Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 begin{tabular}{|l|l|r|r|r|} hline company A purchased a & vehicle & for & $93,810 & on Jul 12014, their year end is jun 30th

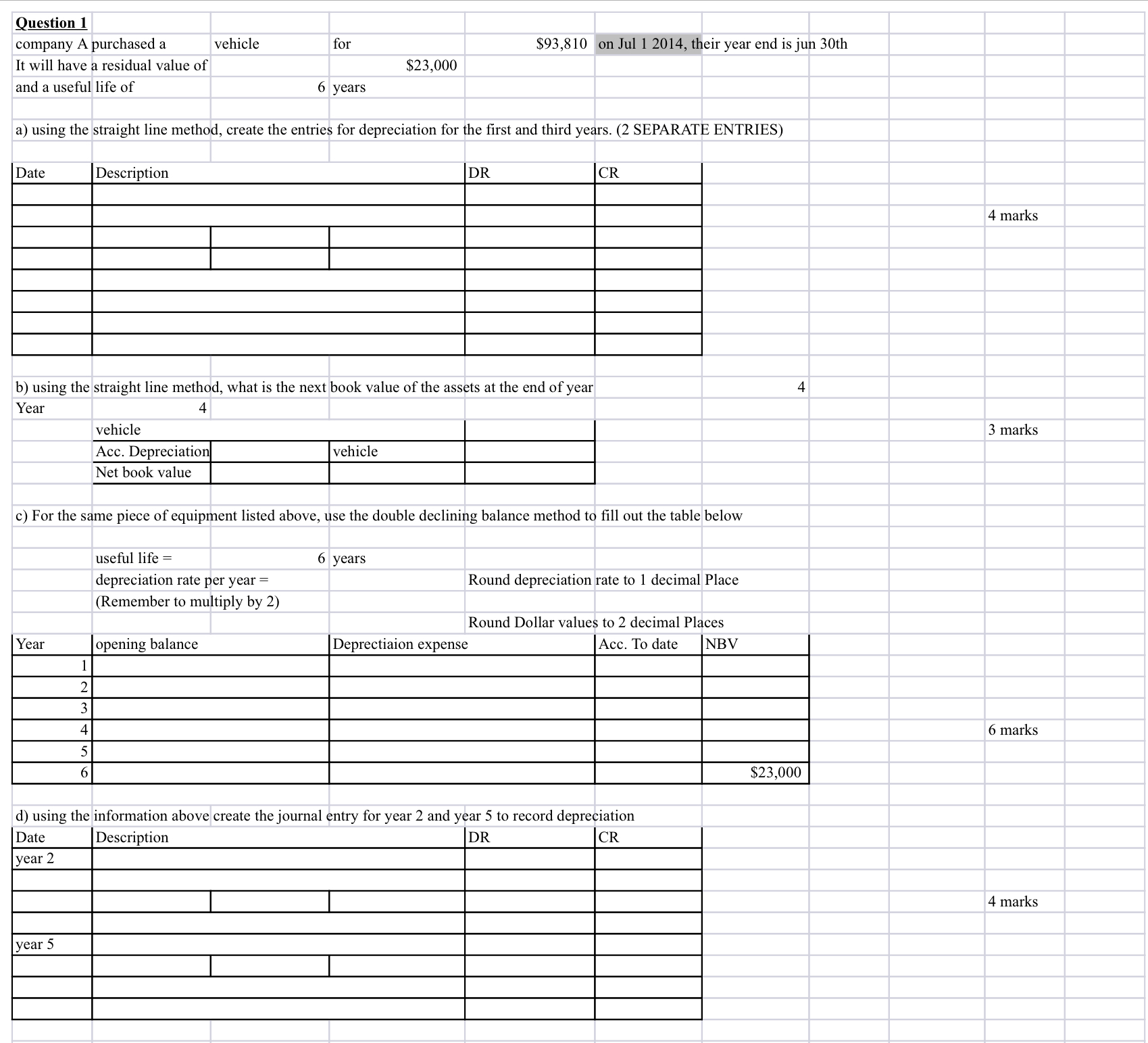

Question 1 \begin{tabular}{|l|l|r|r|r|} \hline company A purchased a & vehicle & for & $93,810 & on Jul 12014, their year end is jun 30th \\ \hline It will have a residual value of & & $23,000 & & \\ \hline and a useful life of & 6 & years & & \\ \hline \end{tabular} a) using the straight line method, create the entries for depreciation for the first and third years. (2 SEPARATE ENTRIES) b) using the straight line method, what is the next book value of the assets at the end of year 4 \begin{tabular}{|l|l|l|l|} \hline Year & \multicolumn{2}{|c|}{4} & \\ \hline \multicolumn{2}{|l|}{ vehicle } & \\ \hline & Acc. Depreciation & vehicle & \\ \hline Net book value & & & \\ \hline \end{tabular} c) For the same piece of equipment listed above, use the double declining balance method to fill out the table below useful life = 6 years depreciation rate per year = Round depreciation rate to 1 decimal Place (Remember to multiply by 2 ) Round Dollar values to 2 decimal Places d) using the information above create the journal entry for year 2 and year 5 to record depreciation

Question 1 \begin{tabular}{|l|l|r|r|r|} \hline company A purchased a & vehicle & for & $93,810 & on Jul 12014, their year end is jun 30th \\ \hline It will have a residual value of & & $23,000 & & \\ \hline and a useful life of & 6 & years & & \\ \hline \end{tabular} a) using the straight line method, create the entries for depreciation for the first and third years. (2 SEPARATE ENTRIES) b) using the straight line method, what is the next book value of the assets at the end of year 4 \begin{tabular}{|l|l|l|l|} \hline Year & \multicolumn{2}{|c|}{4} & \\ \hline \multicolumn{2}{|l|}{ vehicle } & \\ \hline & Acc. Depreciation & vehicle & \\ \hline Net book value & & & \\ \hline \end{tabular} c) For the same piece of equipment listed above, use the double declining balance method to fill out the table below useful life = 6 years depreciation rate per year = Round depreciation rate to 1 decimal Place (Remember to multiply by 2 ) Round Dollar values to 2 decimal Places d) using the information above create the journal entry for year 2 and year 5 to record depreciation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started