Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 - Capital structure Granby Biotech has no debt financing and an asset beta of 0.7. Assume a risk free rate of 5%

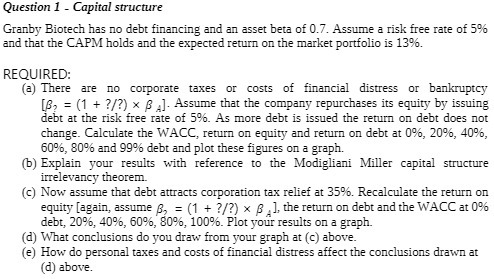

Question 1 - Capital structure Granby Biotech has no debt financing and an asset beta of 0.7. Assume a risk free rate of 5% and that the CAPM holds and the expected return on the market portfolio is 13%. REQUIRED: (a) There are no corporate taxes or costs of financial distress or bankruptcy [B = (1 + ?/?) B A]. Assume that the company repurchases its equity by issuing debt at the risk free rate of 5%. As more debt is issued the return on debt does not change. Calculate the WACC, return on equity and return on debt at 0%, 20%, 40%, 60%, 80% and 99% debt and plot these figures on a graph. (b) Explain your results with reference to the Modigliani Miller capital structure irrelevancy theorem. (c) Now assume that debt attracts corporation tax relief at 35%. Recalculate the return on equity [again, assume = (1 + ?/?) x B1, the return on debt and the WACC at 0% debt, 20%, 40%, 60%, 80%, 100%. Plot your results on a graph. (d) What conclusions do you draw from your graph at (c) above. (e) How do personal taxes and costs of financial distress affect the conclusions drawn at (d) above.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Given Asset beta 07 Risk free rate 5 Market return 13 WACC EV x RE DV x RD 1t ROE ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started