Answered step by step

Verified Expert Solution

Question

1 Approved Answer

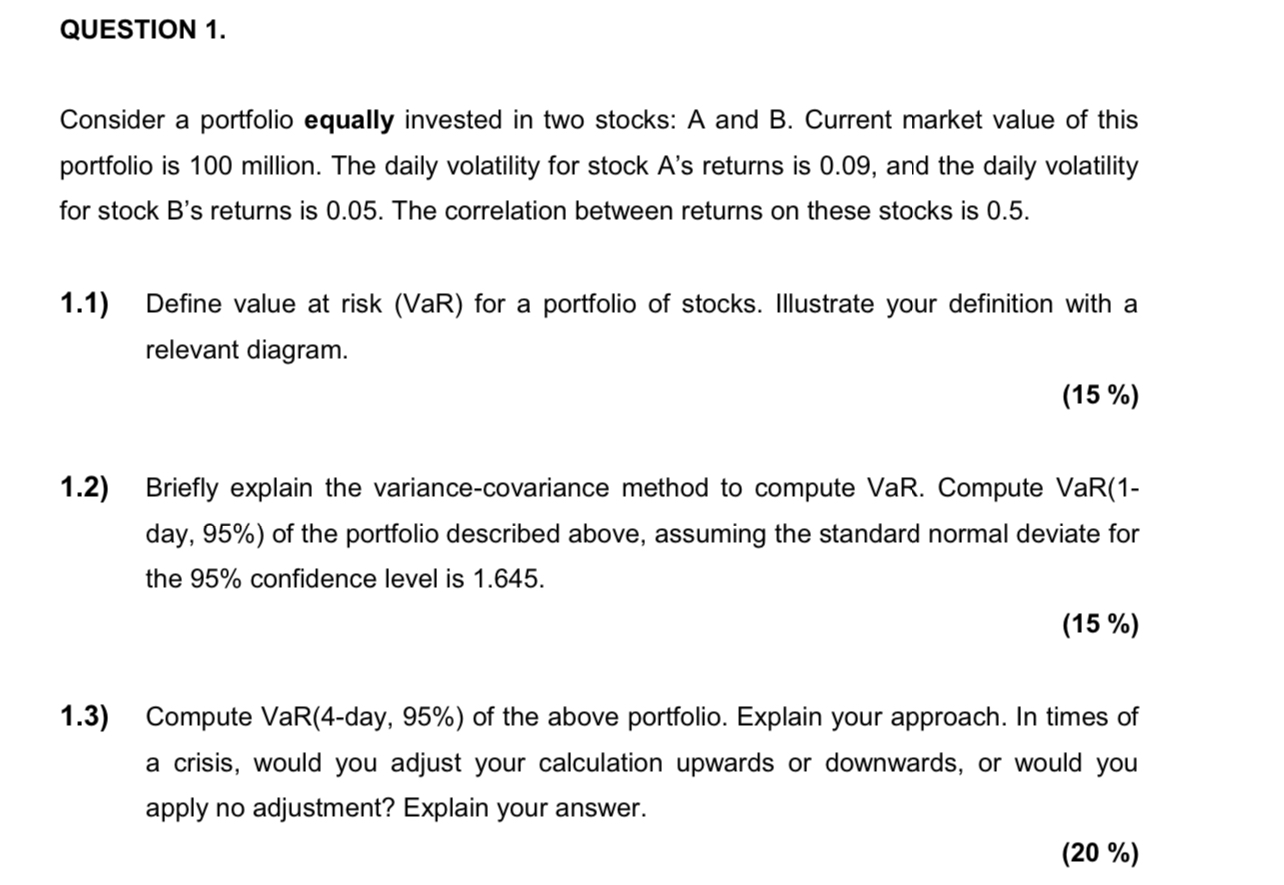

QUESTION 1 . Consider a portfolio equally invested in two stocks: A and B . Current market value of this portfolio is 1 0 0

QUESTION

Consider a portfolio equally invested in two stocks: A and Current market value of this portfolio is million. The daily volatility for stock As returns is and the daily volatility for stock Bs returns is The correlation between returns on these stocks is

Define value at risk for a portfolio of stocks. Illustrate your definition with a relevant diagram.

Briefly explain the variancecovariance method to compute VaR. Compute VaRday, of the portfolio described above, assuming the standard normal deviate for the confidence level is

Compute VaRday, of the above portfolio. Explain your approach. In times of a crisis, would you adjust your calculation upwards or downwards, or would you apply no adjustment? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started