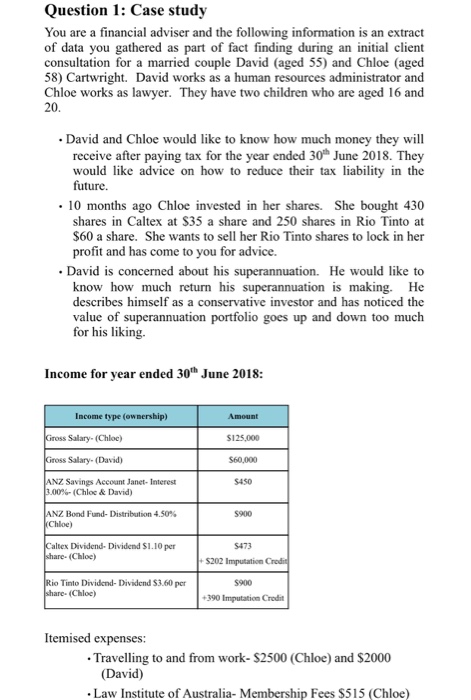

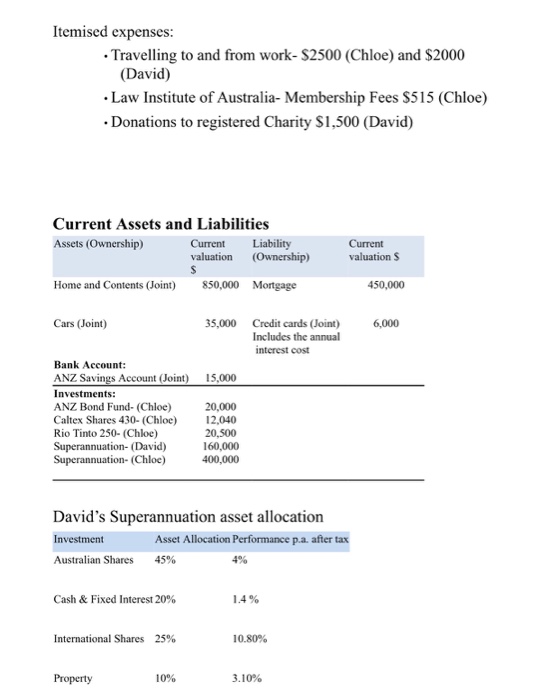

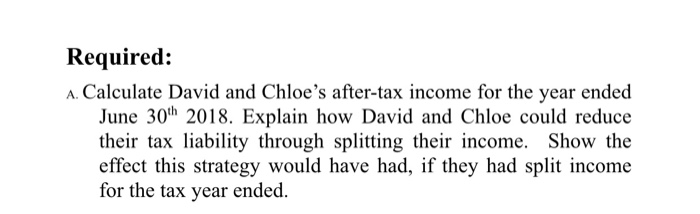

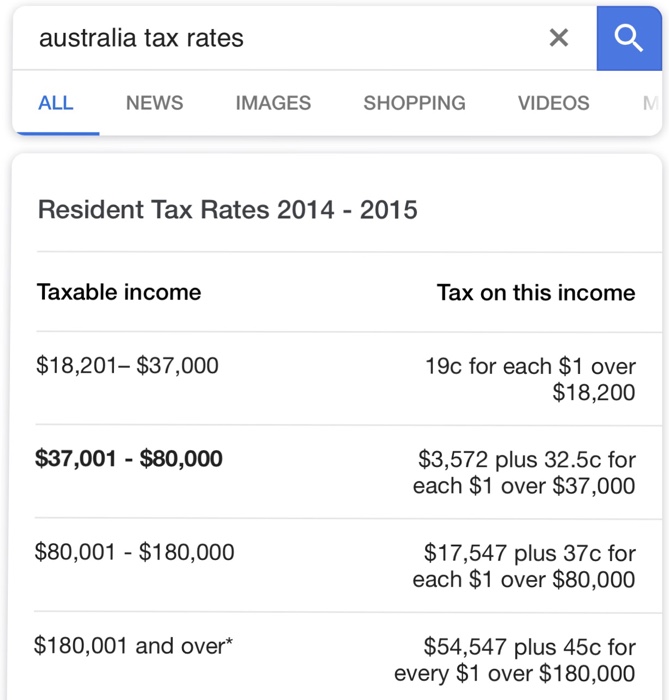

Question 1: Case study You are a financial adviser and the following information is an extract of data you gathered as part of fact finding during an initial client consultation for a married couple David (aged 55) and Chloe (aged 58) Cartwright. David works as a human resources administrator and Chloe works as lawyer. They have two children who are aged 16 and 20 David and Chloe would like to know how much money they will receive after paying tax for the year ended 30th June 2018. They would like advice on how to reduce their tax liability in the future. . 10 months ago Chloe invested in her shares. She bought 430 shares in Caltex at $35 a share and 250 shares in Rio Tinto at $60 a share. She wants to sell her Rio Tinto shares to lock in her profit and has come to you for advice. David is concerned about his superannuation. He would like to know how much return his superannuation is making. He describes himself as a conservative investor and has noticed the value of superannuation portfolio goes up and down too much for his liking. Income for year ended 30th June 2018 Income type (ownership) Salary-(Chloc) S125,000 ross Salary-(David) S60,000 Savings Account Janet- Interest S450 00%-(Chloe & David) Bond Fund-Distribution 450% S900 altex Dividend- Dividend $1.10 per Chloc) $202 Imputation o Tinto Dividend-Dividend S3.60 per $900 Chloc) 390 Imputation Crodit Itemised expenses: Travelling to and from work-S2500 (Chloe) and $2000 (David) Law Institute of Australia- Membership Fees $515 (Chloe) Question 1: Case study You are a financial adviser and the following information is an extract of data you gathered as part of fact finding during an initial client consultation for a married couple David (aged 55) and Chloe (aged 58) Cartwright. David works as a human resources administrator and Chloe works as lawyer. They have two children who are aged 16 and 20 David and Chloe would like to know how much money they will receive after paying tax for the year ended 30th June 2018. They would like advice on how to reduce their tax liability in the future. . 10 months ago Chloe invested in her shares. She bought 430 shares in Caltex at $35 a share and 250 shares in Rio Tinto at $60 a share. She wants to sell her Rio Tinto shares to lock in her profit and has come to you for advice. David is concerned about his superannuation. He would like to know how much return his superannuation is making. He describes himself as a conservative investor and has noticed the value of superannuation portfolio goes up and down too much for his liking. Income for year ended 30th June 2018 Income type (ownership) Salary-(Chloc) S125,000 ross Salary-(David) S60,000 Savings Account Janet- Interest S450 00%-(Chloe & David) Bond Fund-Distribution 450% S900 altex Dividend- Dividend $1.10 per Chloc) $202 Imputation o Tinto Dividend-Dividend S3.60 per $900 Chloc) 390 Imputation Crodit Itemised expenses: Travelling to and from work-S2500 (Chloe) and $2000 (David) Law Institute of Australia- Membership Fees $515 (Chloe)