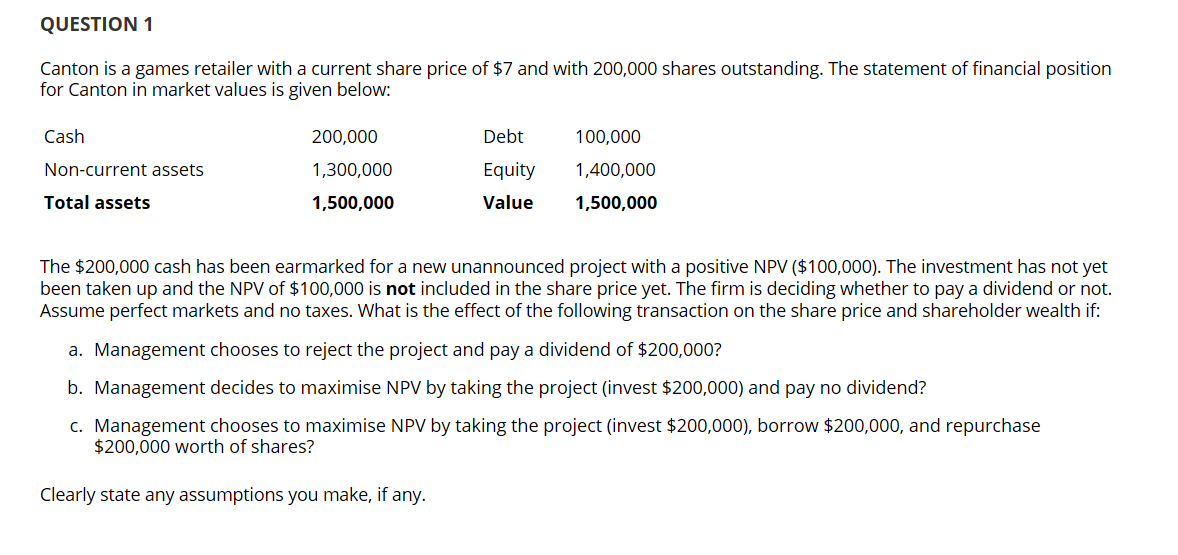

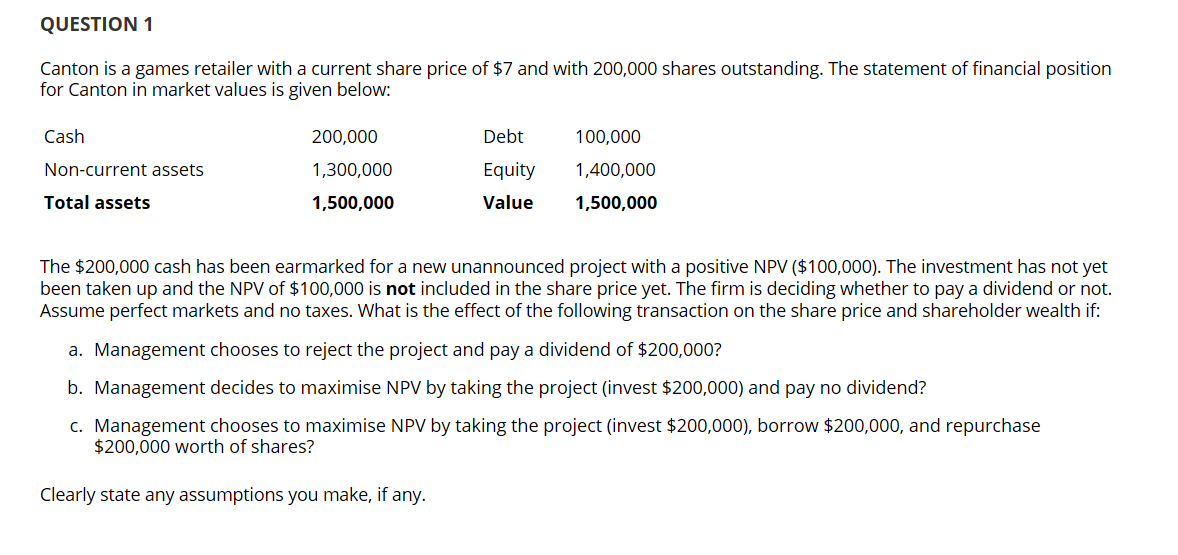

QUESTION 1 Canton is a games retailer with a current share price of $7 and with 200,000 shares outstanding. The statement of financial position for Canton in market values is given below: Cash 200,000 Debt 100,000 Non-current assets Equity 1,400,000 1,300,000 1,500,000 Total assets Value 1,500,000 The $200,000 cash has been earmarked for a new unannounced project with a positive NPV ($100,000). The investment has not yet been taken up and the NPV of $100,000 is not included in the share price yet. The firm is deciding whether to pay a dividend or not. Assume perfect markets and no taxes. What is the effect of the following transaction on the share price and shareholder wealth if: a. Management chooses to reject the project and pay a dividend of $200,000? b. Management decides to maximise NPV by taking the project invest $200,000) and pay no dividend? c. Management chooses to maximise NPV by taking the project (invest $200,000), borrow $200,000, and repurchase $200,000 worth of shares? Clearly state any assumptions you make, if any. QUESTION 1 Canton is a games retailer with a current share price of $7 and with 200,000 shares outstanding. The statement of financial position for Canton in market values is given below: Cash 200,000 Debt 100,000 Non-current assets Equity 1,400,000 1,300,000 1,500,000 Total assets Value 1,500,000 The $200,000 cash has been earmarked for a new unannounced project with a positive NPV ($100,000). The investment has not yet been taken up and the NPV of $100,000 is not included in the share price yet. The firm is deciding whether to pay a dividend or not. Assume perfect markets and no taxes. What is the effect of the following transaction on the share price and shareholder wealth if: a. Management chooses to reject the project and pay a dividend of $200,000? b. Management decides to maximise NPV by taking the project invest $200,000) and pay no dividend? c. Management chooses to maximise NPV by taking the project (invest $200,000), borrow $200,000, and repurchase $200,000 worth of shares? Clearly state any assumptions you make, if any