Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Consider the following independent items. Each item represents a separate class of assets. A company has developed a masthead for its newspaper to

Question

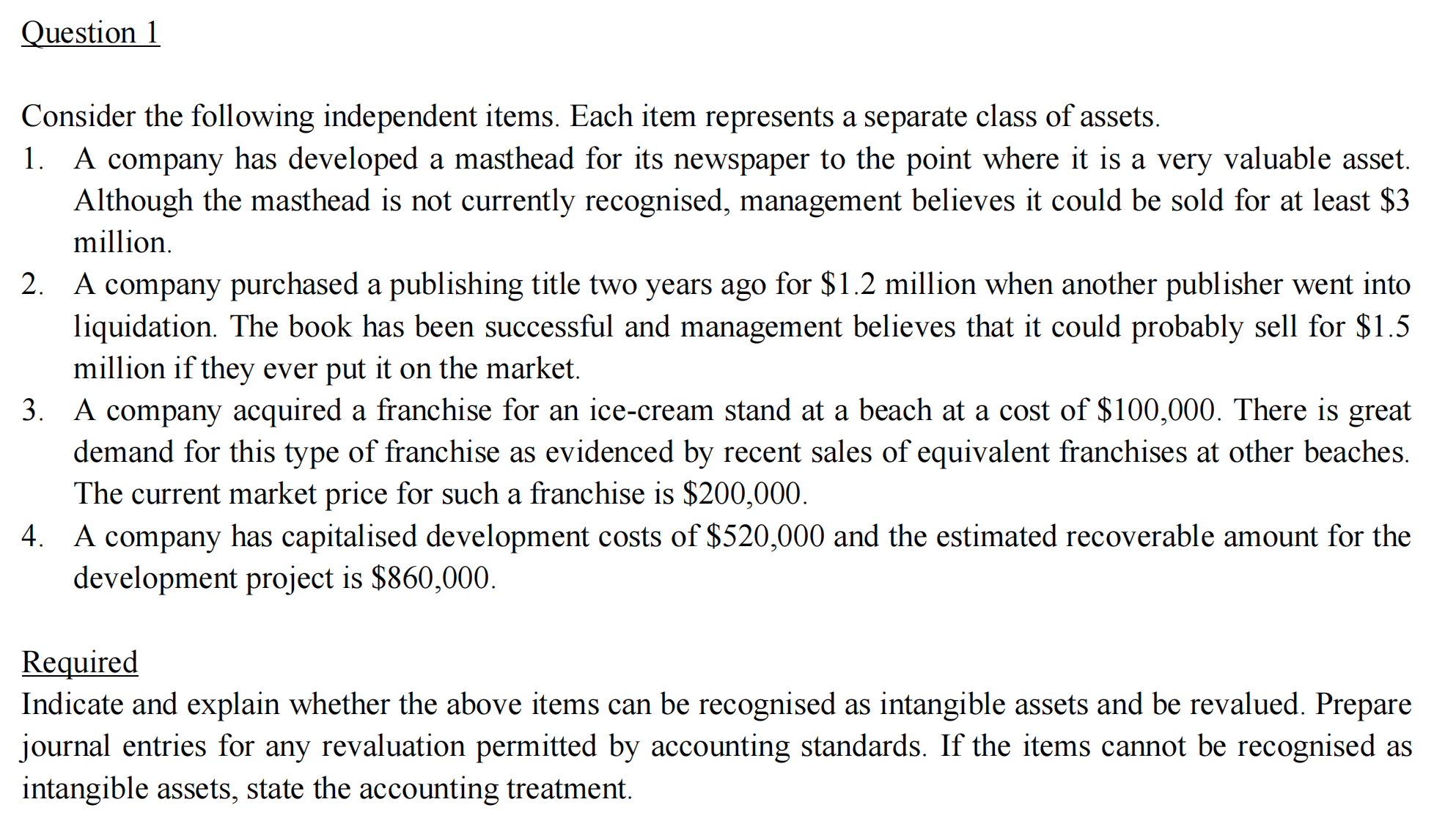

Consider the following independent items. Each item represents a separate class of assets.

A company has developed a masthead for its newspaper to the point where it is a very valuable asset. Although the masthead is not currently recognised, management believes it could be sold for at least $ million.

A company purchased a publishing title two years ago for $ million when another publisher went into liquidation. The book has been successful and management believes that it could probably sell for $ million if they ever put it on the market.

A company acquired a franchise for an icecream stand at a beach at a cost of $ There is great demand for this type of franchise as evidenced by recent sales of equivalent franchises at other beaches. The current market price for such a franchise is $

A company has capitalised development costs of $ and the estimated recoverable amount for the development project is $

Required

Indicate and explain whether the above items can be recognised as intangible assets and be revalued. Prepare journal entries for any revaluation permitted by accounting standards. If the items cannot be recognised as intangible assets, state the accounting treatment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started