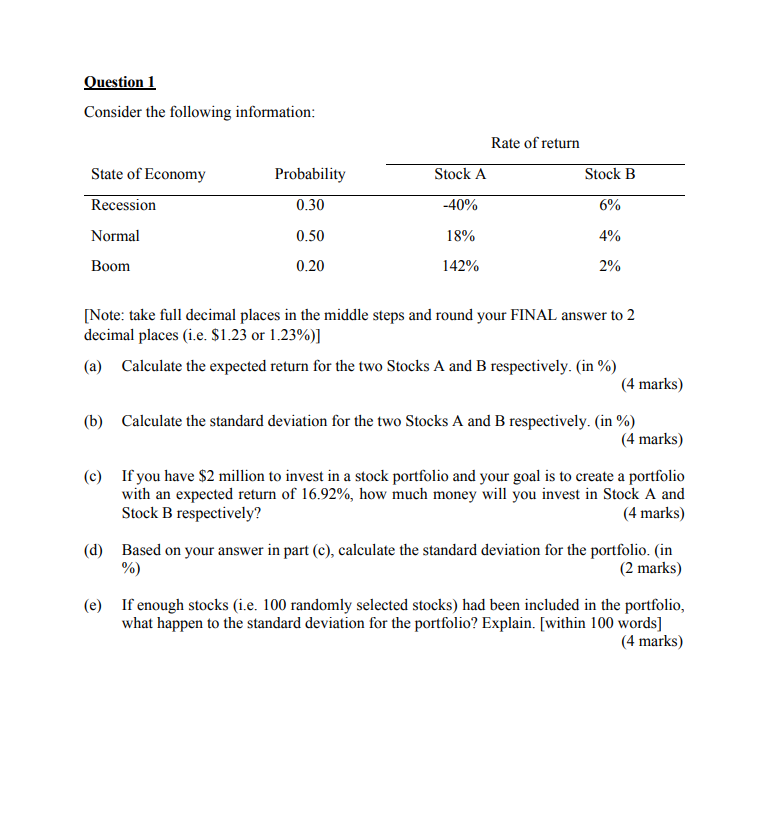

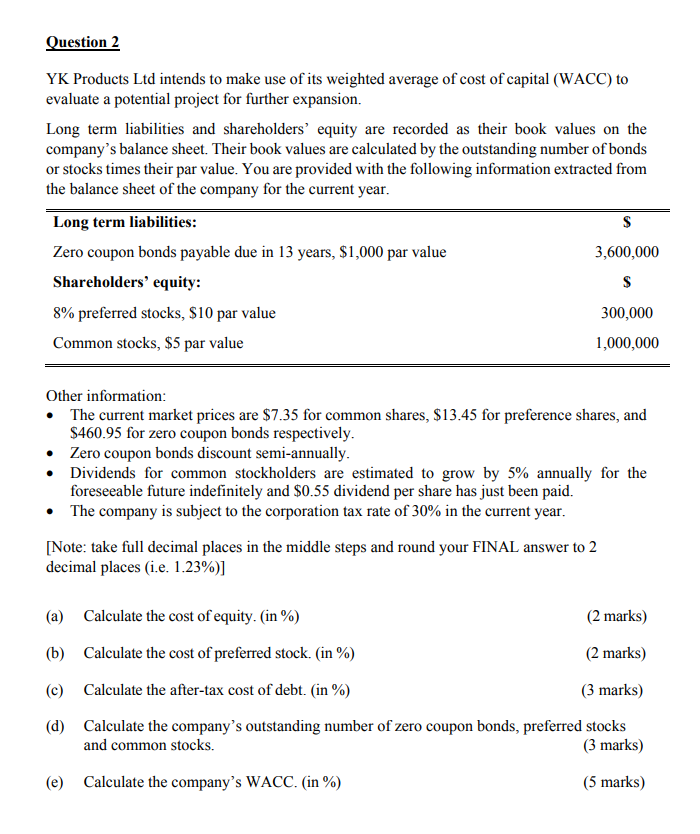

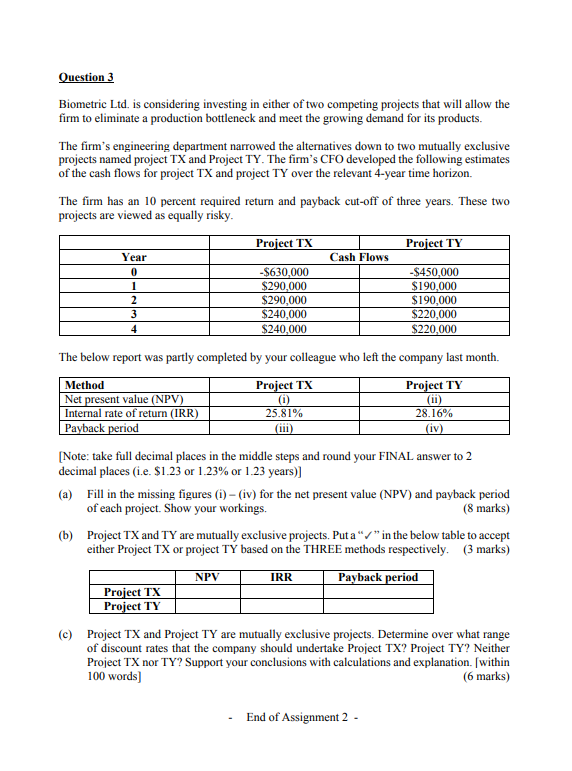

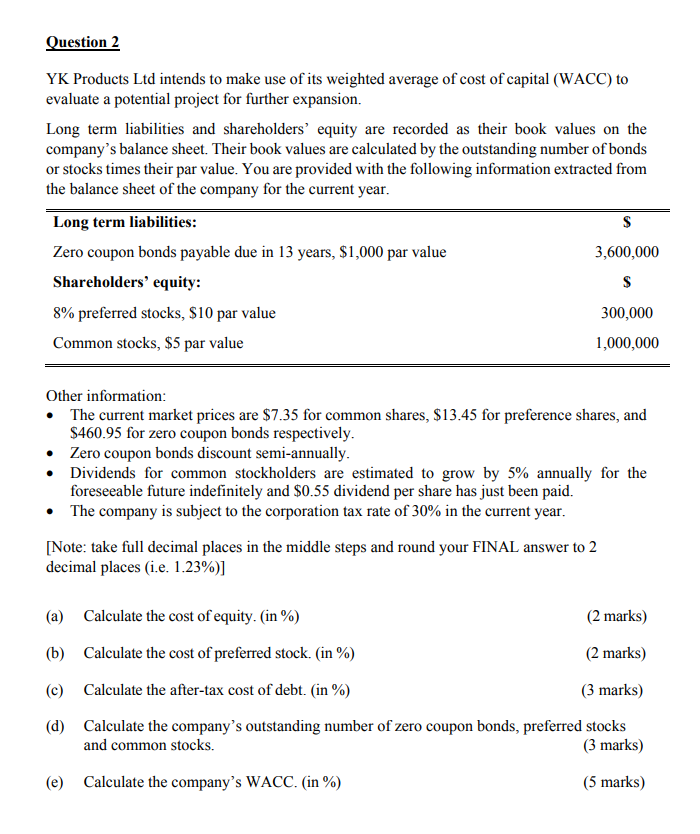

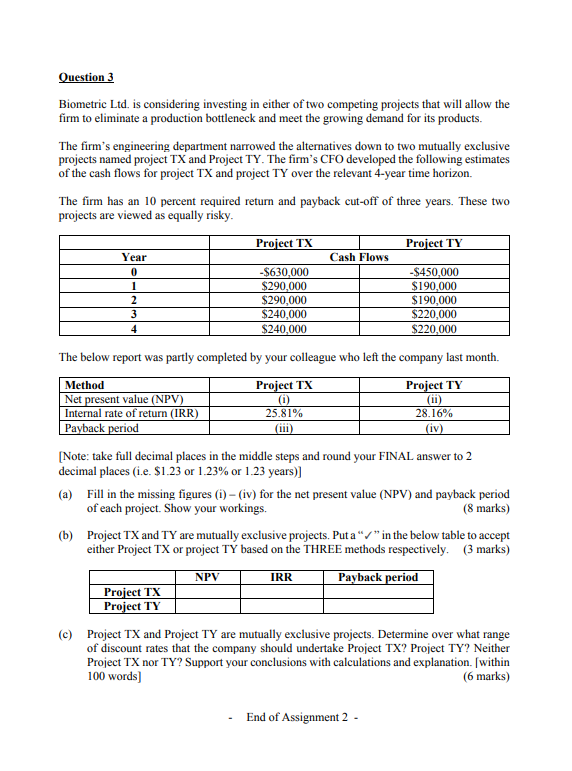

Question 1 Consider the following information: Rate of return Stock A Stock B State of Economy Recession Probability 0.30 -40% 6% Normal 0.50 18% 4% Boom 0.20 142% 2% [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. $1.23 or 1.23%)] (a) Calculate the expected return for the two Stocks A and B respectively. (in %) (4 marks) (b) Calculate the standard deviation for the two Stocks A and B respectively. (in %) (4 marks) (c) If you have $2 million to invest in a stock portfolio and your goal is to create a portfolio with an expected return of 16.92%, how much money will you invest in Stock A and Stock B respectively? (4 marks) (d) Based on your answer in part (c), calculate the standard deviation for the portfolio. (in %) (2 marks) (e) If enough stocks (i.e. 100 randomly selected stocks) had been included in the portfolio, what happen to the standard deviation for the portfolio? Explain. [within 100 words] (4 marks) Question 2 YK Products Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential project for further expansion. Long term liabilities and shareholders' equity are recorded as their book values on the company's balance sheet. Their book values are calculated by the outstanding number of bonds or