Question

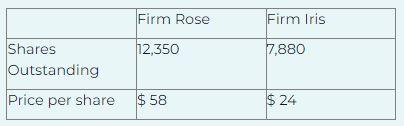

QUESTION 1. Consider the following premerger information about a bidding firm (Firm Rose) and a target firm (Firm Iris). Both firms have no debt outstanding.

QUESTION 1. Consider the following premerger information about a bidding firm (Firm Rose) and a target firm (Firm Iris). Both firms have no debt outstanding. Firm Rose has estimated that the value of the synergistic benefits from acquiring Firm Iris is $ 35,000.

a. If Firm Iris is willing to be acquired for $ 26.5 per share in cash, what is the NPV of the merger?

b. What will the price per share of the merged firm be assuming the conditions in (a)?

c. What is the cost or merger premium?

d. Suppose Firm Iris is agreeable to a merger by an exchange of stock. If Firm Rose offers one of its shares for every three of Iriss shares, what will the price per share of the merged firm be?

e. What is the NPV of the merger assuming the conditions in (d)?

QUESTION 2. Best company and Beat company need to raise funds for capital improvements at their manufacturing plants. Best company can borrow funds either at a 5 percent fixed rate or at EURIBOR+2 percent floating rate. Beat company can borrow funds at the debt market either at a 8 percent fixed rate or at EURIBOR+1 percent floating rate.

a. Is there an opportunity here for Best and Beat company to do interest rate swap? Explain!

b. Suppose the dealer in the swaps market demand 2 percent of profit, describe how these two company can do interest rate swap! Use diagram to expalain your answer!

QUESTION 3. Suppose the Vietnam Dong exchange rate is VND2= IDR 1, and the Chinese yuan is CNY 1= IDR 1900.

a) What is the cross-rate in terms of Vietnamese dong per Chinese Yuan?

b) Suppose the cross rate is VND 3700= CNY 1. Is there an arbitrage opportunity here? If there is, explain how to take advantage of the mispricing starting by taking out a loan for IDR 1,000,000!

*NOTE: please give step of calculation (if any)

Firm Rose Firm Iris 7,880 Shares 12,350 Outstanding Price per share $ 58 $ 24 Firm Rose Firm Iris 7,880 Shares 12,350 Outstanding Price per share $ 58 $ 24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started