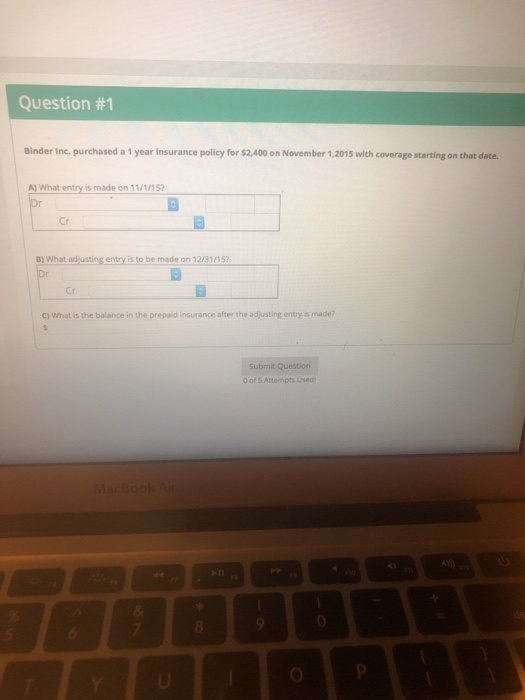

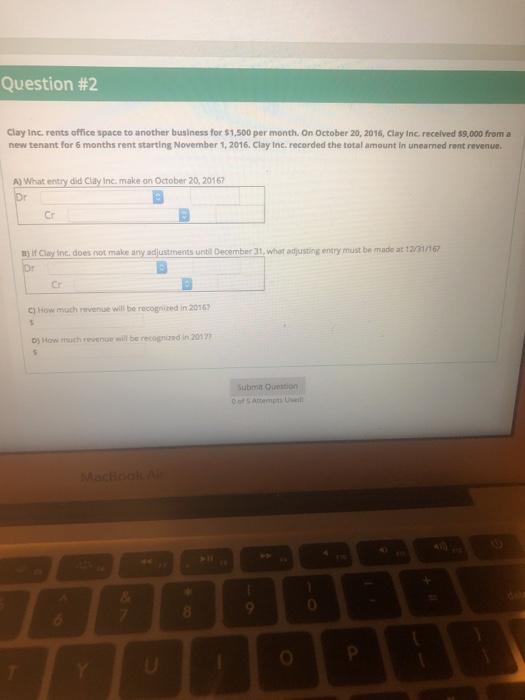

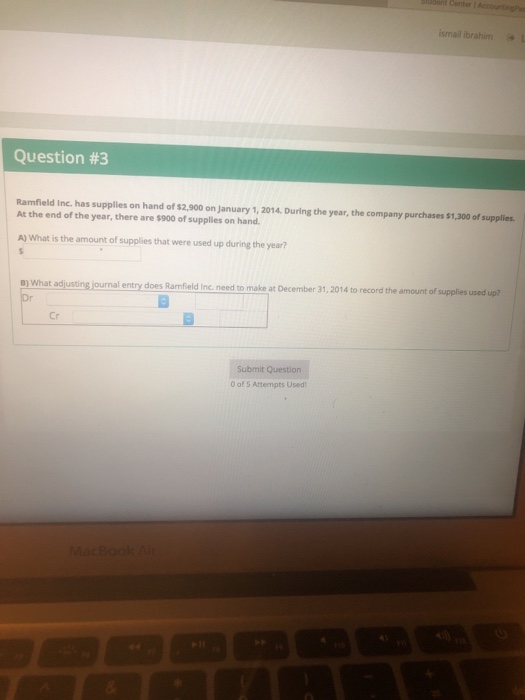

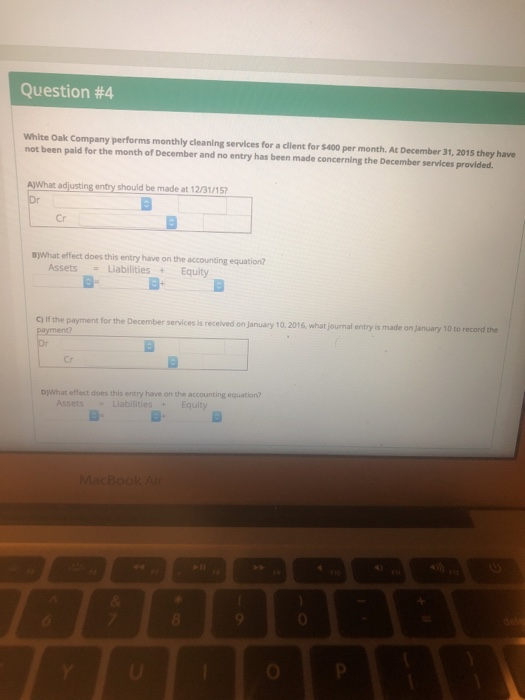

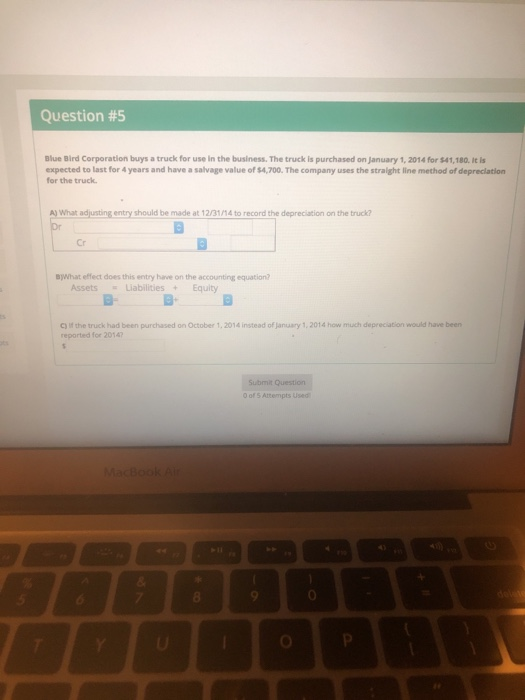

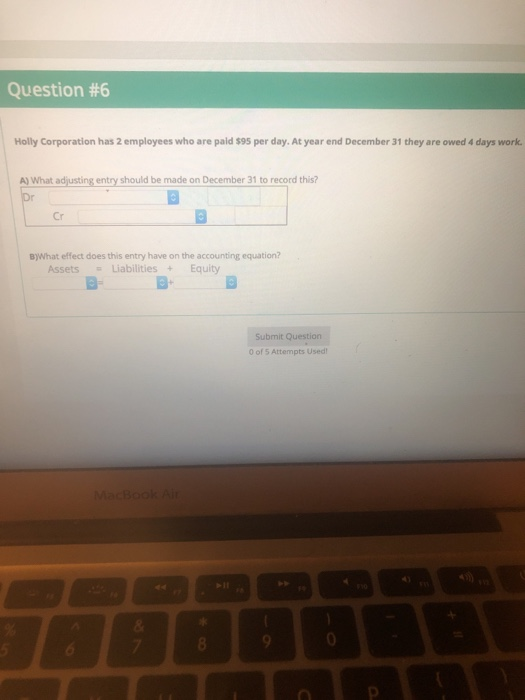

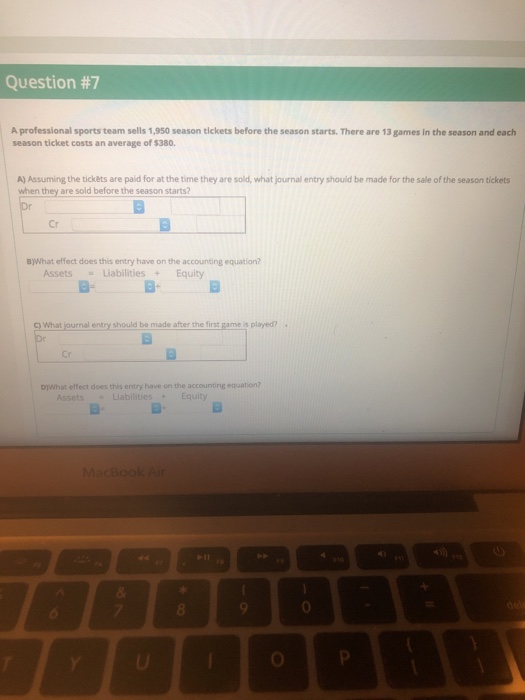

Question #1 Binder Inc. purchased a 1 year Insurance policy for $2,400 on November 1,2015 with coverage starting on that date. A) What entry is made on 11/115 Cr B) What adjusting entry is to be made on 12/31/15 Cr C) What is the balance in the prepaid insurance after the adjusting entry is made? ubmit Question 0 of S Attempts Used acBookA 0 Question #2 Clay Inc. rents office space to another business for $1,500 per month. On October 20, 2016, Clay Inc. recelved $9,000 from a new tenant for 6 months rent starting November 1, 2016. Clay Inc. recorded the total amount in unearned rent revenue. A) What entry did Clay Inc. make on October 20, 20167 Cr B) If Clay Inc. does not make any adjustments until December 31, what adjusting entry must be made at 12/31/16 Cr C) How much revenue will be recognized in 2016? D) How much revenue will be recognized in 20177 Submit Question 0 of 5 Attempts Used MacBookA 4) 0 ismall ibrahim Question #3 Ramfield Inc. has supplies on hand of $2,900 