Answered step by step

Verified Expert Solution

Question

1 Approved Answer

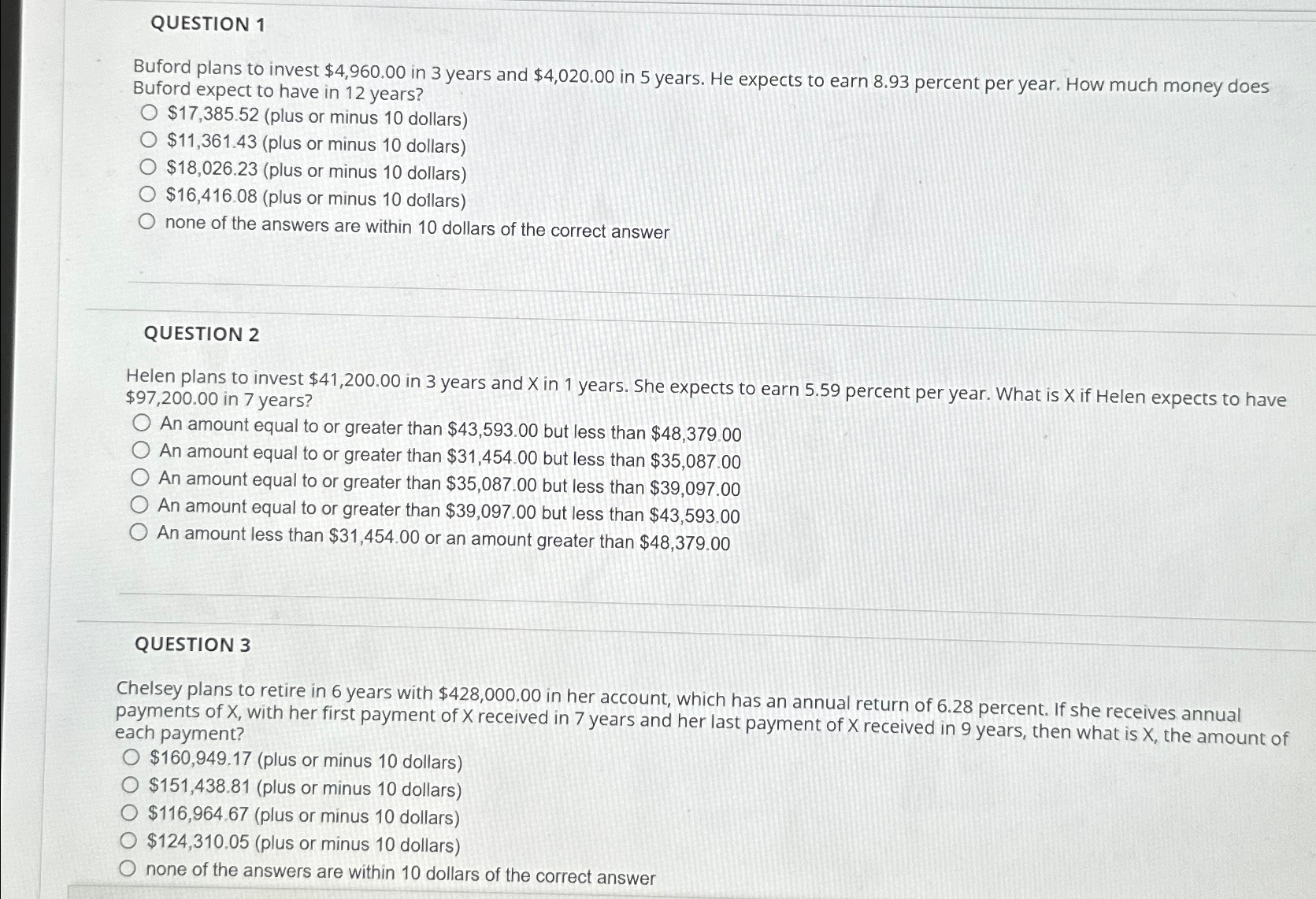

QUESTION 1 Buford plans to invest $ 4 , 9 6 0 . 0 0 in 3 years and $ 4 , 0 2 0

QUESTION

Buford plans to invest $ in years and $ in years. He expects to earn percent per year. How much money does Buford expect to have in years?

$plus or minus dollars

$plus or minus dollars

$plus or minus dollars

$plus or minus dollars

none of the answers are within dollars of the correct answer

QUESTION

Helen plans to invest $ in years and in years. She expects to earn percent per year. What is if Helen expects to have $ in years?

An amount equal to or greater than $ but less than $

An amount equal to or greater than $ but less than $

An amount equal to or greater than $ but less than $

An amount equal to or greater than $ but less than $

An amount less than $ or an amount greater than $

QUESTION

Chelsey plans to retire in years with $ in her account, which has an annual return of percent. If she receives annual payments of with her first payment of received in years and her last payment of received in years, then what is the amount of each payment?

$plus or minus dollars

$plus or minus dollars

$plus or minus dollars

$plus or minus dollars

none of the answers are within dollars of the correct answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started