Question: Suppose a researcher collects data on houses that have been sold in a particular neighborhood over the past year and obtains the regression results in

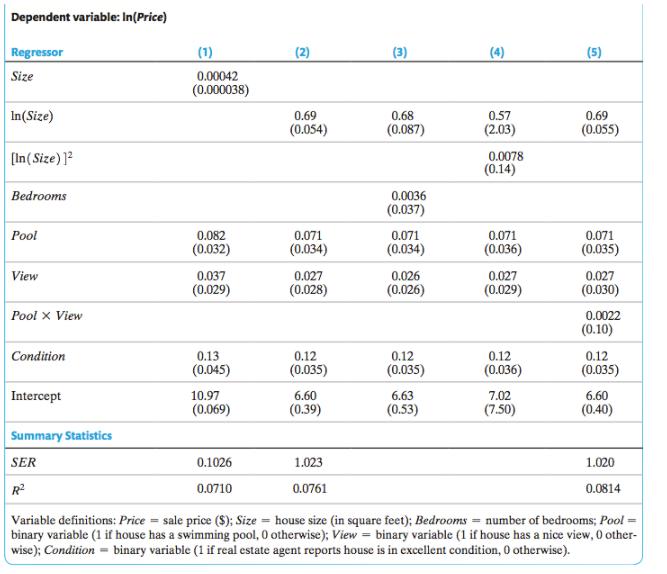

Suppose a researcher collects data on houses that have been sold in a particular neighborhood over the past year and obtains the regression results in the following table.

Using the results in column (1), what is the expected percentage change in price of building a 1500-square-foot addition to a house? (Report your answer as a percentage to the nearest whole number, without a % sign)

Construct a 99% confidence interval for the percentage change in price from building a 1500-square-foot addition to a house.

The lower bound is: (Report your answer as a percentage to three decimal places, without a % sign)

The upper bound is: (Report your answer as a percentage to three decimal places, without a % sign)

Using the regression results in column (3), calculate the estimated percentage effect of adding two bedrooms to a house. (Report your answer as a percentage to two decimal places, without a % sign)

Is the effect of adding bedrooms statistically significant? Assume a 1% level of significance. (Type Yes or No)

Which of the two variables - size or number of bedrooms - do you think is relatively more important in determining the price of a house? (Type Size if size is more important, or Bedrooms if bedrooms are more important).

Is the coefficient on Condition significant in column (4)...

At the 1% level of significance? (Type Yes or No)

At the 5% level of significance? (Type Yes or No)

Is the interaction term between Pool and View statistically significant at the 1% level in column (5)? (Type Yes or No)

Find the percentage effect of adding a view on the price of a house with a pool.

Find the percentage effect of adding a view on the price of a house without a pool.

(Report both answers as a percentage to one decimal place, without a % sign.)

critical value at 99% confidence is 2.58

Dependent variable: In(Price) Regressor (1) (2) (3) (4) (5) 0.00042 (0.000038) Size In(Size) 0.69 0.68 0.57 0.69 (0.054) (0.087) (2.03) (0.055) [In(Size) 1? 0.0078 (0.14) Bedrooms 0.0036 (0.037) 0.082 (0.032) Pool 0.071 0.071 0.071 0.071 (0.034) (0.034) (0.036) (0.035) 0.027 (0.028) 0.027 (0.029) View 0.037 (0.029) 0.026 0.027 (0.026) (0.030) Pool x View 0.0022 (0.10) 0.12 (0.035) 0.12 (0.036) Condition 0.13 0.12 0.12 (0.045) (0.035) (0.035) 6.60 (0.39) Intercept 10.97 6.63 (0.53) 7.02 6.60 (0.40) (0.069) (7.50) Summary Statistics SER 0.1026 1.023 1.020 R 0.0710 0.0761 0.0814 Variable definitions: Price = sale price ($); Size = house size (in square feet); Bedrooms = number of bedrooms; Pool binary variable (1 if house has a swimming pool, 0 otherwise); View = binary variable (1 if house has a nice view, 0 other- wise); Condition = binary variable (1 if real estate agent reports house is in excellent condition, 0 otherwise).

Step by Step Solution

3.58 Rating (183 Votes )

There are 3 Steps involved in it

a The estimation for the selling price of a house given variables size pool view and condition ... View full answer

Get step-by-step solutions from verified subject matter experts