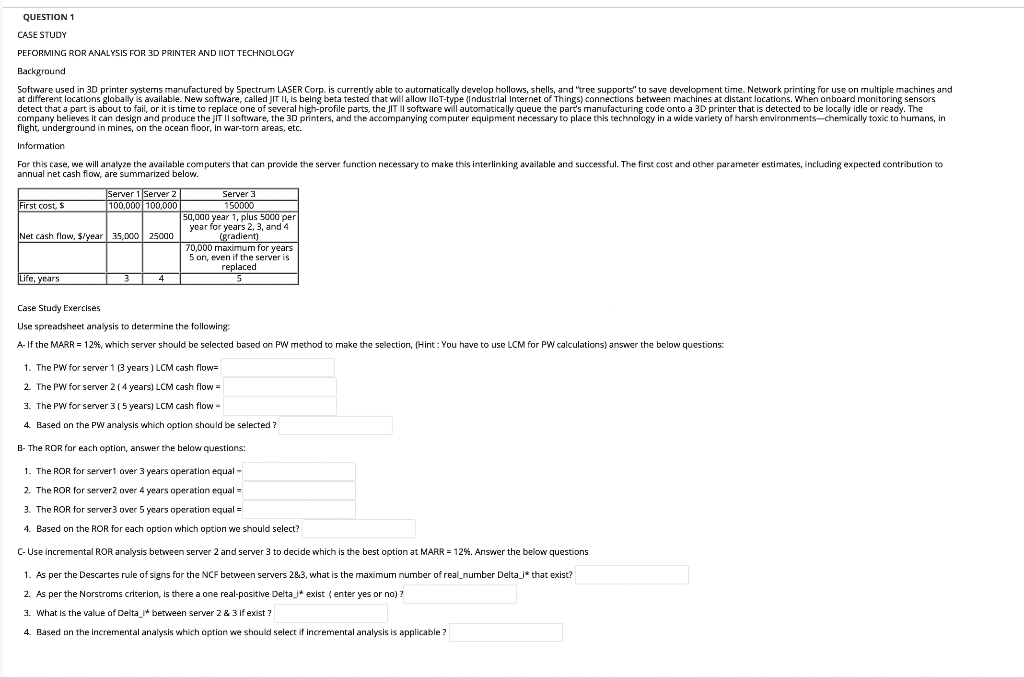

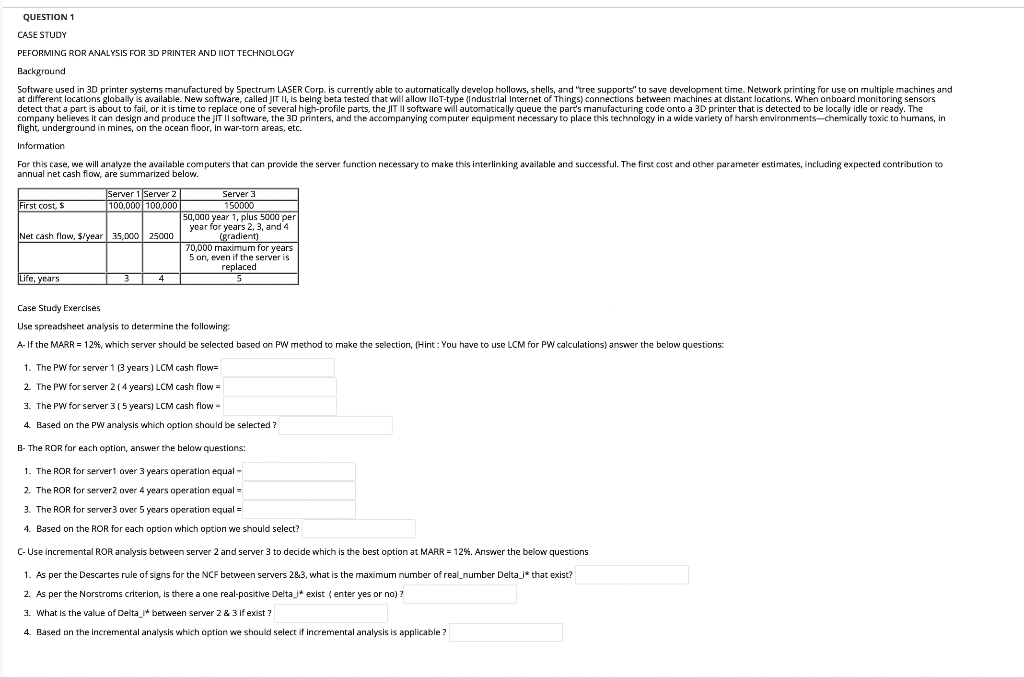

QUESTION 1 CASE STUDY PEFORMING ROR ANALYSIS FOR 3D PRINTER AND IOT TECHNOLOGY Background Software used in 3D printer systems manufactured by Spectrum LASER Corp. is currently able to automatically develop hollows, shells, and tree supports" to save development time. Network printing for use on multiple machines and at different locations globally is available. New software, called JIT II, is being beta tested that will allow IoT-type (Industrial Internet of Things) connections between machines at distant locations. When onboard monitoring sensors detect that a part is about to fail, or it is time to replace one of several high-profile parts, the JIT il software will automatically queue the part's manufacturing code onto a 3D printer that is detected to be locally idle or ready. The company believes it can design and produce the JIT Il software, the 3D printers, and the accompanying computer equipment necessary to place this technology in a wide variety of harsh environments-chemically toxic to humans, in flight, underground in mines, on the ocean floor, in war-torn areas, etc. Information For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Server 1 Server 2 Server 3 First costs 100,000 100,000 150000 50,000 year 1, plus 5000 per year for years 2, 3, and 4 Net cash flow, $/year 35,000 25000 (gradient) 70,000 maximum for years 5 on, even if the server is replaced Life, years 4 4 5 Case Study Exercises Use spreadsheet analysis to determine the following A-If the MARR = 12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1 (3 years) LCM cash flow= 2. The PW for server 2 ( 4 years) LCM cash flow = 3. The PW for server 3 ( 5 years) LCM cash flow- 4. Based on the PW analysis which option should be selected ? B- The ROR for each option, answer the below questions: 1. The ROR for servert over 3 years operation equal - 2. The ROR for server2 over 4 years operation equal = 3. The ROR for server over 5 years operation equal = 4. Based on the ROR for each option which option we should select? -3 = % C-Use incremental ROR analysis between server 2 and server 3 to decide which is the best option at MARR = 12%. Answer the below questions 1. As per the Descartes rule of signs for the NCF between servers 2&3, what is the maximum number of real_number Delta_j* that exist? 2. As per the Norstroms criterion, is there a one real-positive Delta_l* existenter yes or no)? 3. What is the value of Delta i between server 2&3 if exist ? 