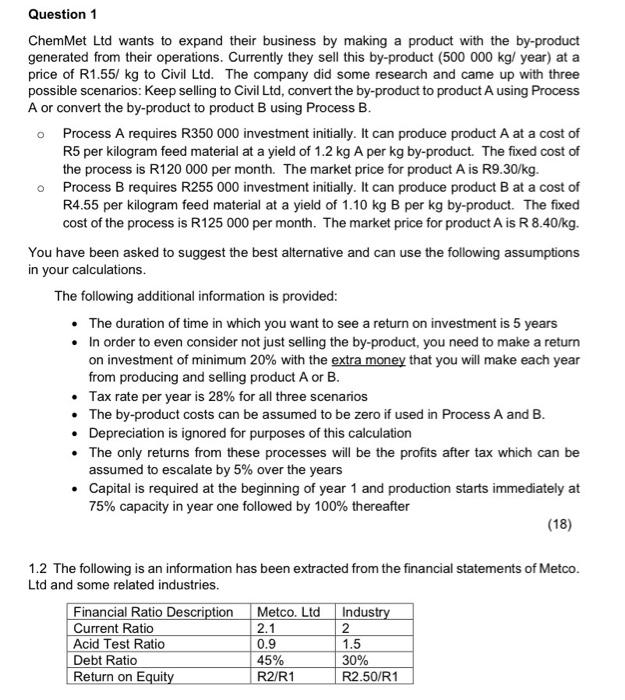

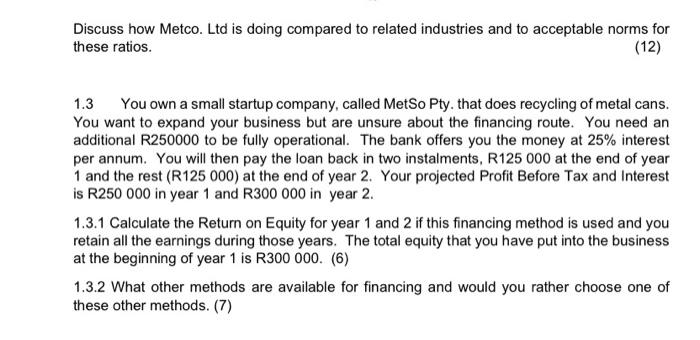

Question 1 ChemMet Ltd wants to expand their business by making a product with the by-product generated from their operations. Currently they sell this by-product (500 000 kg/ year) at a price of R1.55/ kg to Civil Ltd. The company did some research and came up with three possible scenarios: Keep selling to Civil Ltd, convert the by-product to product A using Process A or convert the by-product to product B using Process B. o Process A requires R350 000 investment initially. It can produce product A at a cost of R5 per kilogram feed material at a yield of 1.2 kg A per kg by-product. The fixed cost of the process is R120 000 per month. The market price for product A is R9.30/kg. o Process B requires R255 000 investment initially. It can produce product B at a cost of R4.55 per kilogram feed material at a yield of 1.10 kg B per kg by-product. The fixed cost of the process is R125 000 per month. The market price for product A is R 8.40/kg. You have been asked to suggest the best alternative and can use the following assumptions in your calculations. The following additional information is provided: The duration of time in which you want to see a return on investment is 5 years In order to even consider not just selling the by-product, you need to make a return on investment of minimum 20% with the extra money that you will make each year from producing and selling product A or B. Tax rate per year is 28% for all three scenarios The by-product costs can be assumed to be zero if used in Process A and B. Depreciation is ignored for purposes of this calculation The only returns from these processes will be the profits after tax which can be assumed to escalate by 5% over the years Capital is required at the beginning of year 1 and production starts immediately at 75% capacity in year one followed by 100% thereafter (18) 1.2 The following is an information has been extracted from the financial statements of Metco. Ltd and some related industries. Financial Ratio Description Metco. Ltd Industry Current Ratio 2.1 2 Acid Test Ratio 0.9 1.5 Debt Ratio 45% 30% Return on Equity R2/R1 R2.50/R1 Discuss how Metco. Ltd is doing compared to related industries and to acceptable norms for these ratios. (12) 1.3 You own a small startup company, called Metso Pty. that does recycling of metal cans. You want to expand your business but are unsure about the financing route. You need an additional R250000 to be fully operational. The bank offers you the money at 25% interest per annum. You will then pay the loan back in two instalments, R125 000 at the end of year 1 and the rest (R125 000) at the end of year 2. Your projected Profit Before Tax and Interest is R250 000 in year 1 and R300 000 in year 2. 1.3.1 Calculate the Return on Equity for year 1 and 2 if this financing method is used and you retain all the earnings during those years. The total equity that you have put into the business at the beginning of year 1 is R300 000. (6) 1.3.2 What other methods are available for financing and would you rather choose one of these other methods. (7)