Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #1 Complete problem P6.1 part A. Post your answer in the discussion board as well as your approach to solving it. Then, discuss with

Question #1

Complete problem P6.1 part A. Post your answer in the discussion board as well as your approach to solving it.

Then, discuss with your peers how to best arrive at the correct answer.

The Attached Excel Should Help you in completing this problem:

please I need help with this question

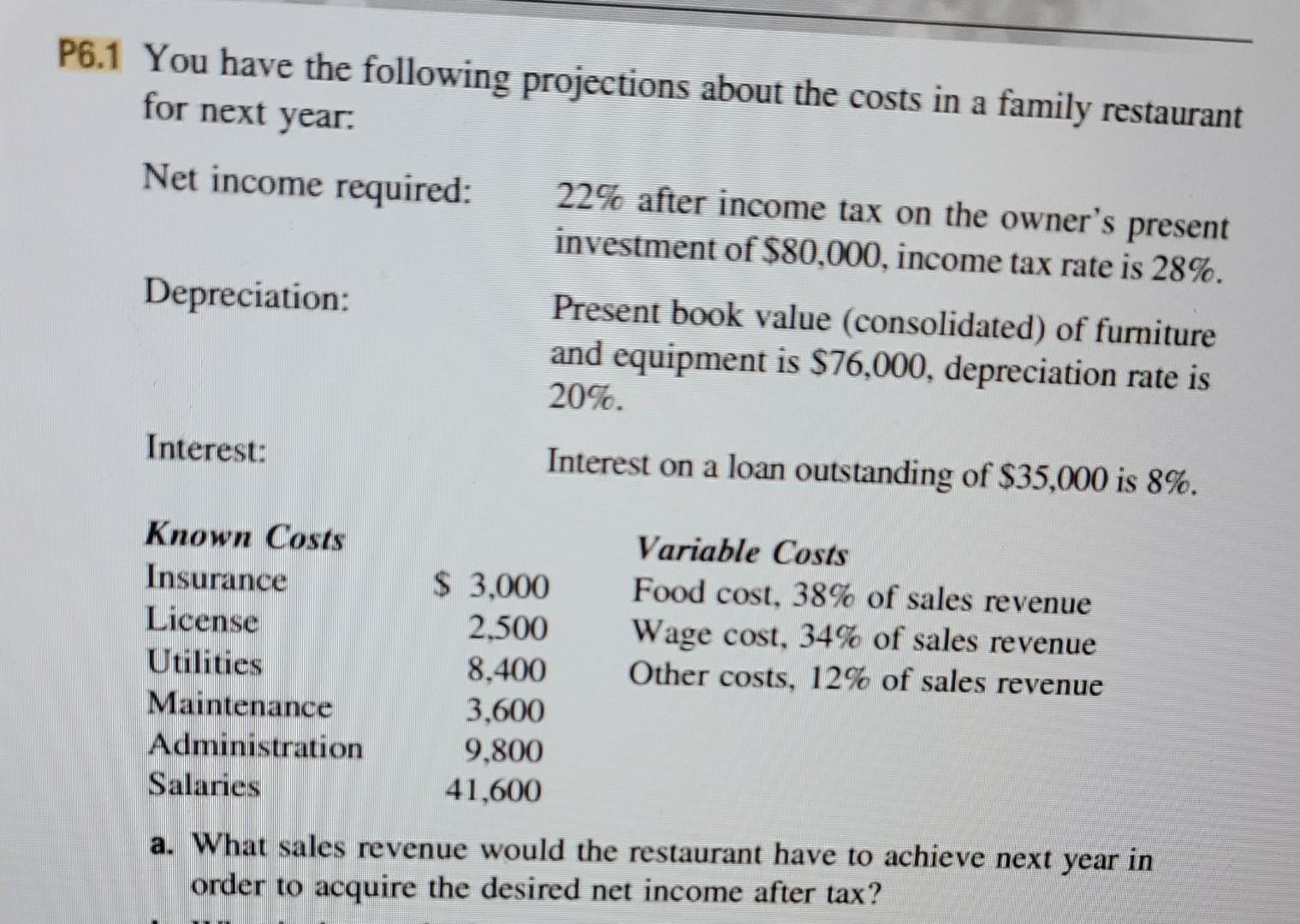

P6.1 You have the following projections about the costs in a family restaurant for next year. Net income required: 22% after income tax on the owner's present investment of $80,000, income tax rate is 28%. Depreciation: Present book value (consolidated) of furniture and equipment is $76,000, depreciation rate is 20%. Interest: Interest on a loan outstanding of $35,000 is 8%. Known Costs Insurance License Utilities Maintenance Administration Salaries $ 3.000 2.500 8.400 3,600 9,800 41,600 Variable Costs Food cost, 38% of sales revenue Wage cost, 34% of sales revenue Other costs, 12% of sales revenue a. What sales revenue would the restaurant have to achieve next year in order to acquire the desired net income after taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started