Answered step by step

Verified Expert Solution

Question

1 Approved Answer

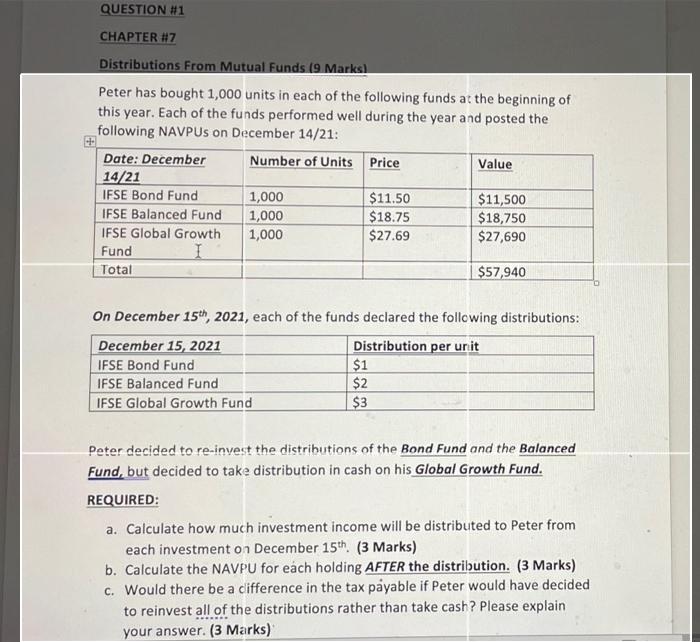

QUESTION #1 CHAPTER #7 Distributions From Mutual Funds (9 Marks) Peter has bought 1,000 units in each of the following funds at the beginning

QUESTION #1 CHAPTER #7 Distributions From Mutual Funds (9 Marks) Peter has bought 1,000 units in each of the following funds at the beginning of this year. Each of the funds performed well during the year and posted the following NAVPUS on December 14/21: Number of Units Date: December 14/21 IFSE Bond Fund 1,000 1,000 IFSE Balanced Fund IFSE Global Growth 1,000 Fund I Total Price December 15, 2021 IFSE Bond Fund IFSE Balanced Fund IFSE Global Growth Fund $11.50 $18.75 $27.69 Value On December 15th, 2021, each of the funds declared the following distributions: Distribution per unit $1 $2 $3 $11,500 $18,750 $27,690 $57,940 Peter decided to re-invest the distributions of the Bond Fund and the Balanced Fund, but decided to take distribution in cash on his Global Growth Fund. REQUIRED: a. Calculate how much investment income will be distributed to Peter from each investment on December 15th. (3 Marks) b. Calculate the NAVPU for each holding AFTER the distribution. (3 Marks) c. Would there be a difference in the tax payable if Peter would have decided to reinvest all of the distributions rather than take cash? Please explain your answer. (3 Marks)

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate how much investment income will be distributed to Peter from each investment on December 15th 3 Marks Computing the Value of the portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started