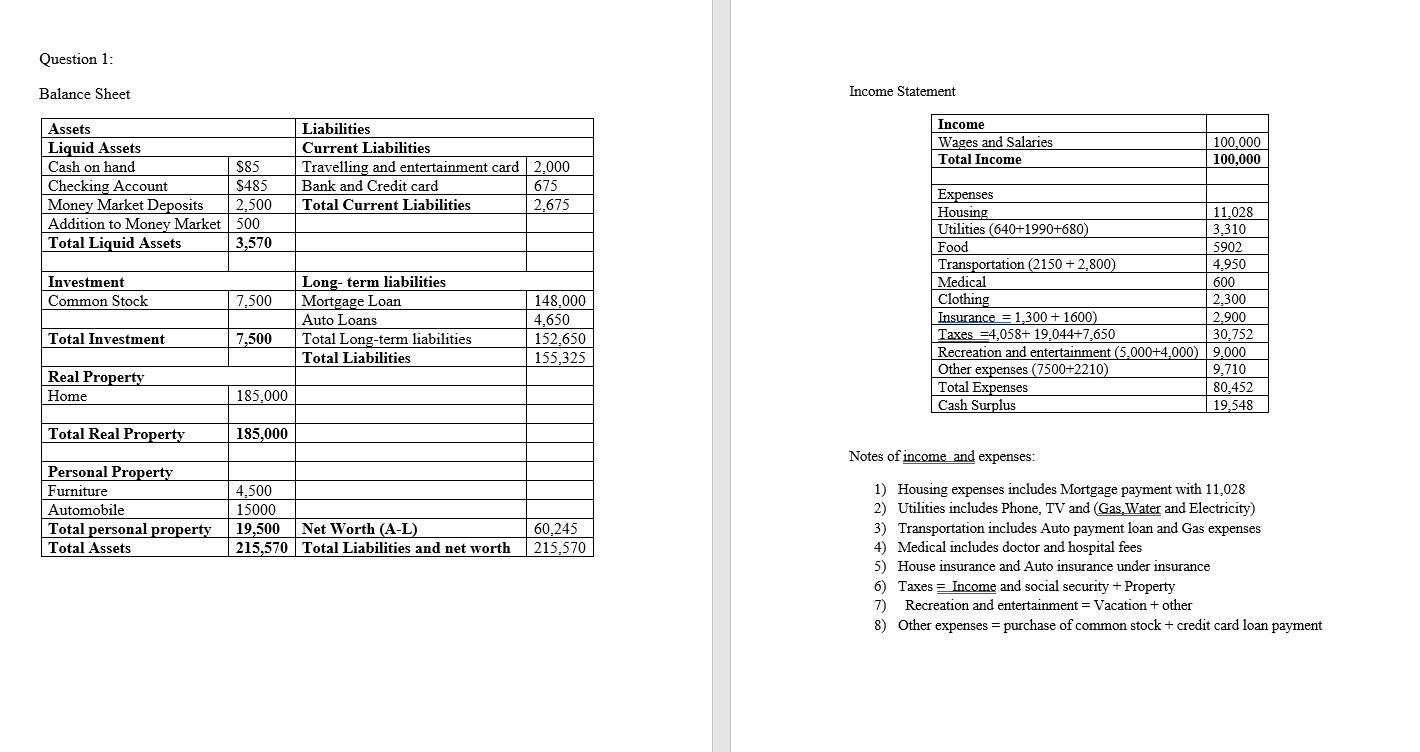

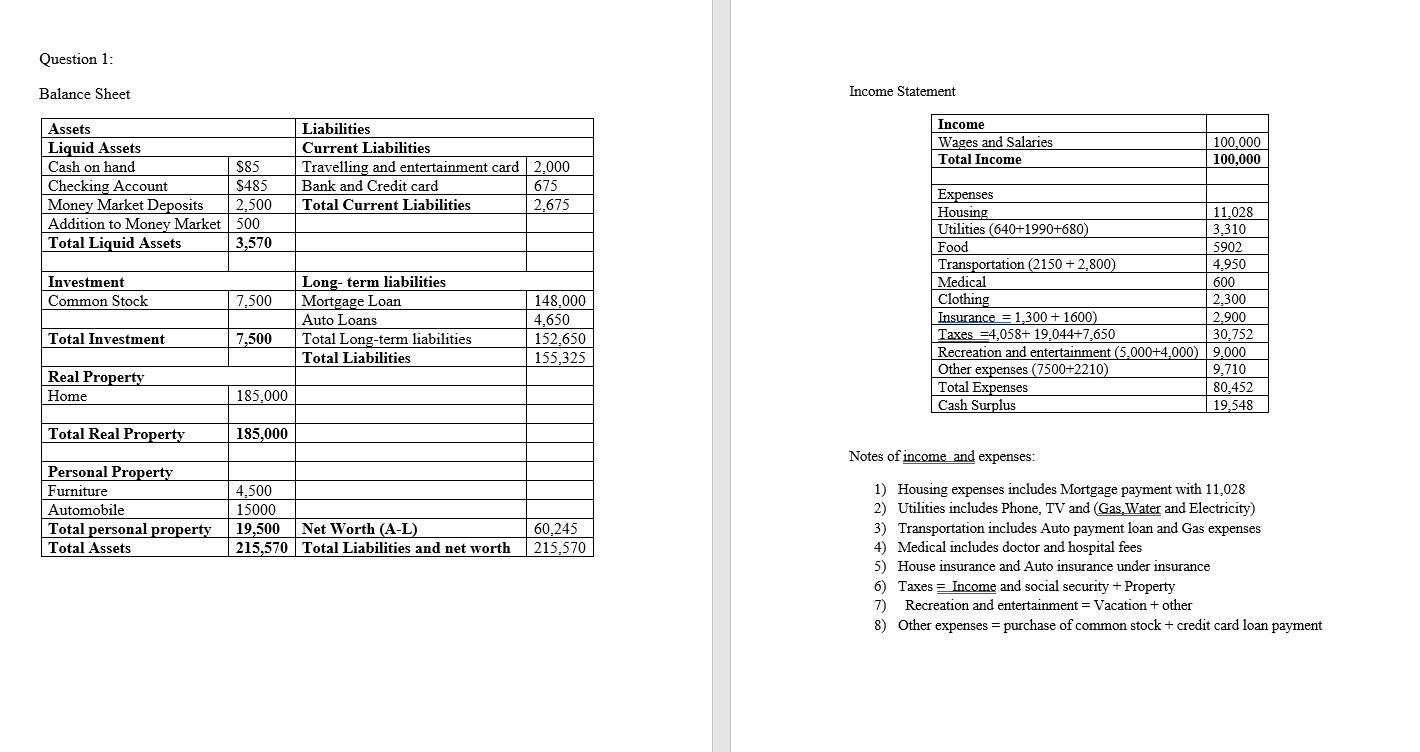

Question 1: Balance Sheet Income Statement Income Wages and Salaries Total Income Liabilities Current Liabilities Travelling and entertainment card 2,000 Bank and Credit card 675 Total Current Liabilities 2.675 100,000 100,000 Assets Liquid Assets Cash on hand 85 Checking Account $485 Money Market Deposits 2.500 Addition to Money Market 500 Total Liquid Assets 3,570 Investment Common Stock 7.500 Long-term liabilities Mortgage Loan Auto Loans Total Long-term liabilities Total Liabilities 148.000 4,650 152,650 155,325 Expenses Housing 11,028 Utilities (640+1990+680) 3,310 Food 5902 Transportation (2150 + 2,800) 4,950 Medical 600 Clothing 2,300 Insurance = 1,300 + 1600) 2.900 Taxes =4,058+ 19,044+7,650 30,752 Recreation and entertainment (5,000+4,000) 9,000 Other expenses (7500+2210) 9,710 Total Expenses 80,452 Cash Surplus 19.548 Total Investment 7,500 Real Property Home 185,000 Total Real Property 185,000 Notes of income and expenses: Personal Property Furniture Automobile Total personal property Total Assets 4,500 15000 19,500 Net Worth (A-L) 215,570 Total Liabilities and net worth 60.245 215,570 1) Housing expenses includes Mortgage payment with 11,028 2) Utilities includes Phone, TV and Gas Water and Electricity) 3) Transportation includes Auto payment loan and Gas expenses 4) Medical includes doctor and hospital fees 5) House insurance and Auto insurance under insurance 6) Taxes = Income and social security + Property 7) Recreation and entertainment = Vacation + other 8) Other expenses = purchase