Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 Chrome File Edit View History Bookmarks People Tab Window Help 8 15% [4] Fri 11:37 PM QE ... Assignmen x Rachel Wor X

question 1

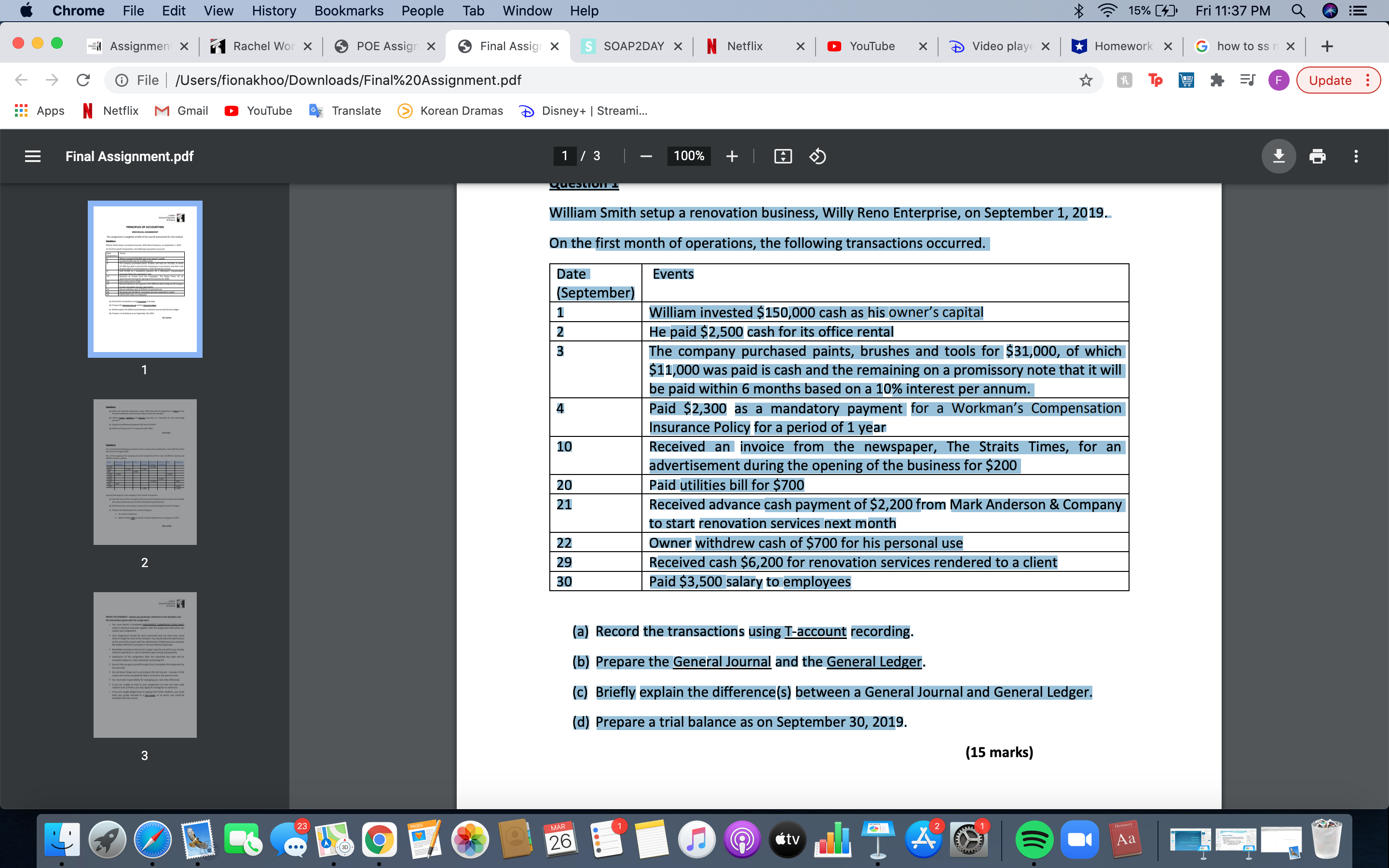

Chrome File Edit View History Bookmarks People Tab Window Help 8 15% [4] Fri 11:37 PM QE ... Assignmen x Rachel Wor X POE Assign X Final Assign X S SOAP2DAY X N Netflix X YouTube X Video play X Homework X G how to ss X + - -> C @ File | /Users/fionakhoo/Downloads/Final%20Assignment.pdf F Update Apps N Netflix M Gmail YouTube Translate Korean Dramas Disney+ | Streami... Final Assignment.pdf 1 / 3 100% + question 1 William Smith setup a renovation business, Willy Reno Enterprise, on September 1, 2019. POPLES OF ACCOUNTING On the first month of operations, the following transactions occurred. Date Events (September) 1 William invested $150,000 cash as his owner's capita 2 He paid $2,500 cash for its office rental 3 The company purchased paints, brushes and tools for $31,000, of which 1 $11,000 was paid is cash and the remaining on a promissory note that it will be paid within 6 months based on a 10% interest per annum. 4 Paid $2,300 as a mandatory payment for a Workman's Compensation Insurance Policy for a period of 1 year 10 Received an invoice from the newspaper, The Straits Times, for an advertisement during the opening of the business for $200 20 Paid utilities bill for $700 21 Received advance cash payment of $2,200 from Mark Anderson & Company to start renovation services next month 22 Owner withdrew cash of $700 for his personal use 2 29 Received cash $6,200 for renovation services rendered to a client 30 Paid $3,500 salary to employees (a) Record the transactions using T-account recording. (b) Prepare the General Journal and the General Ledger. (c) Briefly explain the difference(s) between a General Journal and General Ledger. (d) Prepare a trial balance as on September 30, 2019. 3 (15 marks) CO MAR 26 E Aa

Chrome File Edit View History Bookmarks People Tab Window Help 8 15% [4] Fri 11:37 PM QE ... Assignmen x Rachel Wor X POE Assign X Final Assign X S SOAP2DAY X N Netflix X YouTube X Video play X Homework X G how to ss X + - -> C @ File | /Users/fionakhoo/Downloads/Final%20Assignment.pdf F Update Apps N Netflix M Gmail YouTube Translate Korean Dramas Disney+ | Streami... Final Assignment.pdf 1 / 3 100% + question 1 William Smith setup a renovation business, Willy Reno Enterprise, on September 1, 2019. POPLES OF ACCOUNTING On the first month of operations, the following transactions occurred. Date Events (September) 1 William invested $150,000 cash as his owner's capita 2 He paid $2,500 cash for its office rental 3 The company purchased paints, brushes and tools for $31,000, of which 1 $11,000 was paid is cash and the remaining on a promissory note that it will be paid within 6 months based on a 10% interest per annum. 4 Paid $2,300 as a mandatory payment for a Workman's Compensation Insurance Policy for a period of 1 year 10 Received an invoice from the newspaper, The Straits Times, for an advertisement during the opening of the business for $200 20 Paid utilities bill for $700 21 Received advance cash payment of $2,200 from Mark Anderson & Company to start renovation services next month 22 Owner withdrew cash of $700 for his personal use 2 29 Received cash $6,200 for renovation services rendered to a client 30 Paid $3,500 salary to employees (a) Record the transactions using T-account recording. (b) Prepare the General Journal and the General Ledger. (c) Briefly explain the difference(s) between a General Journal and General Ledger. (d) Prepare a trial balance as on September 30, 2019. 3 (15 marks) CO MAR 26 E Aa Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started