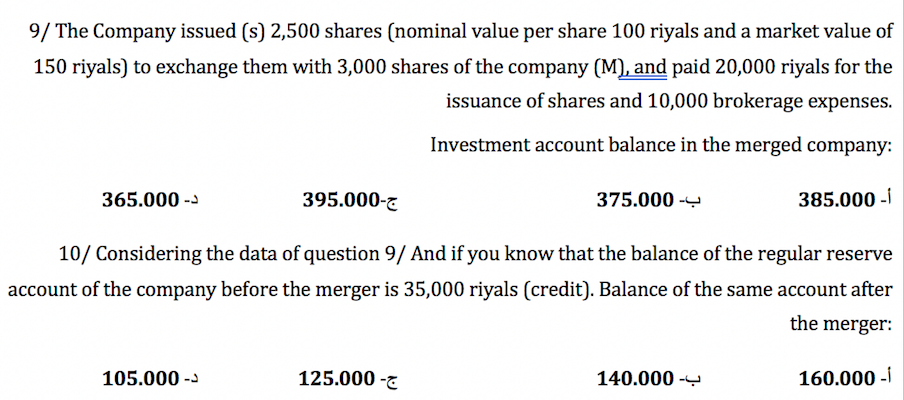

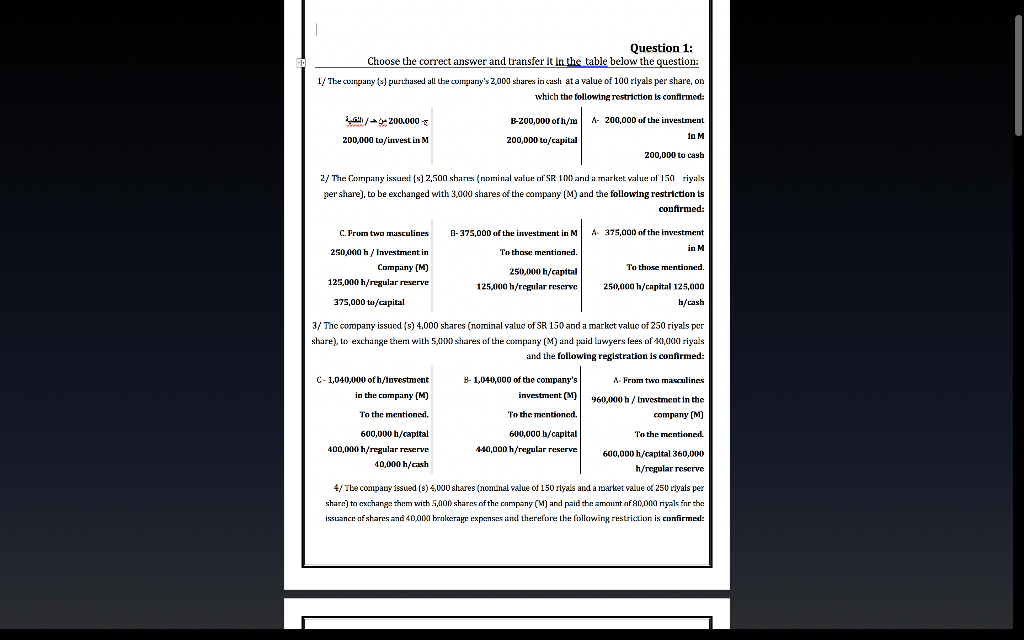

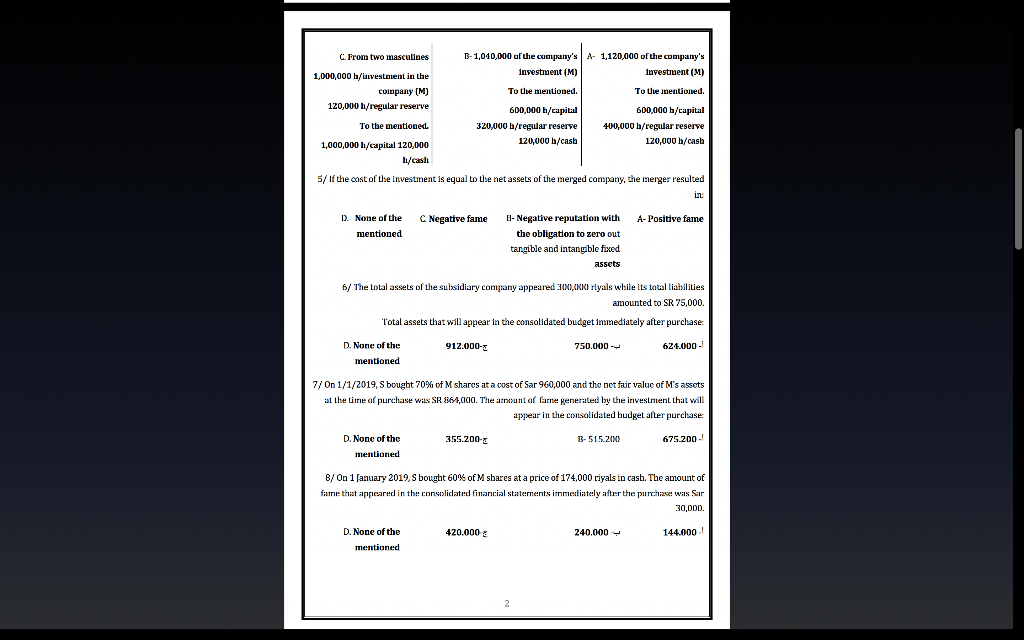

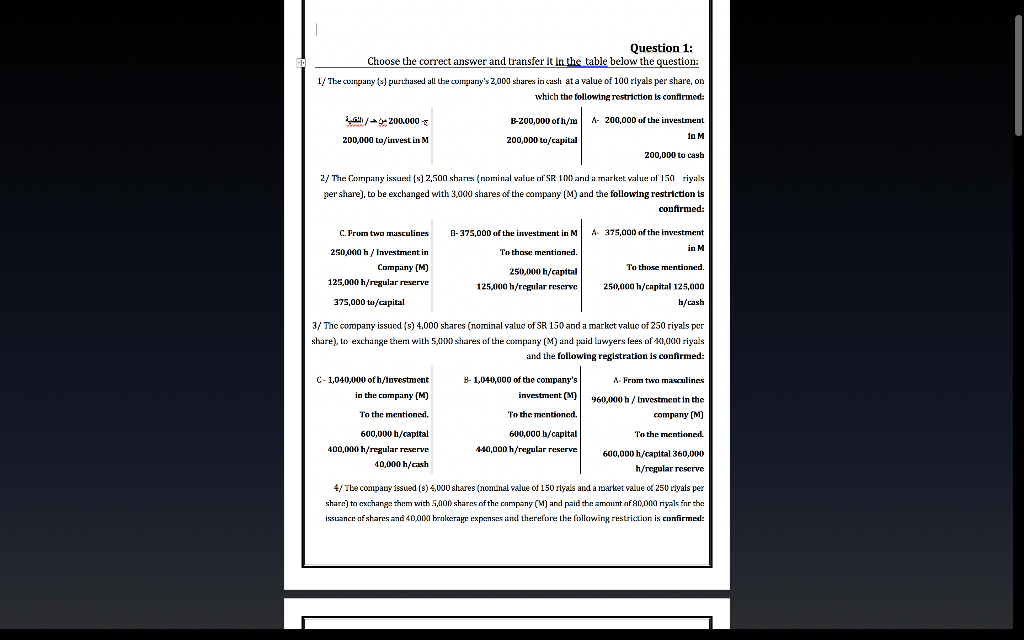

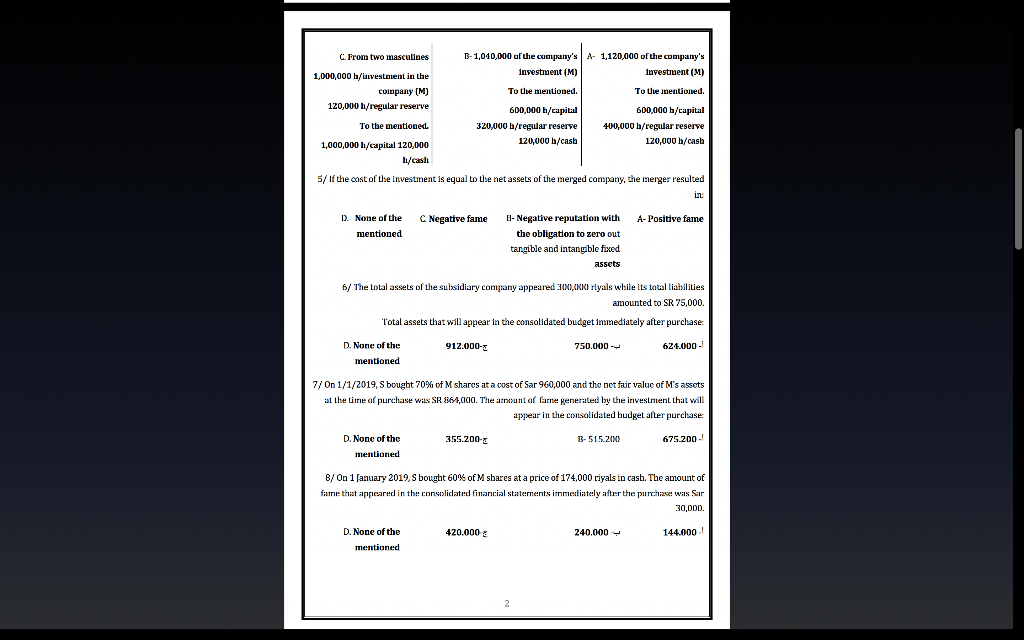

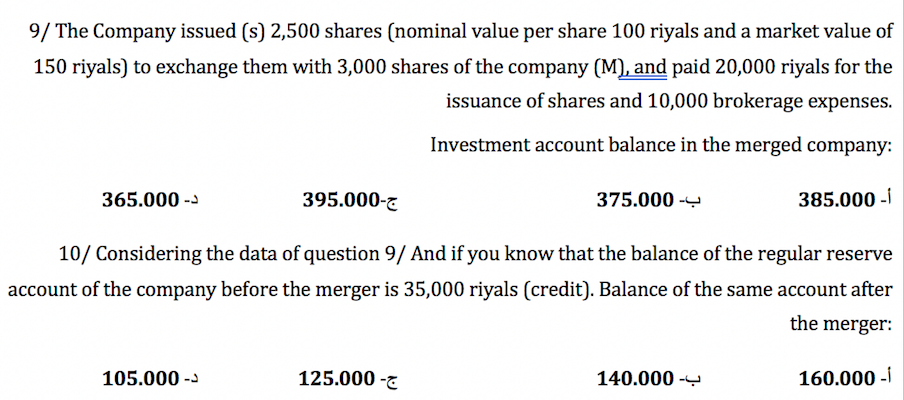

Question 1: Choose the correct answer and transfer it in the table below the question: 1/ The company (a) purchased all the company's 2,000 shares in cash at a value of 100 riyals per share, on which the following restriction is confirmed: A- 200,000 of the investment A/ 200.000 200,000 Lo/unvest in M B-200,000 of h/m 200,000 to/capital In M 200,000 to cash 2/ The Company issued (s) 2,500 shares (nominal value of SR 100) and a market value of 150 riyals per share), to be exchanged with 3,000 shares of the company (M) and the following restriction is confirmed: C. From two masculines A 375,000 of the investment in M 250,000 h / Investment in Company (M) 125,000 h/regular reserve -375,000 of the investment in M To those mentioned. 250,000 h/capital 125,000 h/regular reserve To those mentioned. 250,000 h/capital 125,000 h/cash 375,000 to/capital 3/ The company issued (s) 4,000 shares (nominal value of SR 150 and a marlect value of 250 riyals per share), to exchange them with 5,0000) shares of the company (M) and said lawyers lees of 1,000 riyals and the following registration is confirmed: