Question

Question 1: Cost Flows and Income Statement [30 marks] Floyds Tap Company manufacturers an extensive range of high-quality brass and chrome taps and has an

Question 1: Cost Flows and Income Statement [30 marks] Floyds Tap Company manufacturers an extensive range of high-quality brass and chrome taps and has an excellent reputation for quality. The company is managed by John Smith and employs 20 people. It has annual sales averaging approximately $10 million. Although it has been consistently profitable, Floyds Tap Company has experienced increasing pressure from competitors in recent years. The company uses a cost-plus approach to pricing but is having to reduce its mark-up constantly to maintain market share. John qualified as an engineer. The business is small and has never been able to employ an accountant. Instead, a bookkeeper calculates monthly profit as sales revenue minus expenses. Prices are based on rough estimates of the cost of direct material and direct labour inputs plus a 50 per cent mark-up. With the decline in profit and constant pressure on prices, John began to feel uneasy about the way costs and profits were calculated.

Question 1: Cost Flows and Income Statement [30 marks] Floyds Tap Company manufacturers an extensive range of high-quality brass and chrome taps and has an excellent reputation for quality. The company is managed by John Smith and employs 20 people. It has annual sales averaging approximately $10 million. Although it has been consistently profitable, Floyds Tap Company has experienced increasing pressure from competitors in recent years. The company uses a cost-plus approach to pricing but is having to reduce its mark-up constantly to maintain market share. John qualified as an engineer. The business is small and has never been able to employ an accountant. Instead, a bookkeeper calculates monthly profit as sales revenue minus expenses. Prices are based on rough estimates of the cost of direct material and direct labour inputs plus a 50 per cent mark-up. With the decline in profit and constant pressure on prices, John began to feel uneasy about the way costs and profits were calculated.

Additional information: The inventory levels for the month: o Raw materials, 1 January $50,000 o Raw materials, 31 January $60,000 o Work in Process, 1 January $200,000 o Work in Process, 31 January $280,000 o Finished Goods, 1 January $95,000 o Finished Goods, 31 January $150,000 The factory occupies 80 per cent of the premises, the sales area occupies 15 per cent and administration 5 per cent. Most of the equipment is used for manufacturing, with only 5 per cent of the book value being used for sales and administrative functions. Almost all the electricity is consumed in the factory. The truck is used to deliver finished goods to customers. John spends about half of his time on factory management, the rest of his time in the sales area and on administration. Required: Show ALL your workings. (i) Comment on the cost classifications currently being used in Floyds Tap Companys profit statement. (3 marks) (ii) Prepare a schedule of cost of goods manufactured for the month, as per Exhibit 2.7 (p.55) of the textbook. (8 marks) (iii) Prepare a schedule of cost of goods sold for the month, as per Exhibit 2.7 (p.55) of the textbook. (3 marks) (iv) Prepare a revised income statement for the month as per Exhibit 2.7 (p.55) of the textbook. (8 marks) (v) Explain what constitutes the difference between the income statement you prepared in part (iv) and the profit statement prepared by the companys bookkeeper. (3 marks) (vi) Evaluate the usefulness of product costs based on direct materials and direct labour.

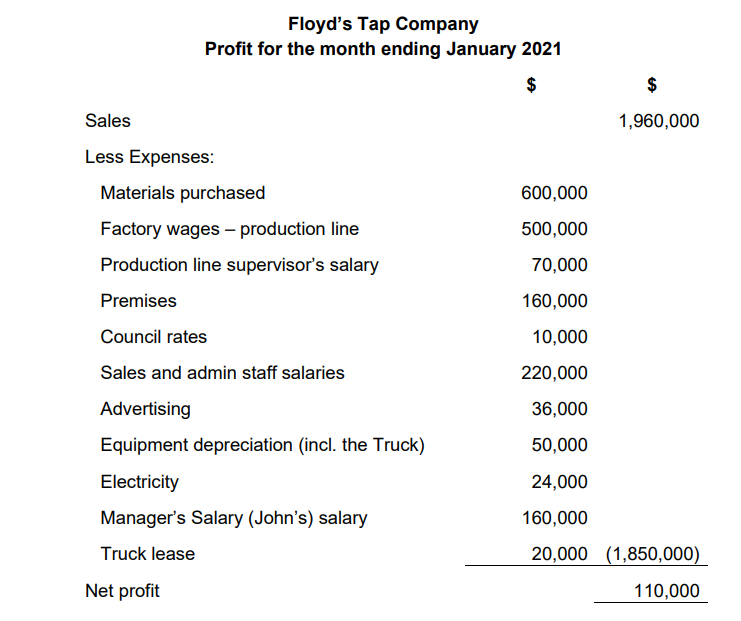

Floyd's Tap Company Profit for the month ending January 2021 $ $ 1,960,000 600,000 500,000 70,000 Sales Less Expenses: Materials purchased Factory wages - production line Production line supervisor's salary Premises Council rates Sales and admin staff salaries Advertising Equipment depreciation (incl. the Truck) 160,000 10,000 220,000 36,000 50,000 Electricity 24,000 160,000 Manager's Salary (John's) salary Truck lease 20,000 (1,850,000) Net profit 110,000 Floyd's Tap Company Profit for the month ending January 2021 $ $ 1,960,000 600,000 500,000 70,000 Sales Less Expenses: Materials purchased Factory wages - production line Production line supervisor's salary Premises Council rates Sales and admin staff salaries Advertising Equipment depreciation (incl. the Truck) 160,000 10,000 220,000 36,000 50,000 Electricity 24,000 160,000 Manager's Salary (John's) salary Truck lease 20,000 (1,850,000) Net profit 110,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started