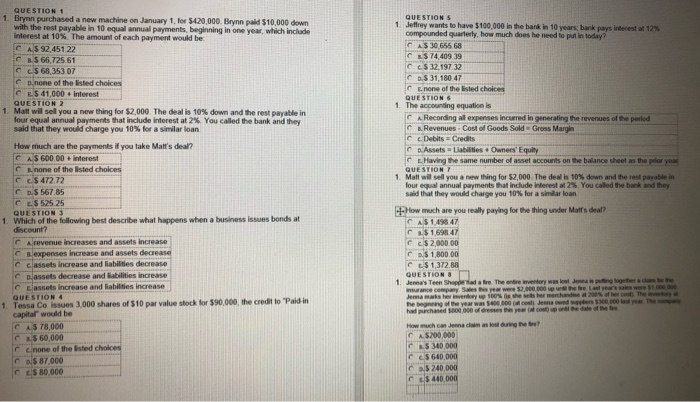

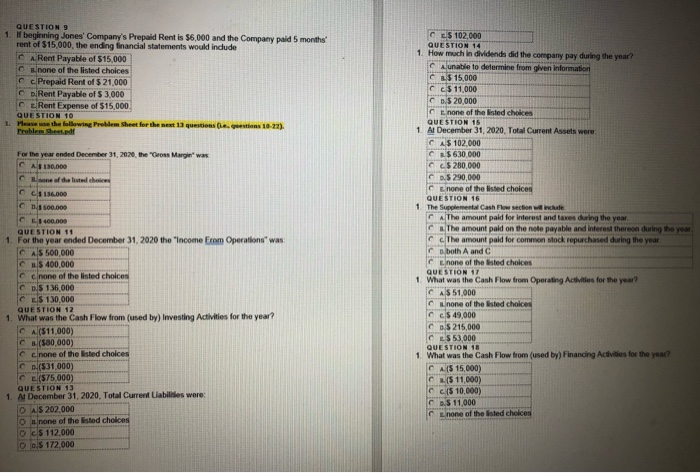

QUESTION 1 Brynn purchased a new machine on January 1, for $420,000. Brynn paid $10.000 down with the rest payable in 10 equal annual payments, beginning in one year, which include Interest at 10%. The amount of each payment would be GAS 92 451 22 CLS 66,725 61 C $ 68,353.07 b.none of the listed choices C $ 41,000 interest QUESTION 2 1. Matt will sell you a new thing for $2,000. The deal is 10% down and the rest payable in four equal annual payments that include interest at 2%. You called the bank and they said that they would charge you 10% for a similar loan QUESTIONS 1 Jeffrey wants to have $100,000 in the bank in 10 years, bank pays interest : 12% compounded quarterly, how much does he need to put in today? CAS 10 655 68 C S 74 409 39 CCS 32. 19732 CDS 31.180.47 C Enone of the listed choices QUESTIONS 1. The accounting equation is CA Recording al expenses incurred in generating the revenues of the period c Revenues. Cost of Goods Sold - Gross Margin Cc Debits = Credits CD Assets Lates. Owners' Equity CL. Having the same number of asset accounts on the balance sheet as the prior year QUESTION 1. Matt will you a new thing for $2.000 The dew is 10% down and the res payable in four equal annual payments that include interest at 2%. You called the bank and they said that they would charge you 10% for a similar loan How much are the payments if you take Matt's deal? CAS 600 00 Interest C L none of the listed choices c. $ 472 72 CD.S 567.85 $525 25 QUESTION 3 Which of the following best describe what happens when a business issues bonds at discount? C revenue increases and assets increase CB expenses increase and assets decrease C Cassets increase and liabilities decrease CDassets decrease and abilities increase e assets increase and liabilities increase QUESTION 4 Tessa Co issues 3,000 shares of $10 par value stock for $90,000, the credit to Paid in capital' would be CA$ 78,000 560,000 none of the Ested chake C D $ 87,000 25 80.000 - How much are you really paying for the thing under Malf's deal? CAS149847 C $ 169847 $ 2.000.00 C .S 1,800.00 C S 1,372.88 QUESTIONS Jenna's Teen Shordatre The entire w ory was lost i punohet the surance company they were 12.000.000 p h otoLayers were 1.000 Jenama hemory up the the merchande 2008 other cou The the beginning of the year was 600 col Jenna wew e 300.000 the had purchased 1000000 s c ope of the How much Jenama unghere? CAS200 000 C S 340.000 $ 640 000 C $ 240.000 C 440 DOO QUESTION 9 1 beginning Jones' Company's Prepaid Rent is $6.000 and the Company paid 5 months rent of $15.000, the ending financial statements would include C Rent Payable of $15,000 none of the listed choices Prepaid Rent of $ 21,000 Rent Payable of $ 3.000 Rent Expense of $15,000 QUESTION 10 1. Please use the following Problem Sheet for Problem sheet.pdf For the year ended December 31, 2020, the "Gron 110.000 D. 500.000 CLS 102.000 QUESTION 14 1 How much in dividends did the company pay during the year? oven information CB $ 15.000 C 5 11,000 0.5 20.000 CL none of the listed choice QUESTION 15 Al December 31, 2020, Total Current Assets were C A $ 102,000 $ 630 000 $ 280 000 CDS 290 000 C none of the listed choices QUESTION 16 The Supreme Cash Flow section include CA The amount paid for interest and taxes during the year The amount paid on the note payable and interest thereon during the year The amount paid for common stock repurchased during the year both A and C E none of the listed choices QUESTION 17 1 What was the Cash Flow from Operating Activities for the year? CAS 51.000 none of the listed choices Ces 49.000 CDS 215,000 C 553.000 QUESTION 18 1. What was the Cash Flow from (used by) Financing Activities for the year? CAS 15000) C ($ 11,000) oc(10,000) C.S 11,000 E none of the listed choices QUESTION 11 1. For the year ended December 31, 2020 the "Income From Operations was CAS 500,000 CBS 400,000 cc none of the listed choices CDS 136,000 C ES 130.000 QUESTION 12 1. What was the Cash Flow from (used by) Investing Activities for the year? CA(511,000) CB (580,000) Cc none of the listed choices D.