Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 CCM Bhd is a company operating in the Industrial Products and Services sector in Malaysia. It has been in existence for more

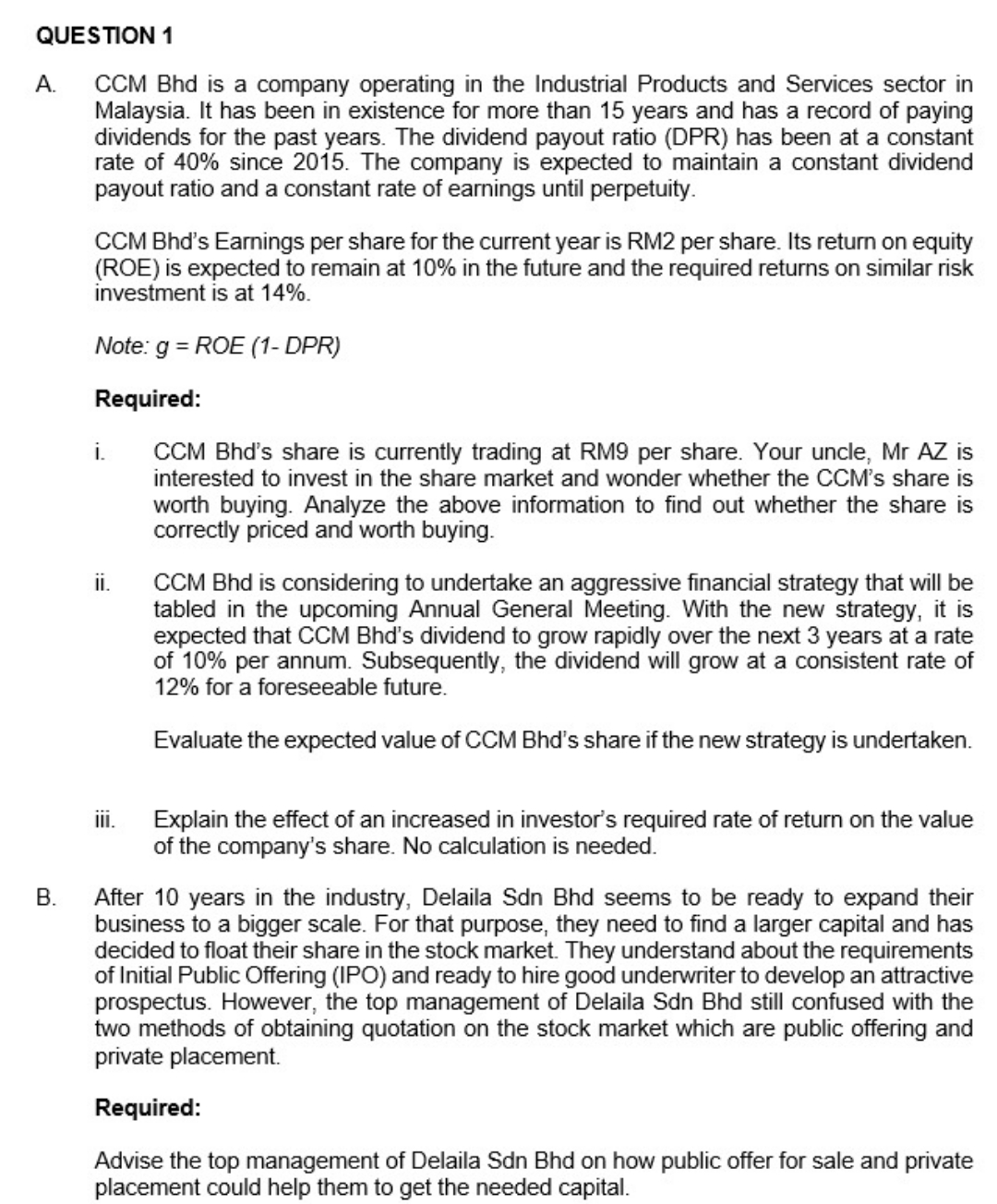

QUESTION 1 CCM Bhd is a company operating in the Industrial Products and Services sector in Malaysia. It has been in existence for more than 15 years and has a record of paying dividends for the past years. The dividend payout ratio (DPR) has been at a constant rate of 40% since 2015. The company is expected to maintain a constant dividend payout ratio and a constant rate of earnings until perpetuity. A. B. CCM Bhd's Earnings per share for the current year is RM2 per share. Its return on equity (ROE) is expected to remain at 10% in the future and the required returns on similar risk investment is at 14%. Note: g = ROE (1-DPR) Required: i. ii. iii. CCM Bhd's share is currently trading at RM9 per share. Your uncle, Mr AZ is interested to invest in the share market and wonder whether the CCM's share is worth buying. Analyze the above information to find out whether the share is correctly priced and worth buying. CCM Bhd is considering to undertake an aggressive financial strategy that will be tabled in the upcoming Annual General Meeting. With the new strategy, it is expected that CCM Bhd's dividend to grow rapidly over the next 3 years at a rate of 10% per annum. Subsequently, the dividend will grow at a consistent rate of 12% for a foreseeable future. Evaluate the expected value of CCM Bhd's share if the new strategy is undertaken. Explain the effect of an increased in investor's required rate of return on the value of the company's share. No calculation is needed. After 10 years in the industry, Delaila Sdn Bhd seems to be ready to expand their business to a bigger scale. For that purpose, they need to find a larger capital and has decided to float their share in the stock market. They understand about the requirements of Initial Public Offering (IPO) and ready to hire good underwriter to develop an attractive prospectus. However, the top management of Delaila Sdn Bhd still confused with the two methods of obtaining quotation on the stock market which are public offering and private placement. Required: Advise the top management of Delaila Sdn Bhd on how public offer for sale and private placement could help them to get the needed capital.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A CCM Bhd Share Valuation and New Strategy i Current Share Price Analysis Using the constant growth dividend discount model DDMwe can analyze if the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started