Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Company XYZ had the following information during 2020: 1. Beginning inventory was $50,000. Purchases of inventory was $20,000. Ending inventory was 35% of

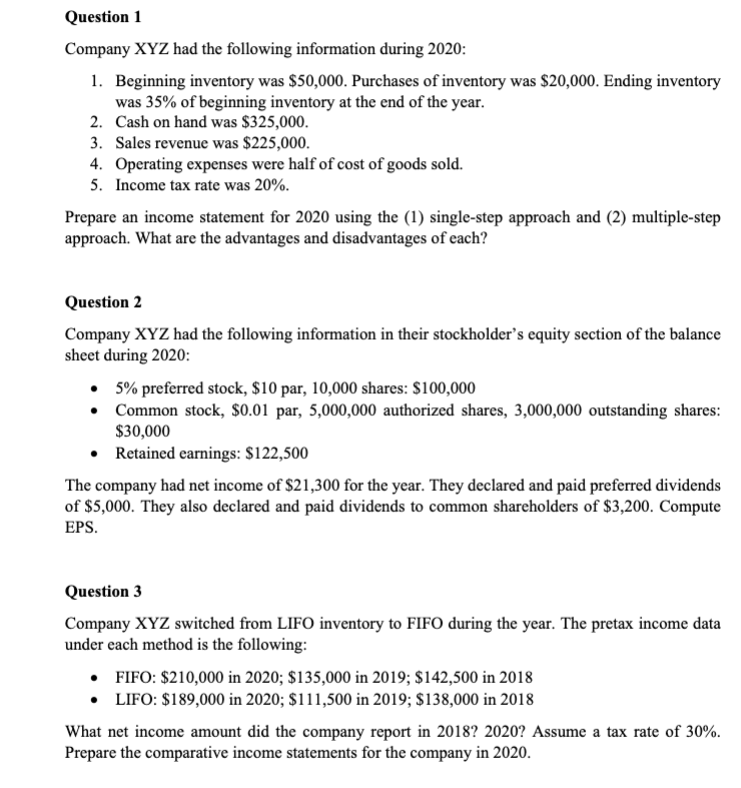

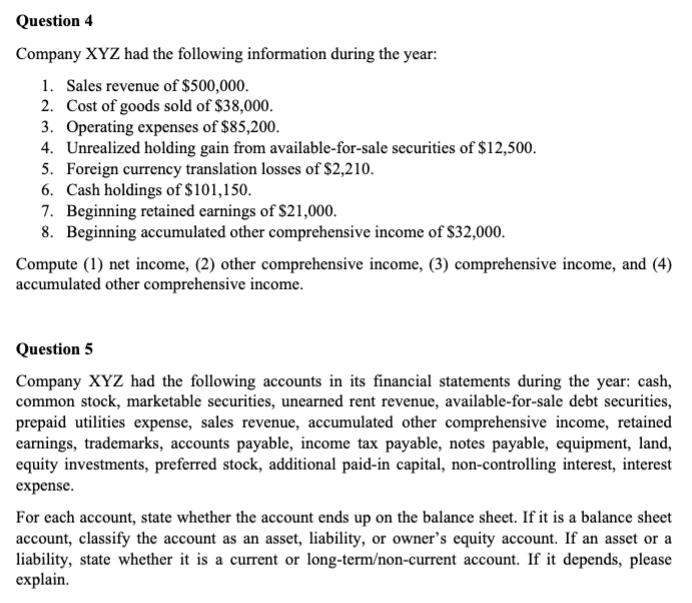

Question 1 Company XYZ had the following information during 2020: 1. Beginning inventory was $50,000. Purchases of inventory was $20,000. Ending inventory was 35% of beginning inventory at the end of the year. 2. Cash on hand was $325,000. 3. Sales revenue was $225,000. 4. Operating expenses were half of cost of goods sold. 5. Income tax rate was 20%. Prepare an income statement for 2020 using the (1) single-step approach and (2) multiple-step approach. What are the advantages and disadvantages of each? Question 2 Company XYZ had the following information in their stockholder's equity section of the balance sheet during 2020: - 5% preferred stock, $10 par, 10,000 shares: $100,000 - Common stock, $0.01 par, 5,000,000 authorized shares, 3,000,000 outstanding shares: $30,000 - Retained earnings: $122,500 The company had net income of $21,300 for the year. They declared and paid preferred dividends of $5,000. They also declared and paid dividends to common shareholders of $3,200. Compute EPS. Question 3 Company XYZ switched from LIFO inventory to FIFO during the year. The pretax income data under each method is the following: - FIFO: $210,000 in 2020;$135,000 in 2019;$142,500 in 2018 - LIFO: $189,000 in 2020;$111,500 in 2019;$138,000 in 2018 What net income amount did the company report in 2018? 2020? Assume a tax rate of 30%. Prepare the comparative income statements for the company in 2020. Company XYZ had the following information during the year: 1. Sales revenue of $500,000. 2. Cost of goods sold of $38,000. 3. Operating expenses of $85,200. 4. Unrealized holding gain from available-for-sale securities of $12,500. 5. Foreign currency translation losses of $2,210. 6. Cash holdings of $101,150. 7. Beginning retained earnings of $21,000. 8. Beginning accumulated other comprehensive income of $32,000. Compute (1) net income, (2) other comprehensive income, (3) comprehensive income, and (4) accumulated other comprehensive income. Question 5 Company XYZ had the following accounts in its financial statements during the year: cash, common stock, marketable securities, unearned rent revenue, available-for-sale debt securities, prepaid utilities expense, sales revenue, accumulated other comprehensive income, retained earnings, trademarks, accounts payable, income tax payable, notes payable, equipment, land, equity investments, preferred stock, additional paid-in capital, non-controlling interest, interest expense. For each account, state whether the account ends up on the balance sheet. If it is a balance sheet account, classify the account as an asset, liability, or owner's equity account. If an asset or a liability, state whether it is a current or long-termon-current account. If it depends, please explain