C-1,040,000 of h/luvestruent - 1,040,000 of the company's A-Prom two masculines in the company (M) investment (M) 960,000 h / Investment in the To the mentioned. To the mentioned. company (M) 600,000 h/capital 600,000 h/capital To the mentioned 400,000 h/regular reserve 440,000 h/regular reserve 600,000 h/capital 360,000 40,000 h/aash h/regular reserve 4/ The company issued (9) 4.000 suares (nontinal value of 150 Ylyals and a market value of 250 ryals per share) to exchange them with 5,000 shares of the company (M) and paid the amount af ,000 riyals for the issuance of shares and 40.000 bralcerage expenses and therefore the following restriction is confirmed: C. From two masculines B-1,010,000 of the company's A- 1,120,000 of the company's 1,000,000 h/investment in the investment (M) luvestment (M) company (M) To the mentioned. To the mentioned. 120,000 h/regular reserve 600,000 h/capital 600,000 h/capital To the mentioned 320,000 b/regular reserve 400,000 h/regular reserve 1,000,000 h/capital 120,000 120,000 b/cash 120,000 h/cash 1/cash 5/1f the cost of the Investment is equal to the net assets of the merged company, the merger resulted Negative fame A-Positive fame D. None of the mentioned - Negative reputation with the obligation to zero out tangible and intangible fixed assets 6/ The total assets of the subsidiary company appeared 