on January 1, 2014. During the year, the company purchases $1,300 of supplies At the end of the year, there are $900 of supplies on hand. A) What is the amount of supplies that were used up during the year? )What adjusting journal entry does Ramfield Inc, need to does Ramfield Inc. need to make at December 31, 2014 to record the amount of supplies used Cr Submit Question 0 of S Attempts Used Question #4 White Oak Company performs monthly cleaning services for a client for $400 per month. At December 31, 2015 they have not been paid for the month of December and no entry has been made concerning the December services provided. A)What adjusting entry should be made at 12/31/15 Cr ByWhat effect does this entry have on the accounting equation? Assets Liabilities + Equity . C) If the payment for the December services is received on January 10, 2016, what journal entry is made on January 10 to record the Cr DjWhat effect does this entry have on the accounting equation? Assets Liabilities Equity a- MacBookA 0 Question #5 Blue Bird Corporation buys a truck for use in the business. The truck is purchased on January 1, 2014 for $41,180It i expected to last for 4 years and have a salvage value of $4,700. The company uses the stralght line method of depreclation for the truck What adjusting entry should be made at 12/31/14 to record the depreciation on the truck? Cr B)What effect does this entry have on the accounting equation Assets LiabilitiesEquity B- c) if the truck had been purchased on October 1,2014 instead of january 1,2014 how much depreciation would have been reported for 2014 t Question O of 5 Attempts 0 Question #6 Holly Corporation has 2 employees who are paid $95 per day. At year end December 31 they are owed 4 days work A) What adjusting entry should be made on December 31 to record this? Cr B)What effect does this entry have on the accounting equation? AssetsLiabilities+Equity E- Submit Question 0 of 5 Attempts Used MacBook A Question #7 A professional sports team sells 1,950 season tickets before the season starts. There are 13 games in the season and each season ticket costs an average of $380. A) Assuming the tickts are palid for at the time they are sold, what journal entry should be made for the sale of the season tickets are sold before the season starts? Cr B)What effect does this entry have on the accounting equation? Assets Liabilities Equity CWhat journal entry should be made after the first game is played? Cr ojWhat effect does this entry have on the accounting equation? AssetsLiabilitiesEquity B- MacBookA 0