Answered step by step

Verified Expert Solution

Question

1 Approved Answer

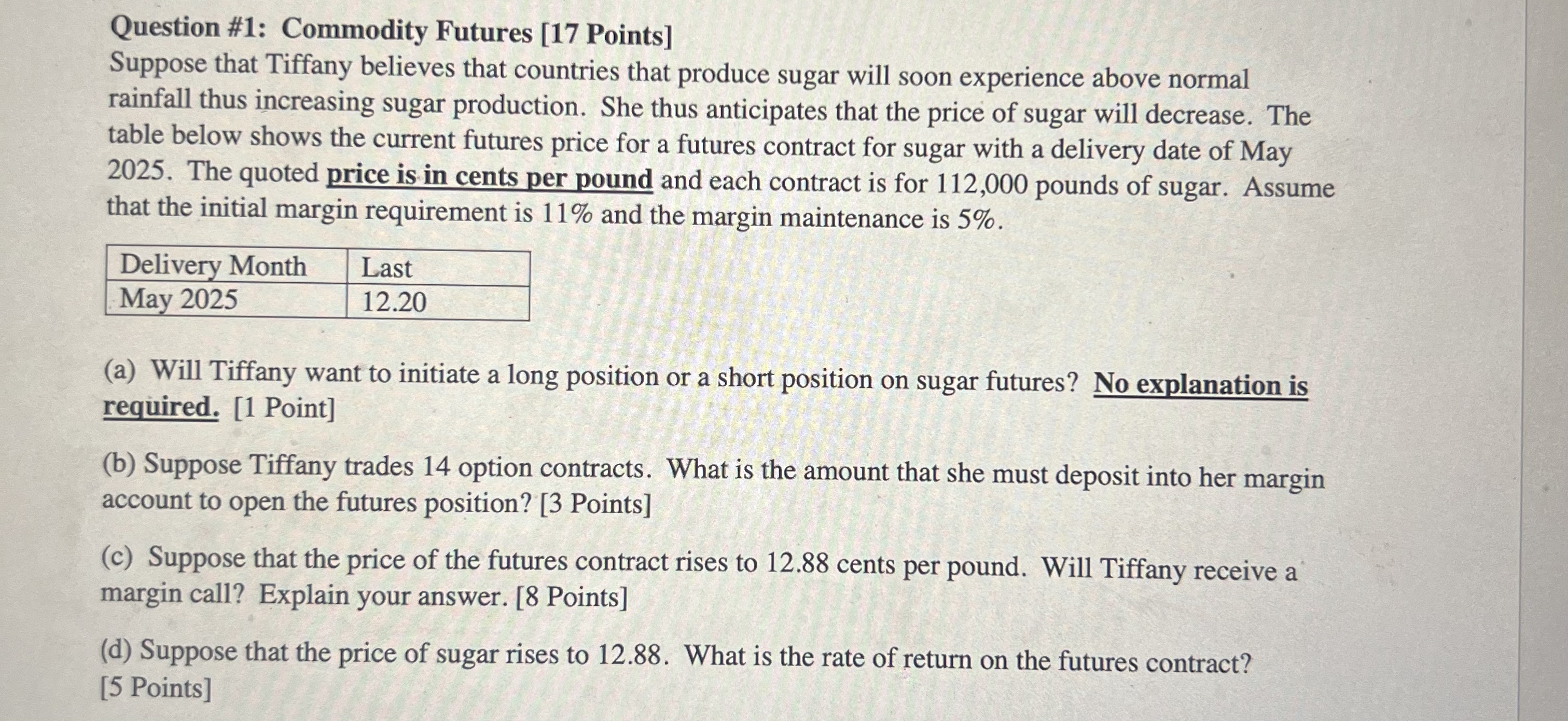

Question # 1 : Commodity Futures [ 1 7 Points ] Suppose that Tiffany believes that countries that produce sugar will soon experience above normal

Question #: Commodity Futures Points

Suppose that Tiffany believes that countries that produce sugar will soon experience above normal rainfall thus increasing sugar production. She thus anticipates that the price of sugar will decrease. The table below shows the current futures price for a futures contract for sugar with a delivery date of May The quoted price is in cents per pound and each contract is for pounds of sugar. Assume that the initial margin requirement is and the margin maintenance is

tableDelivery Month,LastMay

a Will Tiffany want to initiate a long position or a short position on sugar futures? No explanation is required. Point

b Suppose Tiffany trades option contracts. What is the amount that she must deposit into her margin account to open the futures position? Points

c Suppose that the price of the futures contract rises to cents per pound. Will Tiffany receive a margin call? Explain your answer. Points

d Suppose that the price of sugar rises to What is the rate of return on the futures contract?

Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started