Answered step by step

Verified Expert Solution

Question

1 Approved Answer

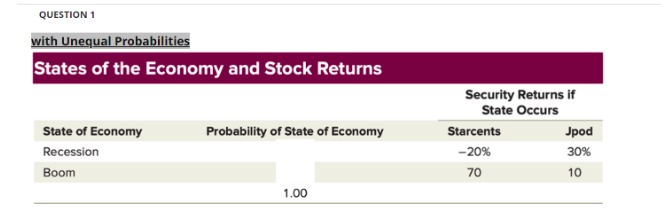

QUESTION #1 Calculating Portfolio Expected Return and Std. dev with unequal portfolio weights : With the aforementioned scenario, now you decide to invest 30% into

QUESTION #1

Calculating Portfolio Expected Return and Std. dev with unequal portfolio weights : With the aforementioned scenario, now you decide to invest 30% into Starcents and 70% into Jpods

- What is the expected return of this portfolio?

- What is the correlation coefficient between Starcents and Jpod?

- What is the standard deviation of this portfolio?

- How much of diversification benefit did you achieve?

QUESTION #2

- What should be the portfolio weights for Starcents and Jpod, respectively, to achieve a Minimum-Variance Portfolio (MVP)?

- What is the standard deviation of the Minimum-Variance Portfolio (MVP)?

- What is the expected return of the Minimum-Variance Portfolio (MVP)?

QUESTION #3

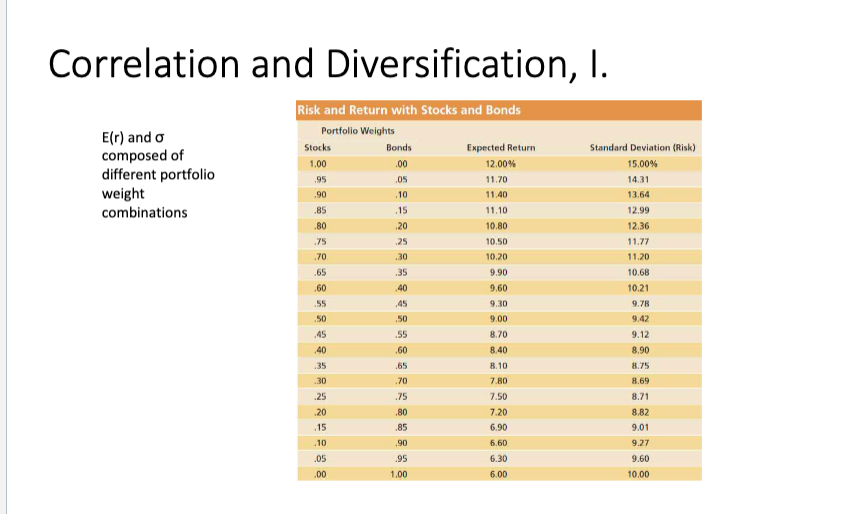

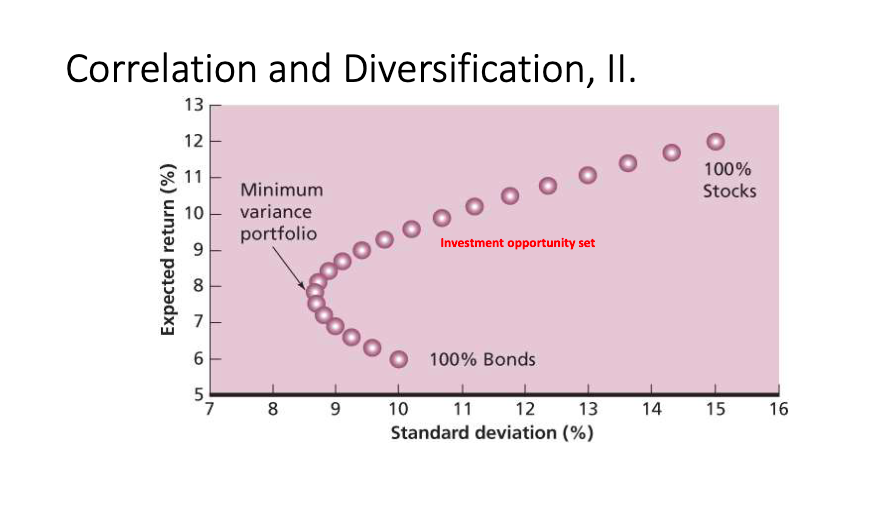

Create a table (similar to the one attached bellow: of portfolio expected return and standard deviation by varying portfolio weights. Then, draw the investment opportunity set (either using Excel or by hand-drawing neatly) for the portfolio and identify the efficient portfolios along with the minimum-variance portfolio.

QUESTION 1 with Unequal Probabilities States of the Economy and Stock Returns Security Returns if State Occurs \begin{tabular}{lccc} State of Economy & Probability of State of Economy & Starcents & Jpod \\ Recession & & 20% & 30% \\ Boom & 1.00 & 70 & 10 \\ \hline \end{tabular} Correlation and Diversification, I. E(r) and composed of different portfolio weight combinations Correlation and Diversification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started