Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Create an excel sheet that takes as input Face Value ( one number in dollars ) , Coupon Rate ( one number as

Question

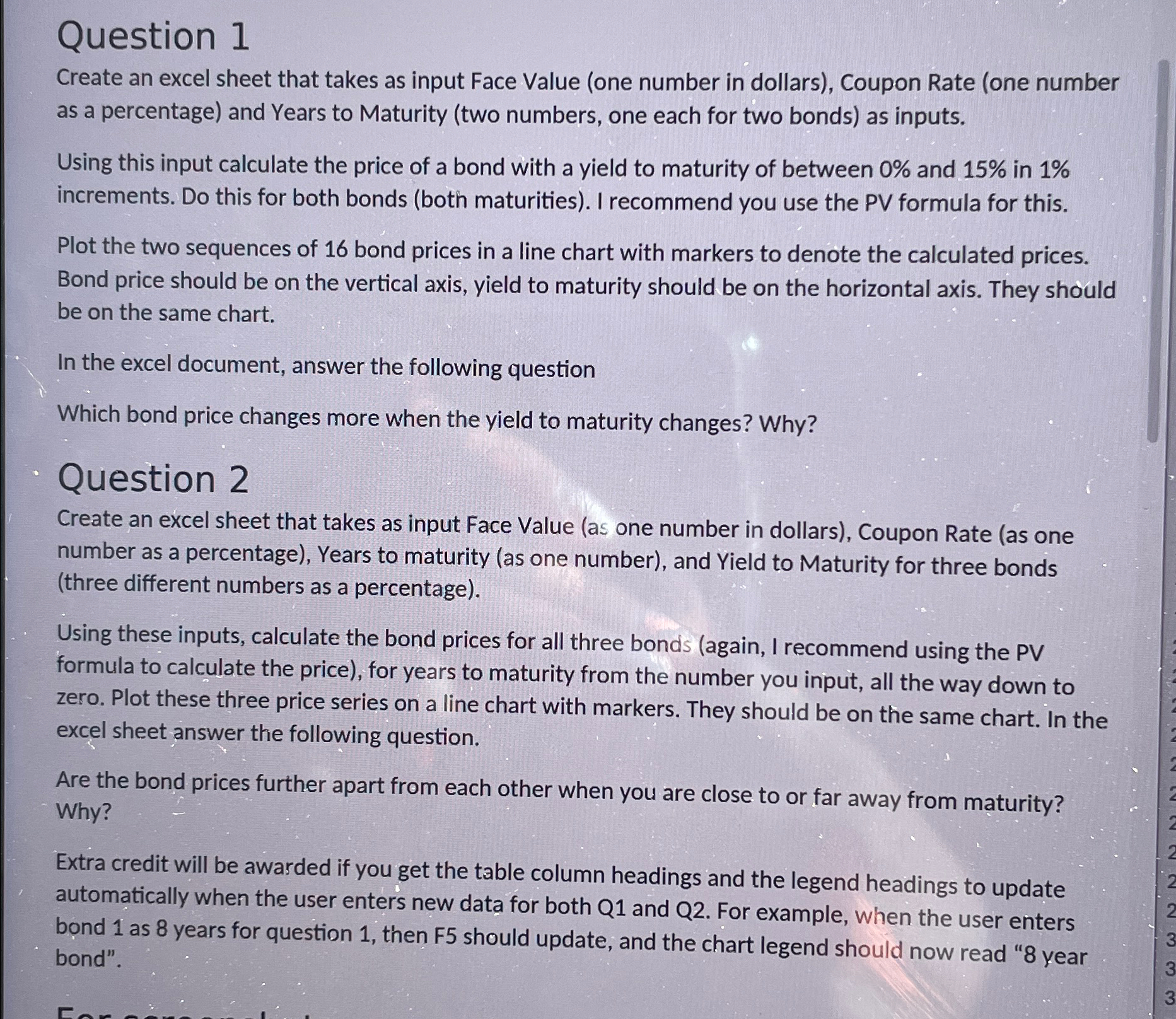

Create an excel sheet that takes as input Face Value one number in dollars Coupon Rate one number as a percentage and Years to Maturity two numbers, one each for two bonds as inputs.

Using this input calculate the price of a bond with a yield to maturity of between and in increments. Do this for both bonds both maturities I recommend you use the PV formula for this.

Plot the two sequences of bond prices in a line chart with markers to denote the calculated prices. Bond price should be on the vertical axis, yield to maturity should be on the horizontal axis. They should be on the same chart.

In the excel document, answer the following question

Which bond price changes more when the yield to maturity changes? Why?

Question

Create an excel sheet that takes as input Face Value as one number in dollars Coupon Rate as one number as a percentage Years to maturity as one number and Yield to Maturity for three bonds three different numbers as a percentage

Using these inputs, calculate the bond prices for all three bonds again I recommend using the PV formula to calculate the price for years to maturity from the number you input, all the way down to zero. Plot these three price series on a line chart with markers. They should be on the same chart. In the excel sheet answer the following question.

Are the bond prices further apart from each other when you are close to or far away from maturity? Why?

Extra credit will be awarded if you get the table column headings and the legend headings to update automatically when the user enters new data for both Q and Q For example, when the user enters bond as years for question then F should update, and the chart legend should now read year bond". Please make this in excel and show me the steps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started