Question

QUESTION 1 (COMPULSORY) On the 1st January 2013, Cold & Sweet Ice-cream (CSI) was set up by Paul Edwards as a business importing various types

QUESTION 1 (COMPULSORY)

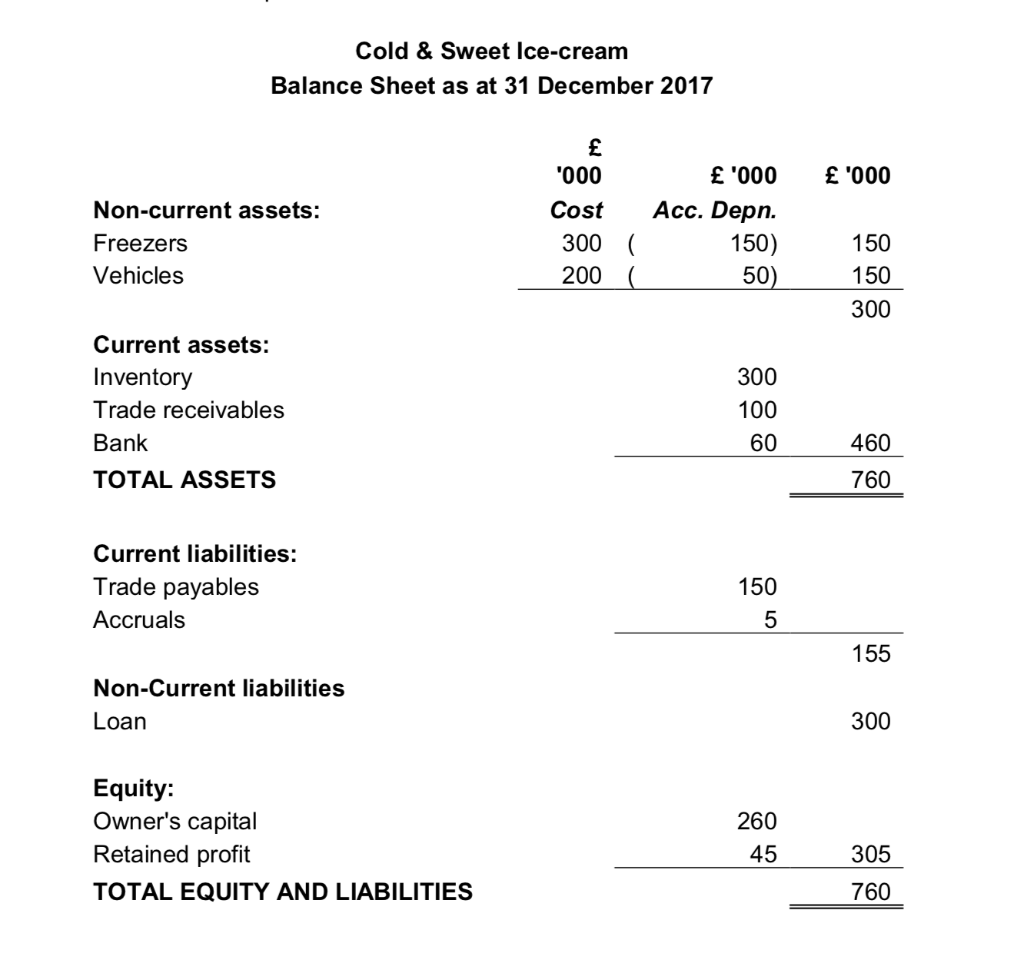

On the 1st January 2013, Cold & Sweet Ice-cream (CSI) was set up by Paul Edwards as a business importing various types of ice-cream from overseas and selling them locally in Glasgow. After his last full year of business, Paul produced his latest set of accounts and the latest balance sheet is reproduced the picture:

Additional notes: 1. The loan was taken out on the 1st of June 2014 and was for a period of five years

repayable at the end of the period with interest payable on a monthly basis at 5% per annum

3

2. The freezers have been being used since their purchase on the first day of trading, but all the vehicles were replaced on the 1st January 2017

Transactions for the year of trading to 31 December 2018 are listed below:

-

i) The depreciation policy for the non-current assets is to charge a full year of depreciation in the year of purchase and to make no charge in the year of sale. Freezers are depreciated on a straight line basis over 10 years with no residual value. However, CSI uses 25% reducing balance method to depreciate vehicles

-

ii) CSI disposed of a vehicle that had cost 40,000. CSI sold the vehicle for 25,000, which was received in cash

-

iii) CSI purchased a new vehicle for 45,000 paying by cash

-

iv) During the year, CSI spent 700,000 on the purchase of various types of ice-

cream. All purchases were made on credit terms

-

v) CSI raised 1,000,000 of revenue in the year from selling the opening stock of

inventory (300,000) and additional inventory purchased within the year that had cost 500,000. 20% of the sales were made on a cash basis, and the rest were sold on credit terms

-

vi) Within the first few months of the year, the opening balance of trade payables was cleared, and at the end of the year, the balance of trade payable was 30,000

-

vii) During the year, 750,000 was collected from credit customers

-

viii) During the year, the following cash payments were made:

-

- Wages and salaries (1 Jan 2018 to 31 Dec 2018) 24,000

-

- Electricity (1 Jan 2018 to 30 Sep 2018) 9,000

-

- Rent (paid for 18 months, staring 1 Jan 2018) 18,000

-

-

ix) Accrual balance as at 31 Dec 2017 related to electricity consumed in 2017

-

x) Paul withdrew 100,000 in cash from CSI

-

xi) Paul was informed that a credit customer who owed 4,000 went bankrupt, and it

was clear at the end of the year that no cash would ever be forthcoming from this customer

REQUIRED: Using the information provided, prepare the income statement and the balance sheet for CSI for the year ended 31 December 2018.

Cold & Sweet Ice-cream Balance Sheet as at 31 December 2017 '000 Non-current assets: Freezers Vehicles "000 Cost 300 200 '000 Acc. Depn. 150) 50) 150 ( 150 300 300 Current assets: Inventory Trade receivables Bank TOTAL ASSETS 100 460 760 Current liabilities: Trade payables Accruals 150 5 155 Non-Current liabilities Loan 300 260 Equity: Owner's capital Retained profit TOTAL EQUITY AND LIABILITIES 45 305 760 Cold & Sweet Ice-cream Balance Sheet as at 31 December 2017 '000 Non-current assets: Freezers Vehicles "000 Cost 300 200 '000 Acc. Depn. 150) 50) 150 ( 150 300 300 Current assets: Inventory Trade receivables Bank TOTAL ASSETS 100 460 760 Current liabilities: Trade payables Accruals 150 5 155 Non-Current liabilities Loan 300 260 Equity: Owner's capital Retained profit TOTAL EQUITY AND LIABILITIES 45 305 760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started