4. Based on the incremental analysis which option we should select if incremental analysis is applicable ? QUESTION 1 CASE STUDY PEFORMING ROR ANALYSIS FOR 3D PRINTER AND IOT TECHNOLOGY Background Software used in 3D printer systems manufactured by Spectrum LASER Corp. is currently able to automatically develop hollows, shells, and tree supports" to save development time. Network printing for use on multiple machines and at different locations globally is available. New software, called JIT II, is being beta tested that will allow IoT-type (Industrial Internet of Things) connections between machines at distant locations. When onboard monitoring sensors detect that a part is about to fail, or it is time to replace one of several high-profile parts, the JIT il software will automatically queue the part's manufacturing code onto a 3D printer that is detected to be locally idle or ready. The company believes it can design and produce the JIT Il software, the 3D printers, and the accompanying computer equipment necessary to place this technology in a wide variety of harsh environments-chemically toxic to humans, in flight, underground in mines, on the ocean floor, in war-torn areas, etc. Information For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Server 1 Server 2 Server 3 First costs 100,000 100,000 150000 50,000 year 1, plus 5000 per year for years 2, 3, and 4 Net cash flow, $/year 35,000 25000 (gradient) 70,000 maximum for years 5 on, even if the server is replaced Life, years 4 4 5 Case Study Exercises Use spreadsheet analysis to determine the following A-If the MARR = 12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1 (3 years) LCM cash flow= 2. The PW for server 2 ( 4 years) LCM cash flow = 3. The PW for server 3 ( 5 years) LCM cash flow- 4. Based on the PW analysis which option should be selected ? B- The ROR for each option, answer the below questions: 1. The ROR for servert over 3 years operation equal - 2. The ROR for server2 over 4 years operation equal = 3. The ROR for server over 5 years operation equal = 4. Based on the ROR for each option which option we should select? -3 = % C-Use incremental ROR analysis between server 2 and server 3 to decide which is the best option at MARR = 12%. Answer the below questions 1. As per the Descartes rule of signs for the NCF between servers 2&3, what is the maximum number of real_number Delta_j* that exist? 2. As per the Norstroms criterion, is there a one real-positive Delta_l* existenter yes or no)? 3. What is the value of Delta i between server 2&3 if exist ? 4. Based on the incremental analysis which option we should select if incremental analysis is applicable