of common stock + credit card loan payment Question 1: Balance Sheet Income Statement Income Wages and Salaries Total Income Liabilities Current Liabilities Travelling and entertainment card 2,000 Bank and Credit card 675 Total Current Liabilities 2.675 100,000 100,000 Assets Liquid Assets Cash on hand 85 Checking Account $485 Money Market Deposits 2.500 Addition to Money Market 500 Total Liquid Assets 3,570 Investment Common Stock 7.500 Long-term liabilities Mortgage Loan Auto Loans Total Long-term liabilities Total Liabilities 148.000 4,650 152,650 155,325 Expenses Housing 11,028 Utilities (640+1990+680) 3,310 Food 5902 Transportation (2150 + 2,800) 4,950 Medical 600 Clothing 2,300 Insurance = 1,300 + 1600) 2.900 Taxes =4,058+ 19,044+7,650 30,752 Recreation and entertainment (5,000+4,000) 9,000 Other expenses (7500+2210) 9,710 Total Expenses 80,452 Cash Surplus 19.548 Total Investment 7,500 Real Property Home 185,000 Total Real Property 185,000 Notes of income and expenses: Personal Property Furniture Automobile Total personal property Total Assets 4,500 15000 19,500 Net Worth (A-L) 215,570 Total Liabilities and net worth 60.245 215,570 1) Housing expenses includes Mortgage payment with 11,028 2) Utilities includes Phone, TV and Gas Water and Electricity) 3) Transportation includes Auto payment loan and Gas expenses 4) Medical includes doctor and hospital fees 5) House insurance and Auto insurance under insurance 6) Taxes = Income and social security + Property 7) Recreation and entertainment = Vacation + other 8) Other expenses = purchase of common stock + credit card loan payment