stocks times their par value. You are provided with the following information extracted from the balance sheet of the company for the current year. Long term liabilities: S Zero coupon bonds payable due in 13 years, $1,000 par value 3,600,000 Shareholders' equity: $ 8% preferred stocks, $10 par value 300,000 Common stocks, $5 par value 1,000,000 Other information: The current market prices are $7.35 for common shares, $13.45 for preference shares, and $460.95 for zero coupon bonds respectively. Zero coupon bonds discount semi-annually. Dividends for common stockholders are estimated to grow by 5% annually for the foreseeable future indefinitely and $0.55 dividend per share has just been paid. The company is subject to the corporation tax rate of 30% in the current year. [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. 1.23%)] (a) Calculate the cost of equity. (in %) (2 marks) (b) Calculate the cost of preferred stock. (in %) (2 marks) (c) Calculate the after-tax cost of debt. (in %) (3 marks) (d) Calculate the company's outstanding number of zero coupon bonds, preferred stocks and common stocks. (3 marks) (e) Calculate the company's WACC. (in %) (5 marks) Question 3 Biometric Ltd. is considering investing in either of two competing projects that will allow the firm to eliminate a production bottleneck and meet the growing demand for its products. The firm's engineering department narrowed the alternatives down to two mutually exclusive projects named project TX and Project TY. The firm's CFO developed the following estimates of the cash flows for project TX and project TY over the relevant 4-year time horizon. The firm has an 10 percent required return and payback cut-off of three years. These two projects are viewed as equally risky. Project TX Project TY Cash Flows Year 0 1 2 3 4 -$630,000 $290,000 $290,000 $240,000 $240,000 -$450,000 $190,000 $190,000 $220,000 $220,000 The below report was partly completed by your colleague who left the company last month. Method Project TX Project TY Net present value (NPV) (i) (ii) Internal rate of return (IRR) 25.81% 28.16% Payback period (iii) (iv) [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. $1.23 or 1.23% or 1.23 years)] (a) Fill in the missing figures (1) - (iv) for the net present value (NPV) and payback period of each project. Show your workings. (8 marks) (b) Project TX and TY are mutually exclusive projects. Put a "v" in the below table to accept either Project TX or project TY based on the THREE methods respectively. (3 marks) NPV IRR Payback period Project TX Project TY (c) Project TX and Project TY are mutually exclusive projects. Determine over what range of discount rates that the company should undertake Project TX? Project TY? Neither Project TX nor TY? Support your conclusions with calculations and explanation. [within 100 words) (6 marks) End of Assignment 2