(31.000) O (575.000) QUESTION 13 1. December 31, 2020, Total Current Liabilities were O AS 202,000 O none of the listed choices 0 25 112,000 DD.S 172.000 QUESTION 1 Brynn purchased a new machine on January 1, for $420,000. Brynn paid $10.000 down with the rest payable in 10 equal annual payments, beginning in one year, which include Interest at 10%. The amount of each payment would be GAS 92 451 22 CLS 66,725 61 C $ 68,353.07 b.none of the listed choices C $ 41,000 interest QUESTION 2 1. Matt will sell you a new thing for $2,000. The deal is 10% down and the rest payable in four equal annual payments that include interest at 2%. You called the bank and they said that they would charge you 10% for a similar loan QUESTIONS 1 Jeffrey wants to have $100,000 in the bank in 10 years, bank pays interest : 12% compounded quarterly, how much does he need to put in today? CAS 10 655 68 C S 74 409 39 CCS 32. 19732 CDS 31.180.47 C Enone of the listed choices QUESTIONS 1. The accounting equation is CA Recording al expenses incurred in generating the revenues of the period c Revenues. Cost of Goods Sold - Gross Margin Cc Debits = Credits CD Assets Lates. Owners' Equity CL. Having the same number of asset accounts on the balance sheet as the prior year QUESTION 1. Matt will you a new thing for $2.000 The dew is 10% down and the res payable in four equal annual payments that include interest at 2%. You called the bank and they said that they would charge you 10% for a similar loan How much are the payments if you take Matt's deal? CAS 600 00 Interest C L none of the listed choices c. $ 472 72 CD.S 567.85 $525 25 QUESTION 3 Which of the following best describe what happens when a business issues bonds at discount? C revenue increases and assets increase CB expenses increase and assets decrease C Cassets increase and liabilities decrease CDassets decrease and abilities increase e assets increase and liabilities increase QUESTION 4 Tessa Co issues 3,000 shares of $10 par value stock for $90,000, the credit to Paid in capital' would be CA$ 78,000 560,000 none of the Ested chake C D $ 87,000 25 80.000 - How much are you really paying for the thing under Malf's deal? CAS149847 C $ 169847 $ 2.000.00 C .S 1,800.00 C S 1,372.88 QUESTIONS Jenna's Teen Shordatre The entire w ory was lost i punohet the surance company they were 12.000.000 p h otoLayers were 1.000 Jenama hemory up the the merchande 2008 other cou The the beginning of the year was 600 col Jenna wew e 300.000 the had purchased 1000000 s c ope of the How much Jenama unghere? CAS200 000 C S 340.000 $ 640 000 C $ 240.000 C 440 DOO QUESTION 9 1 beginning Jones' Company's Prepaid Rent is $6.000 and the Company paid 5 months rent of $15.000, the ending financial statements would include C Rent Payable of $15,000 none of the listed choices Prepaid Rent of $ 21,000 Rent Payable of $ 3.000 Rent Expense of $15,000 QUESTION 10 1. Please use the following Problem Sheet for Problem sheet.pdf For the year ended December 31, 2020, the "Gron 110.000 D. 500.000 CLS 102.000 QUESTION 14 1 How much in dividends did the company pay during the year? oven information CB $ 15.000 C 5 11,000 0.5 20.000 CL none of the listed choice QUESTION 15 Al December 31, 2020, Total Current Assets were C A $ 102,000 $ 630 000 $ 280 000 CDS 290 000 C none of the listed choices QUESTION 16 The Supreme Cash Flow section include CA The amount paid for interest and taxes during the year The amount paid on the note payable and interest thereon during the year The amount paid for common stock repurchased during the year both A and C E none of the listed choices QUESTION 17 1 What was the Cash Flow from Operating Activities for the year? CAS 51.000 none of the listed choices Ces 49.000 CDS 215,000 C 553.000 QUESTION 18 1. What was the Cash Flow from (used by) Financing Activities for the year? CAS 15000) C ($ 11,000) oc(10,000) C.S 11,000 E none of the listed choices QUESTION 11 1. For the year ended December 31, 2020 the "Income From Operations was CAS 500,000 CBS 400,000 cc none of the listed choices CDS 136,000 C ES 130.000 QUESTION 12 1. What was the Cash Flow from (used by) Investing Activities for the year? CA(511,000) CB (580,000) Cc none of the listed choices D.(31.000) O (575.000) QUESTION 13 1. December 31, 2020, Total Current Liabilities were O AS 202,000 O none of the listed choices 0 25 112,000 DD.S 172.000