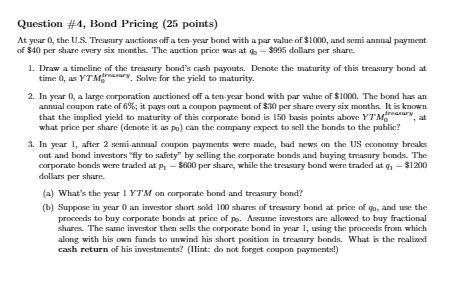

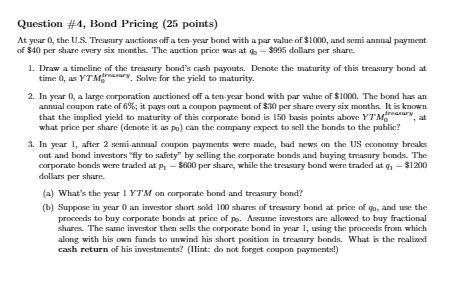

Question #1, Bond Pricing (25 points) At year, the U.S. Treixury auctions off a ten yesur bond with a par value of $1000, and semiannual payment of $40 per share every six months. The auction price was at -9995 dollars per share. 1. Draw a timeline of the treasury bond's cash paycats. Denote: the maturity of this treasury bond at time 0, as YTM Solve for the yield to maturity. 2. In year 0, a large corporation actioned of a ten year bond with par wlue of $1000. The bond has an animal comxn rate of 6%; it pays out a coupon payment of $30 per share every six months. It is known that the implied yiekl to maturity of this corporate bond is 150 bis points above YTM what price per share (denote it was pu) can the company expect to sell the bands to the public? 3. In year 1, after 2 semi-annual coupon payments were made, bad news on the US commy breaks out and bond investors "fly to safety" by selling the corporate bonds and buying treasury hands. The corporate bonds were traded at p. - seno per share, while the treasury hond were traded at - $1200 dollars per share. (a) What's the year 1 YTM onceporate bond and treasury bond? (b) Suppose in year 0 an investor short sold 100 shares of treasury bond at price of go, and use the proceeds to buy corporate bonds at price of po. Assume investors are allowed to buy fractional shares. The same investor then sells the corporate bond in year 1, lasing the proceeds from which along with his own funds to unwind his short position in tresury bonds. What is the realized cash return of his investments? (Ilint: do not forget coupon payments! Question #1, Bond Pricing (25 points) At year, the U.S. Treixury auctions off a ten yesur bond with a par value of $1000, and semiannual payment of $40 per share every six months. The auction price was at -9995 dollars per share. 1. Draw a timeline of the treasury bond's cash paycats. Denote: the maturity of this treasury bond at time 0, as YTM Solve for the yield to maturity. 2. In year 0, a large corporation actioned of a ten year bond with par wlue of $1000. The bond has an animal comxn rate of 6%; it pays out a coupon payment of $30 per share every six months. It is known that the implied yiekl to maturity of this corporate bond is 150 bis points above YTM what price per share (denote it was pu) can the company expect to sell the bands to the public? 3. In year 1, after 2 semi-annual coupon payments were made, bad news on the US commy breaks out and bond investors "fly to safety" by selling the corporate bonds and buying treasury hands. The corporate bonds were traded at p. - seno per share, while the treasury hond were traded at - $1200 dollars per share. (a) What's the year 1 YTM onceporate bond and treasury bond? (b) Suppose in year 0 an investor short sold 100 shares of treasury bond at price of go, and use the proceeds to buy corporate bonds at price of po. Assume investors are allowed to buy fractional shares. The same investor then sells the corporate bond in year 1, lasing the proceeds from which along with his own funds to unwind his short position in tresury bonds. What is the realized cash return of his investments? (Ilint: do not forget coupon payments