Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Candy Messinger is searching for good investments in which to place her firm's capital. She is the CEO and president of PU Consulting

Question

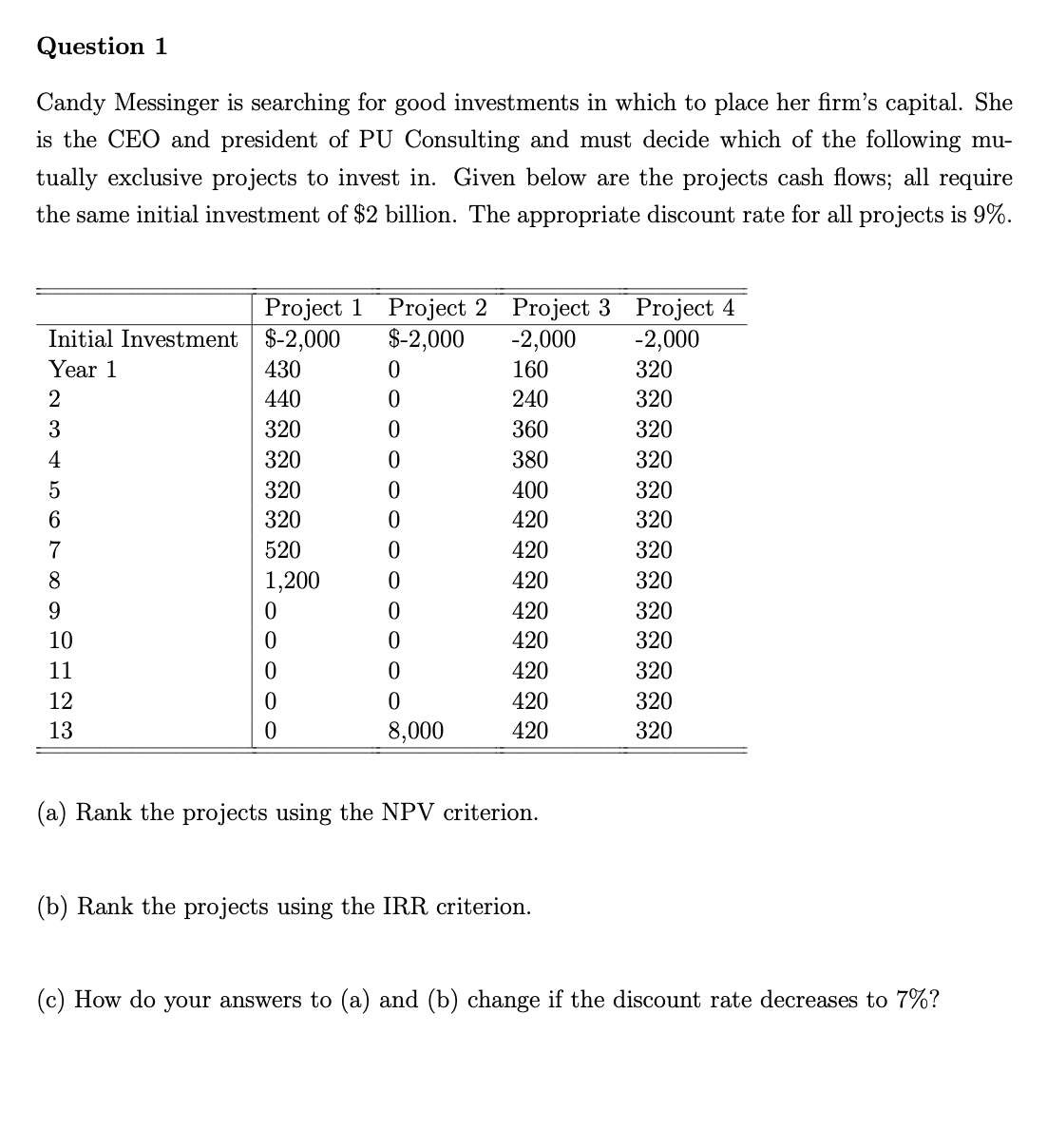

Candy Messinger is searching for good investments in which to place her firm's capital. She is the CEO and president of PU Consulting and must decide which of the following mutually exclusive projects to invest in Given below are the projects cash flows; all require the same initial investment of $ billion. The appropriate discount rate for all projects is

tableProject Project Project Project Initial Investment,$$Year

a Rank the projects using the NPV criterion.

b Rank the projects using the IRR criterion.

c How do your answers to a and b change if the discount rate decreases to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started