Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. Calculate the depreciation of an asset that costs 20000 and has a recovery period of 7 years. What is the net income of

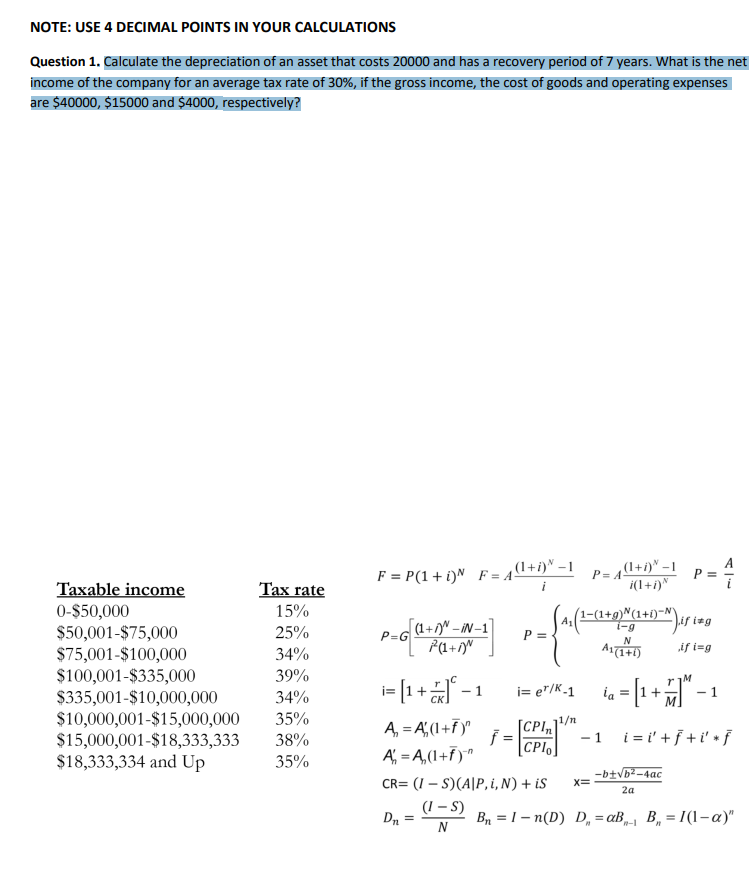

Question 1. Calculate the depreciation of an asset that costs 20000 and has a recovery period of 7 years. What is the net income of the company for an average tax rate of 30%, if the gross income, the cost of goods and operating expenses are $40000, $15000 and $4000, respectively?

URGENTTTT 1 HOUR DEADLINE

NOTE: USE 4 DECIMAL POINTS IN YOUR CALCULATIONS Question 1. Calculate the depreciation of an asset that costs 20000 and has a recovery period of 7 years. What is the net income of the company for an average tax rate of 30%, if the gross income, the cost of goods and operating expenses are $40000, $15000 and $4000, respectively? F = P(1 + i)^ F= A (1+i)" - 1 P=4 (1+)-1 P= i(1+1) if img [(1+1)^ iN-1 P=G P(1+NN P= 1-(1+9)(1+i)-N i-g A1(1+1) N if ing Taxable income 0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 $335,001-$10,000,000 $10,000,001-$15,000,000 $15,000,001-$18,333,333 $18,333,334 and Up Tax rate 15% 25% 34% 39% 34% 35% 38% 35% i= [1 + 1 - 1 i=e"]K.1 ia= [1 +"-1 TCPI 1 A = A (1+f)" f = -1 i = i' + f +i' *f A = A,(1+F)" | CPIO -btvb2-4ac CR= (1 -S) (A|P,1,N) + is (1 -S) Dn Bn = 1 - n(D) D = aB - B, = Il-a)" x= 2a = NStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started