Question 1 Company XYZ had the following information during 2020: 1. Beginning inventory was $50,000. Purchases of inventory was $20,000. Ending inventory was 35% of beginning inventory at the end of the year. 2. Cash on hand was $325,000. 3. Sales revenue was $225,000. 4. Operating expenses were half of cost of goods sold. 5. Income tax rate was 20%. Prepare an income statement for 2020 using the (1) single-step approach and (2) multiple-step approach. What are the advantages and disadvantages of each? Question 2 Company XYZ had the following information in their stockholder's equity section of the balance sheet during 2020: - 5% preferred stock, $10 par, 10,000 shares: $100,000 - Common stock, $0.01 par, 5,000,000 authorized shares, 3,000,000 outstanding shares: $30,000 - Retained earnings: $122,500 The company had net income of $21,300 for the year. They declared and paid preferred dividends of $5,000. They also declared and paid dividends to common shareholders of $3,200. Compute EPS. Question 3 Company XYZ switched from LIFO inventory to FIFO during the year. The pretax income data under each method is the following: - FIFO: $210,000 in 2020;$135,000 in 2019;$142,500 in 2018 - LIFO: $189,000 in 2020;$111,500 in 2019;$138,000 in 2018 What net income amount did the company report in 2018? 2020? Assume a tax rate of 30%. Prepare the comparative income statements for the company in 2020. Company XYZ had the following information during the year: 1. Sales revenue of $500,000. 2. Cost of goods sold of $38,000. 3. Operating expenses of $85,200. 4. Unrealized holding gain from available-for-sale securities of $12,500. 5. Foreign currency translation losses of $2,210. 6. Cash holdings of $101,150. 7. Beginning retained earnings of $21,000. 8. Beginning accumulated other comprehensive income of $32,000. Compute (1) net income, (2) other comprehensive income, (3) comprehensive income, and (4) accumulated other comprehensive income. Question 5 Company XYZ had the following accounts in its financial statements during the year: cash, common stock, marketable securities, unearned rent revenue, available-for-sale debt securities, prepaid utilities expense, sales revenue, accumulated other comprehensive income, retained earnings, trademarks, accounts payable, income tax payable, notes payable, equipment, land, equity investments, preferred stock, additional paid-in capital, non-controlling interest, interest expense. For each account, state whether the account ends up on the balance sheet. If it is a balance sheet account, classify the account as an asset, liability, or owner's equity account. If an asset or a liability, state whether it is a current or long-termon-current account. If it depends, please explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started