3000, CKKI riyals while its total liabilities amounted to SR 75,000. Total assets that will appear in the consolidated budget inmediately after purchase 912.000- D. None of the mentioned 750.000 -- 624.000- 7/ On 1/1/2019, S bought 70% of M shares at a cost of Sar 960,000 and the net fair value of M's assets at the time of purchase was SR 864,000. The amount of famne generated by the investment that will appear in the consolidated budget after purchase 355.200- 13-515.200 675.2001 D. None of the mentioned B/ On 1 January 2019, bought 60% of M sbares at a price of 174,000 riyals to cash. The amount of fume that appeared in the consolidated financial statements immediately after the purchase was Sar 30,000. 420.000 240.000 144.000! D. None of the mentioned 9/ The Company issued (s) 2,500 shares (nominal value per share 100 riyals and a market value of 150 riyals) to exchange them with 3,000 shares of the company (M), and paid 20,000 riyals for the issuance of shares and 10,000 brokerage expenses. Investment account balance in the merged company: 365.000 - 395.000-7 375.000 -4 385.000 -1 10/ Considering the data of question 9/ And if you know that the balance of the regular reserve account of the company before the merger is 35,000 riyals (credit). Balance of the same account after the merger: 105.000 -- 125.000- 140.000 - 160.000 -1